Market Insights: V-Shape Recovery, FUBO's Surge, and Trading Levels for the Week of 8/18

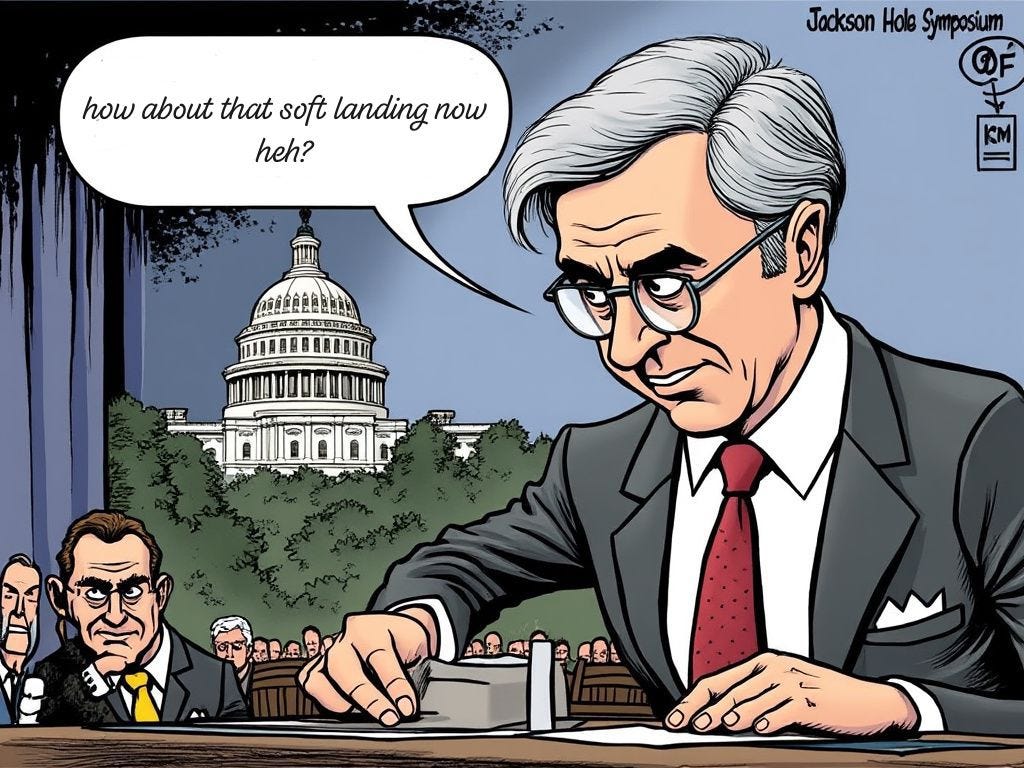

Good cut, Bad cut

Hello traders,

Last week was a great V shape recovery for the indices and now all eyes are on

Powell for Jackson Hole symposium where in all likelihood he will wink and nod for a 25bps cut in September.

Key Developments of the past week:

Economic Resilience: Retail sales data exceeded expectations, while jobless claims dropped below the 230,000 threshold, reversing the recent spike to 250,000. These positive surprises have reinvigorated the "soft landing" narrative, challenging previous assumptions about an imminent economic slowdown.

Disinflation Dynamics: The market continues to differentiate between disinflation and deflation, with the former currently supporting risk asset valuations. This nuanced interpretation of inflation data has been crucial in shaping investor sentiment.

Monetary Policy Implications: The improved economic outlook raises questions about the Federal Reserve's rate path. There's growing concern that rate cuts in the face of rebounding growth could reignite inflationary pressures, potentially shifting the focus from growth fears back to inflation risks.

Market Regime Shift: We appear to be transitioning into a "good news is good news" market regime, where positive economic data is being interpreted favorably by investors. This marks a departure from recent periods where strong data was often viewed negatively due to its implications for monetary policy.

Persistent Uncertainties: Despite the overall positive tone, lingering concerns remain. The rapid shift in market narratives suggests a degree of fragility in current sentiment, with investors remaining alert to potential catalysts that could quickly alter the prevailing outlook.

Paid subscribers are requested to join the telegram channel at their earliest convenience. Link is shared in your welcome email.

EQUITIES SPOTLIGHT:

Subscribers have been asking me to write about equities in depth and this week I will be looking at a small streaming services company FUBO 0.00%↑ and present a bull-case for it.

Older followers may remember me constantly saying to short this name in 2021

But recent developments regarding their lawsuit injunction caused FUBO 0.00%↑ shares to go up 35.66% in afterhours trading on Friday.

With major sports leagues starting this month, there is a decent probability that FUBO stock can go back to $2-3 price in a rate-cut environment.

At the writing of this post I have no short or long position on FUBO. But if and when I build a position it would be around 70-90bps of NAV and not more than that.

Moving on,

This week, I would be looking at 5515-18 and 5456-60 area on ES to buy dips and I would be looking to sell 5690-5700 area.

More Levels for the week:

Subscribers are urged to use the tradingview indicator to plot the levels.