Reading the Trump-Bessent-Lutnick Tea Leaves: Tariffs, Fed Moves, and Trade Ideas

We spent majority of the last week going back and forth on Tariff news with Bessent and Trump suggesting the tariffs on China would be much lower than 145% causing markets to breathe a sigh of relief.

On Friday the S&P and Nasdaq both closed at weekly highs, with the S&P up 4.6% percent and Nasdaq up 6.7 % on the week. Those are not trivial moves and, taken in historical context, make a strong case for continued upside momentum.

Meanwhile the Trump administration has said they are close to 200 deals but none have been signed as of writing of this post.

More on this later but first let’s quickly recap last week.

Note: Telegram channel and chat access is complimentary with the paid substack subscription

Moving on,

The stage is set for a potentially pivotal upcoming week (April 28 - May 2, 2025). Financial markets face a critical juncture as a deluge of high-impact economic data is scheduled for release. The first estimate of U.S. Gross Domestic Product (GDP) for the first quarter will provide the initial official reading on economic activity during a period marked by shifting trade policies. Closely watched will be the March Personal Consumption Expenditures (PCE) Price Index, the Federal Reserve's preferred measure of inflation, offering crucial insights into whether price pressures are genuinely receding towards the central bank's target. Furthermore, the April Employment Situation report will deliver vital statistics on the health of the labor market, a cornerstone of the Fed's dual mandate. This confluence of data arrives at a time when the Fed has repeatedly stressed its data-dependent approach, making the upcoming releases particularly influential for shaping near-term monetary policy expectations. The market's recent resilience, particularly its ability to rebound from the initial tariff shock, will be rigorously tested against this incoming hard data, potentially determining whether the current rally has legs or if a reckoning with underlying economic realities is imminent.

Economic Impact of Tariffs

The potential economic consequences of this new tariff regime are substantial, as highlighted by analysis from the Yale Budget Lab (TBL) released shortly after the announcement. The sheer scale of the policy shift is significant; TBL calculated that the average effective U.S. tariff rate, incorporating all tariffs enacted in 2025 (including those on China, Canada, Mexico, autos, steel/aluminum prior to April 2nd, plus the new reciprocal tariffs and announced retaliation), now stands at approximately 22.5%. This marks the highest level since 1909, signaling a profound departure from decades of trade liberalization.

One of the most immediate and widely anticipated impacts is on inflation. The Yale study estimated that the April 2nd tariffs alone would increase the average effective tariff rate by 11.5 percentage points, leading to a short-run rise in consumer prices of roughly 1.3% (assuming no immediate offsetting monetary policy reaction from the Federal Reserve). This translates to an estimated loss of purchasing power equivalent to $2,100 per household annually (in 2024 dollars). When considering the cumulative effect of all tariffs implemented in 2025, the estimated increase in the average effective tariff rate approaches 20 percentage points, projected to raise consumer prices by 2.3% in the short run. This equates to a more significant purchasing power loss of $3,800 per household on average. The analysis noted that households at the bottom of the income distribution would experience annual losses of $980 from the April 2nd tariffs alone, and $1,700 from all 2025 tariffs combined, with sectors like clothing and textiles hit particularly hard (apparel prices rising 17% under the full suite of tariffs). These projections align with concerns voiced by Federal Reserve officials, including Chair Powell and Governor Kugler, who acknowledged that tariffs are likely to exert at least temporary upward pressure on inflation.

Beyond inflation, the tariffs are projected to act as a significant drag on economic growth. According to the TBL analysis, the April 2nd tariffs alone are expected to reduce U.S. real GDP growth by 0.5 percentage points in calendar year 2025 and by 0.1 percentage points in 2026. Even in the long run, after supply chains potentially reoptimize, the U.S. economy is projected to be persistently 0.4% smaller due to these tariffs, an output loss equivalent to $100 billion annually in 2024 dollars. Real exports are forecast to be 10% lower in the long run under this scenario. The cumulative impact of all 2025 tariffs and associated retaliation is even more severe, estimated to lower real GDP growth by 0.9 percentage points in 2025 and 0.1 percentage points in 2026. The long-run level of real GDP is projected to be persistently 0.6% smaller, equivalent to an annual loss of $160 billion (in 2024 dollars), with real exports falling by a substantial 18.1%. These estimates resonate with broader concerns, such as those from the IMF, about protectionist measures cooling global economic momentum.

From a fiscal perspective, the tariffs are projected to increase government revenue on a conventional scoring basis ($1.4 trillion over 10 years for the April 2nd tariffs, $3.1 trillion for all 2025 tariffs). However, the Yale analysis emphasized the importance of considering dynamic effects. The negative impact of the tariffs on economic growth is expected to significantly reduce other tax revenues, leading to substantial negative dynamic revenue effects estimated at -$366 billion for the April 2nd tariffs and -$582 billion for all 2025 tariffs over the 2026-2035 period. This implies the net fiscal gain is considerably smaller than conventional estimates suggest.

The combination of projected price increases and reduced GDP growth points towards a significant risk: a potential stagflationary environment. Stagflation, characterized by simultaneously rising inflation and stagnant or falling economic output, presents a particularly challenging dilemma for policymakers, especially the Federal Reserve. Standard monetary policy tools are ill-suited to combat both problems at once; tightening policy to fight inflation risks exacerbating the growth slowdown, (If you are still reading this you get a couple levels for free 5645//20086 to fade a rally ) while easing policy to support growth could further fuel inflation. This inherent policy conflict, amplified by the tariff shock, is a major source of the heightened uncertainty currently pervading financial markets and influencing the Fed's cautious approach.

Fed’s Response (Check or Fold)

The collective message from Fed officials reinforced their commitment to a data-dependent strategy. Given the conflicting economic signals – resilient growth juxtaposed with sticky inflation and the large unknown of the tariff impact – the central bank appears poised to maintain its current policy stance until a clearer trend emerges. The federal funds rate target remains at 4.25% to 4.50%, unchanged since the last adjustment, with no alteration made at the March FOMC meeting.

However, a notable disconnect persists between this cautious official rhetoric and prevailing market expectations. As of Friday, April 25th, futures markets, as tracked by the CME FedWatch Tool, were still pricing in a significant probability (62%) of an interest rate cut occurring as early as the June FOMC meeting. Furthermore, market pricing implied expectations of three to four rate cuts throughout 2025, which would bring the target range well below 4%. Some commentary even suggested that futures markets were indicating the possibility of up to two additional cuts in 2025 beyond previous expectations, particularly following bouts of equity market weakness attributed to trade policy shifts.

This divergence presents a significant communication challenge for the Federal Reserve and a potential source of market volatility. The Fed's credibility rests on its commitment to its dual mandate, primarily bringing inflation back to the 2% target. If incoming data, particularly on inflation, remains stubbornly high, forcing the Fed to hold rates steady or even signal a more hawkish stance, it could lead to a sharp, negative repricing in markets that have already baked in substantial easing. Conversely, if the economic fallout from the tariffs proves severe, leading to a rapid deterioration in growth and labor market conditions that validates the market's dovish expectations, it might raise questions about whether the Fed's initial caution caused it to fall behind the curve in responding to emerging risks. The central bank is walking a tightrope, balancing its inflation fight against growing uncertainties and market demands for accommodation.

But What About Bitcoin?

Bitcoin's impressive surge past $94,000 was a standout performance, fueled primarily by the resurgence of broad market risk appetite. As Treasury yields fell and tech stocks rallied, capital flowed readily into higher-beta assets, with Bitcoin acting as a prime beneficiary. Supportive narratives around growing institutional adoption, evidenced by investments from major firms , and potentially easing regulatory hurdles for banks engaging with crypto-assets , likely bolstered underlying sentiment.

Analyzing Bitcoin's performance relative to the week's macro events reveals its strong sensitivity to risk sentiment over other potential drivers. The asset rallied sharply despite the significant uncertainty introduced by the new U.S. tariff regime, suggesting that the positive liquidity impulse from falling yields and the momentum from the equity rebound were the dominant forces. Its gains significantly outpaced even the high-flying Nasdaq index early in the week , showcasing its leveraged response to positive risk sentiment.

Looking ahead, the sustainability of this rally remains a key question. While the narrative of increasing institutionalization and broader adoption provides a potential long-term fundamental underpinning , Bitcoin's short-term price trajectory appears heavily reliant on the continuation of favorable macro conditions, particularly ample liquidity and investor willingness to take risks. A sharp reversal in yields, a significant equity market correction triggered by disappointing economic data, or an escalation in trade tensions could quickly dampen risk appetite and trigger a pullback in Bitcoin, regardless of underlying adoption trends. Regulatory risks also persist globally. Therefore, while institutional involvement may be building a higher floor over time, Bitcoin's price action in the near term remains tightly linked to, and arguably a leading indicator of, broader market sentiment and liquidity dynamics, rather than acting as a truly independent asset class.

Potential Market Reactions & Scenarios (outside of trump truthsocial posts):

GDP (Wed): A print significantly below the 0.4% consensus would likely intensify recession fears and solidify expectations for Fed cuts, potentially leading to lower bond yields (bond price rally), a weaker dollar, and support for growth stocks (NQ). An unexpected positive surprise, however, could challenge the slowdown narrative, possibly pushing yields higher and weighing on equities if it raises concerns about the Fed needing to stay restrictive for longer.

PCE (Wed): This is arguably the week's most critical release for Fed policy expectations. An upside surprise in the core PCE month-over-month reading (e.g., above the 0.3% seen in prior strong months or the 0.5% BofA forecast ) would be distinctly negative for markets. It would undermine the disinflation narrative, likely causing yields to spike, equities (especially NQ) to sell off sharply, and the dollar to strengthen as rate cut hopes diminish. An in-line or softer reading (closer to 0.2% MoM) would provide significant relief, supporting bonds and risk assets. Close attention will also be paid to any revisions to previous months' data.

ISM Mfg (Thu): A reading well below the consensus 48.0 would add fuel to growth concerns, likely supporting bond prices but potentially weighing on cyclical stocks sensitive to manufacturing activity. A surprise move back above 50 (into expansion territory) could temper easing expectations and pressure bonds.

NFP (Fri): The labor market report presents a complex reaction function. A significantly weak headline number (e.g., below 100K ) coupled with a rise in the unemployment rate could signal that the labor market is finally cracking under the weight of past tightening and current uncertainties. This might prompt the Fed to accelerate easing plans, potentially triggering a risk-on rally (lower yields, higher stocks, weaker dollar). Conversely, a robust report, particularly if accompanied by stronger-than-expected wage growth (Average Hourly Earnings > 0.3% MoM ), could reignite fears of wage-push inflation and a more hawkish Fed, leading to higher yields, lower stocks, and a stronger dollar.

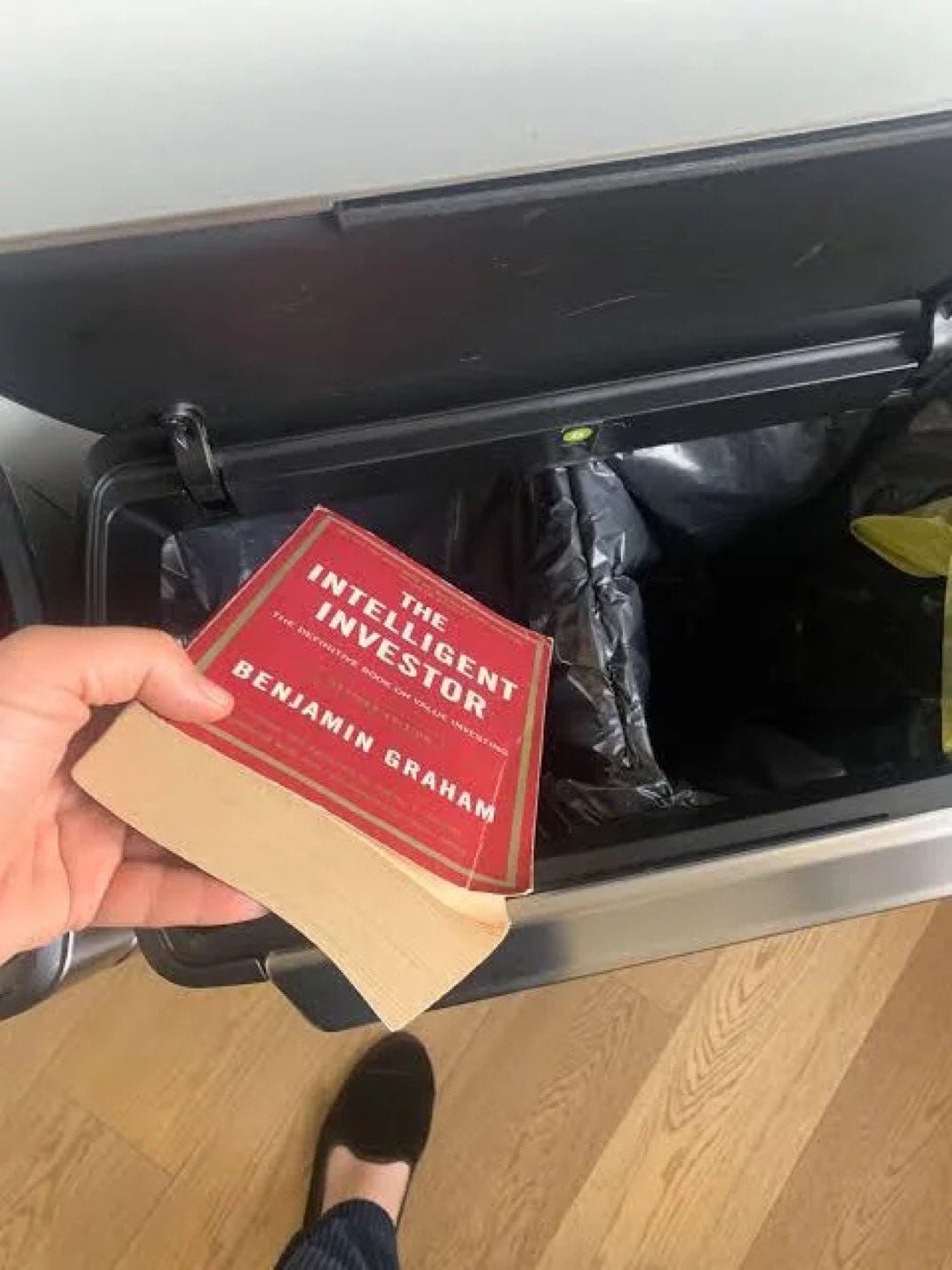

Granted this entire playbook goes down the trashcan based on the truthsocial posts of President Trump. Trade ideas for The Summer Of George(Washington weeping)

(There’s more? just give me the levels Algo I can’t read all this!)

Idea 1: Short US Dollar Index (DXY) on Confirmation of US Economic Slowdown:Rationale: The US dollar surprisingly weakened following the tariff announcements, despite typical safe-haven dynamics. This suggests markets may be pricing in a negative impact from the tariffs on the US economy itself or reacting to broader fiscal concerns. If the upcoming Q1 GDP and April Nonfarm Payrolls data confirm a sharper-than-expected slowdown in the US economy, it would likely intensify expectations for Federal Reserve rate cuts. This divergence in monetary policy expectations (more dovish Fed vs. potentially less dovish central banks elsewhere) could exert further downward pressure on the dollar. This trade anticipates that weak US data will reinforce the dollar-negative narrative seen recently.

Risk: US economic data surprises to the upside, bolstering the dollar. Inflation data (PCE) comes in very hot, forcing a hawkish Fed repricing that overrides growth concerns and strengthens the dollar. A severe global risk-off event triggers overwhelming safe-haven flows into the dollar, irrespective of domestic US data weakness.

Idea 2: Long Gold (#GC_F) as a Hedge Against Stagflationary Risks and Policy Uncertainty:

Rationale: Our Analysis highlights the significant risk of a stagflationary environment emerging from the new tariff regime – characterized by rising inflation and slowing growth. Gold is traditionally viewed as a store of value that can perform well during periods of stagflation, heightened geopolitical uncertainty, and declining confidence in fiat currencies or central bank policies. If upcoming data points towards this scenario (e.g., weak GDP combined with sticky or rising PCE inflation ), or if trade tensions escalate further, gold could attract haven flows. Additionally, a continued decline in real interest rates (nominal yields falling while inflation expectations remain anchored or rise) would reduce the opportunity cost of holding non-yielding gold, further supporting its price.

Risk: Economic data points towards a disinflationary slowdown (weak growth and falling inflation), reducing gold's appeal. A sharp rise in nominal Treasury yields driven by a hawkish Fed increases the opportunity cost of holding gold. A strong, broad-based risk-on rally driven by positive economic surprises could see capital rotate out of safe havens like gold into riskier assets.

Idea 3: Relative Value - Short Industrial Sector / Long Technology Sector (e.g., via ETFs or Futures):

Rationale: This idea refines the NQ/ES spread by focusing on sectors potentially most impacted by the current macro themes. We have observed specific warnings from industrial-linked companies (like Kimberly-Clark and Halliburton) about the negative impact of tariffs. The industrial sector is generally more sensitive to economic cycles and trade flows, making it vulnerable to the projected GDP slowdown and disruptions from reciprocal tariffs. Conversely, the technology sector, while facing its own challenges, has demonstrated earnings resilience and may benefit more directly from falling interest rate expectations and ongoing secular trends like AI adoption. This trade bets that the combination of tariffs and economic slowing will create a performance divergence favoring technology over industrials.

Risk: Tariffs cause unforeseen, severe disruptions to complex global technology supply chains, hitting the tech sector harder than expected. A sharp cyclical downturn negatively impacts enterprise spending, hurting tech revenues. A value rotation occurs, favoring cheaper industrial stocks over potentially stretched technology valuations. Regulatory actions specifically target large-cap tech firms.

Weekly Levels:

Below we outline the exact trade levels for S&P, Nasdaq, Gold, and Crude for this week. Paid subs get full access.

Subscribers are urged to use the tradingview indicator to plot the levels.

Keep reading with a 7-day free trial

Subscribe to Algoflows Capital to keep reading this post and get 7 days of free access to the full post archives.