Weekly Market Outlook 5/11/2025

Art of the Deal

Hello all,

Wishing all the moms a very Happy Mother’s Day. Hope everyone had a wonderful weekend away from the screens.

Recapping select trades from last week.

note: Paid subscribers get detailed idea breakdowns based on algorithmic levels and orderflow tools. Telegram channel and chat access is complimentary with the paid substack subscription.

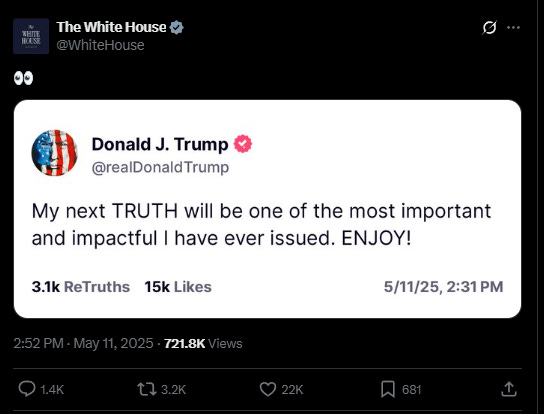

WHITE HOUSE POSTED ON THEIR X ACCOUNT THAT A TRADE DEAL HAS BEEN REACHED.

the @WhiteHouse feed added a cryptic follow‑up. Nothing but a pair of eyes‑emoji staring at a screenshot of former President Trump’s Truth‑Social tease (“My next TRUTH will be one of the most important and impactful I have ever issued. ENJOY!”).X

The social‑media one‑two punch, light on details but heavy on theater, jolted weekend markets as weekend Nasdaq is currently up 100bps and change.

A Tariff War in Reverse?

The Geneva communiqué lands against an unmistakably fraught backdrop:

Record Trade Gap. U.S. Census/BEA data show the March goods‑and‑services deficit ballooning to $140.5 billion, the largest on record, as importers front‑loaded cargoes ahead of Trump‑era “emergency” tariffs.

Goods Deficit at $163 B. Within that total, the goods shortfall alone hit $163.5 billion, a figure bigger than the entire GDP of Hungary.

Tariffs Up to 145 %. The administration’s spring moves lifted levies on a swath of Chinese imports, freezing supply chains and chilling cap‑ex.

Sunday’s accord; still labeled “preliminary” is therefore less a peace treaty than a cease‑fire at the top of the escalation ladder. But even a pause matters for markets already primed for bad news.

The Federal Reserve held its funds-rate target at 4.25 percent to 4.50 percent in May and adopted a wait-and-see stance, warning that both rising unemployment and persistent inflation remain risks. Fed speakers this week include Governor Adriana Kugler on Monday, Vice Chair Philip Jefferson and Governors Waller and Daly on Wednesday, followed by Chair Jerome Powell and Governor Michael Barr after the CPI and PPI prints on Thursday, and Richmond Fed President Tom Barkin on Friday.

Beijing has struck a cautionary note. China’s official media insists core principles will not be compromised, hinting the final deal may be more limited or phased than U S rhetoric suggests. If Monday’s details disappoint, initial relief rallies could reverse, especially if the inflation readings also prove hotter than expected.

Key events for May 12–16

Monday May 12 at 10 AM ET: full trade-deal briefing and remarks by Fed Governor Kugler

Tuesday May 13 at 8:30 AM ET: April CPI, NFIB Small Business Optimism, German ZEW survey

Wednesday May 14 at 10:30 AM ET: EIA crude inventories, speeches by Jefferson, Waller and Daly, UK preliminary GDP, Germany’s final April CPI

Thursday May 15 at 8:30 AM ET: April PPI, retail sales, jobless claims, industrial production, Empire and Philly Fed surveys, remarks by Powell and Barr

Friday May 16: import and export prices, housing starts, University of Michigan consumer sentiment, Barkin speaks

High Level Trade ideas for this week

Rationale for each trade and detailed risk metrics defined below