Daily Plan 3/8

A soft landing with a hard price

Hello traders,

Today Federal Reserve Chairman Jerome Powell's testimony before the Senate Banking Committee on March 7, 2023, conveyed a resolute and vigilant tone regarding the US economy. In his semiannual monetary policy report to Congress, he delivered a hawkish message indicating that the Fed is prepared to implement more aggressive interest rate hikes in order to tackle the 40-year high inflation. He emphasized that the Fed still has "more work to do" to lower inflation and will not hesitate to use its tools "forcefully" if necessary. Powell also announced that the Fed will discontinue its bond-buying program by March and initiate balance sheet reduction later in the year. The market's reaction to Powell's testimony has been intense, with higher chances of a larger half-point rate hike at the March policy meeting and multiple hikes throughout the year. However, some analysts are cautious, warning that the Fed's tightening could trigger a recession or financial crisis.

We had another great trading day today with our levels on ES and NQ providing great spots to short…

Our ES levels from yesterday

Then we kept scalping for the remainder of the day and closed out the day with good number of points.

Moving on,

Today’s Powell testimony did not shed light on anything new but the markets always want to hear from the horse’s mouth before making a nosedive.

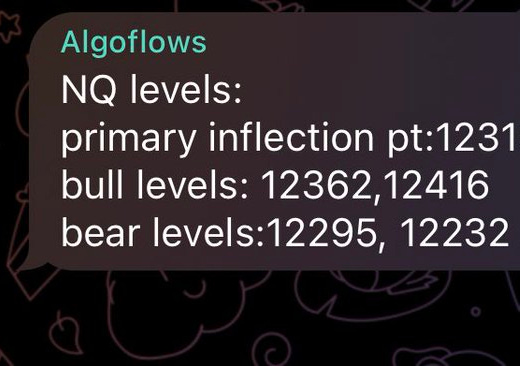

For tomorrow, these would be our key levels.

ES: