The Re-Rating of Chinese Technology: A Bull Case for Sector Leaders

China Good Now?

Hello investors,

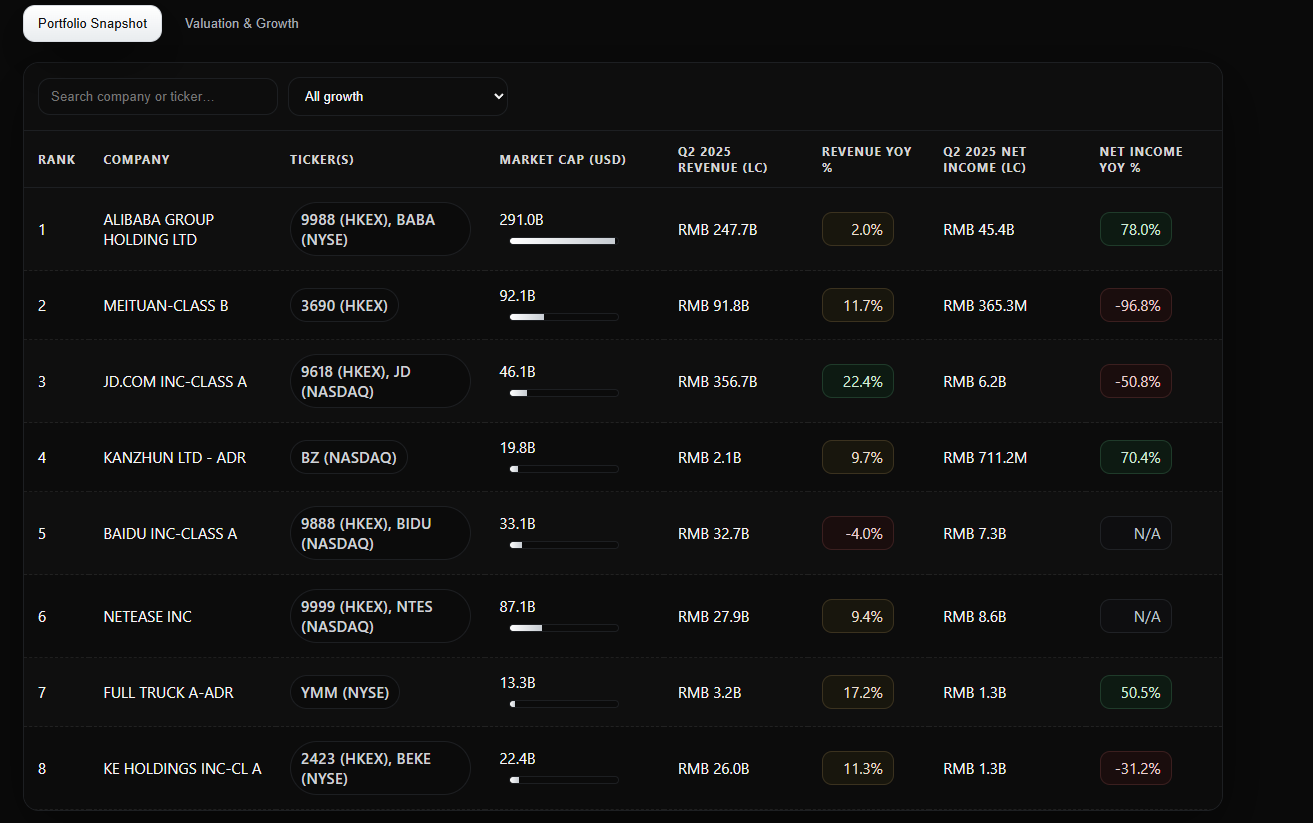

Today we will dive DEEP into a comprehensive bull case for a portfolio of 8 leading Chinese technology companies that SEEK (I had to do it) global dominance in the next few years.

Note: Weekly Levels for index futures will be sent out before Monday RTH open.

After a multi-year period of regulatory recalibration and macroeconomic headwinds, a powerful confluence of factors is creating a compelling, asymmetric investment opportunity for long-term investors. The overarching thesis is that the market's perception of risk and growth has yet to catch up with a rapidly improving fundamental reality. The confluence of a stabilizing and increasingly supportive regulatory environment, the dawn of tangible AI-driven monetization, and deeply discounted valuations underpins this bullish outlook.

The investment case is built upon four key pillars. First, the macro and regulatory environment has shifted from a significant headwind to a structural tailwind. The era of intense, unpredictable regulatory crackdowns has concluded, replaced by a pro-growth policy framework aimed at fostering national champions and stimulating domestic consumption.1 Strategic initiatives like "Made in China 2025" and a balanced approach to AI governance signal a clear state objective to leverage these technology leaders for long-term economic and geopolitical goals.3

Second, Artificial Intelligence (AI) has transitioned from a conceptual long-term bet to a tangible, near-term growth driver. Leading firms such as Alibaba and Baidu are no longer just investing in AI; they are actively monetizing it. Recent earnings reports reveal that AI-related revenue from cloud services is experiencing triple-digit growth, AI is fundamentally enhancing the efficacy of advertising platforms, and new AI-native products are creating entirely new ecosystems.5 This marks the beginning of a new, powerful monetization cycle for the sector.

Third, what the market may perceive as margin compression at key consumer platforms like Meituan and JD.com is, in fact, a calculated and strategic reinvestment into high-growth adjacencies. With fortress-esque balance sheets, these leaders are aggressively investing in arenas such as instant commerce and international expansion—a war of attrition they are uniquely positioned to win.8 This short-term margin pressure is laying the groundwork for long-term, defensible market dominance.

Finally, a significant valuation disconnect persists. Despite their entrenched market leadership, robust growth prospects, and strategic importance, these equities trade at substantial discounts to their own historical averages and their global peers. This provides a substantial margin of safety and the potential for a significant valuation re-rating as the market gradually recognizes the sector's fundamental recovery and new growth trajectory.11

In conclusion, the current market sentiment remains anchored to the challenges of the past, overlooking the reality of a sector that is now leaner, more focused, and poised for a new cycle of AI-powered growth. This report will provide a detailed analysis of the specific catalysts for each of the 8 companies that collectively underpin this compelling investment thesis.

Realtime Discord access with intraday orderflow & option dealer summaries included with the paid newsletter membership . Click here to subscribe.

Part I: The Macro Catalyst - A New Era of Pro-Growth Policy and Innovation

From Headwind to Tailwind: The Evolving Regulatory Landscape

The period from 2021 through 2023 was characterized by a significant regulatory recalibration in China, which introduced substantial uncertainty and created a valuation overhang on the technology sector. The government implemented wide-ranging measures targeting antitrust concerns, data security protocols, and content licensing, particularly in the gaming industry. This environment of heightened scrutiny led to a sharp de-rating of the entire sector as investors priced in a higher risk premium. However, a material shift in this posture has become evident throughout 2024 and 2025, transforming the regulatory landscape from a primary headwind into a structured and supportive framework.

The policy focus has pivoted from punitive actions to the establishment of clear and standardized governance. In 2024, Chinese regulators continued to deepen their practices in cybersecurity and data compliance, but did so by introducing new laws and regulations that refine the obligations of businesses, providing a clearer roadmap for compliance rather than an atmosphere of unpredictable enforcement.1 This move towards standardization and clarity reduces operational uncertainty and allows companies to invest for the long term with greater confidence.

Furthermore, this new regulatory framework is explicitly aligned with ambitious national strategic plans. The "Made in China 2025" initiative is a cornerstone of this alignment, a national strategic plan designed to upgrade China's manufacturing sector and move the country up the value chain.3 The policy identifies key technologies such as AI, 5G, aerospace, and semiconductors as critical areas for development, positioning the technology companies in this portfolio as national champions essential to achieving these goals. The government is incentivizing this development through reduced taxation rates, increased R&D funding, and direct state support.3 Similarly, the government's approach to AI governance has been balanced, focusing on both regulation and development to foster "high-quality growth".4

The previous regulatory crackdown, while disruptive, served as a "reset," forcing these companies to streamline operations, divest non-core assets, and become more disciplined and efficient. The current phase represents a "rebuild," where the state is now actively supporting these more focused technology giants to achieve national objectives of technological self-sufficiency and global competitiveness. This fundamental alignment between corporate strategy and state policy significantly de-risks the long-term investment case. The regulatory risk has evolved from an existential threat into a framework for managed, state-supported growth, creating a much more stable foundation for value creation.

Fueling the Engine: Economic Stimulus and Domestic Consumption

Alongside the stabilizing regulatory environment, a clear policy directive to bolster domestic demand provides another powerful tailwind for the sector. China's economic recovery following the pandemic has been uneven, with particular weakness in consumer confidence and the property sector. In response, Beijing has made stimulating internal consumption a top economic priority. The Central Economic Work Conference in December 2024 explicitly identified boosting domestic demand as the primary focus for 2025, signaling a concerted effort to support consumer spending.2

This policy directly benefits the consumer-facing platforms that dominate this portfolio. E-commerce leaders like Alibaba and JD.com are the primary vehicles through which consumer spending is channeled. Local services giants like Meituan, which facilitate everything from food delivery to travel bookings, are essential to the daily consumption habits of hundreds of millions of people. Digital entertainment providers such as NetEase are key beneficiaries of discretionary spending on gaming and media.

This focus on domestic demand is not merely a cyclical response to a soft economy; it represents a long-term strategic pivot. Faced with increasing geopolitical tensions and a challenging external environment, Chinese leadership is deliberately working to build a more technology-driven economy that is less dependent on property investment and foreign export markets.2 This strategic reorientation makes the domestic platforms in this portfolio more critical to China's economic stability and growth than ever before. They are the primary conduits for executing this national strategy of fostering a robust domestic market. This elevated strategic importance implies a more favorable and supportive operating environment, as the success of these companies is now inextricably linked to the success of China's broader economic agenda. They are no longer just commercial enterprises but are now de facto partners in a national economic strategy, which should translate into sustained policy support and a more predictable path for growth.

Part II: Deep Dive Analysis of Portfolio Holdings

These eight companies according to us are the ones to look out for in the coming years.

1. Alibaba Group Holding Ltd (9988.HK / BABA.N)

Investment Thesis & Market Position

Alibaba Group Holding is a deeply undervalued technology conglomerate at a critical strategic inflection point. The bull case is predicated on its successful transformation from a pure-play e-commerce giant into a dual-engine powerhouse driven by two strategic pillars: Consumption and AI + Cloud.60 The explosive, AI-fueled growth in its Cloud Intelligence Group is poised to become the primary long-term value driver for the company, while aggressive, strategic investments in "quick commerce" are successfully reinvigorating its core retail segment and expanding its user base. This strategic pivot, combined with a massive shareholder return program and a fortress-like balance sheet, provides a strong valuation floor and a clear path to significant upside.

Alibaba's business model is that of a multifaceted technology ecosystem. It operates China's largest and most dominant e-commerce platforms, including the consumer-to-consumer (C2C) marketplace Taobao and the business-to-consumer (B2C) platform Tmall.61 Beyond its domestic commerce core, it is a leading cloud provider through Alibaba Cloud, a major player in international commerce with its Alibaba International Digital Commerce Group (AIDC), a logistics powerhouse via its subsidiary Cainiao, and a significant force in digital media and entertainment.61 The company has recently undergone a significant reorganization to streamline its operations and sharpen its focus on the two strategic pillars of consumption and AI-powered cloud services.5

Alibaba's market position is formidable. It maintains a dominant 45-50% market share in China's vast e-commerce landscape and is the leading cloud computing provider in Mainland China with a 33% market share, comfortably ahead of rivals Huawei Cloud and Tencent Cloud.6 It is one of the world's largest retailers and artificial intelligence companies, competing domestically with Tencent, JD.com, and PDD Holdings, and on the global stage with technology giants like Amazon.27

Q1 FY2026 (June 2025 Quarter) Financial & Operational Review

Alibaba's financial results for the quarter ending in June 2025 highlighted the successful execution of its strategic pivot, with underlying strength masking a mixed headline performance. While reported revenue of $34.5 billion represented a modest 2% year-over-year increase and slightly missed consensus estimates, this was primarily due to the disposal of non-core assets like Sun Art and Intime.14 On a like-for-like basis, excluding these disposals, revenue grew by a much healthier 10% year-over-year, providing a clearer picture of the core business momentum.5 The bottom line was exceptionally strong, with net income attributable to ordinary shareholders surging by an impressive 78% to $6 billion.14

The segment performance clearly illustrates the company's strategic priorities:

Cloud is the Star Performer: The Cloud Intelligence Group was the unequivocal highlight of the quarter. Its revenue growth accelerated sharply to 26% year-over-year, reaching $4.6 billion.5 This surge was explicitly driven by robust demand for AI solutions. Notably, AI-related product revenue maintained a triple-digit growth rate for the eighth consecutive quarter, demonstrating sustained and powerful momentum in this critical high-margin business.5

Commerce Reinvigoration Through Investment: The core China E-commerce Group posted solid 10% year-over-year growth, while the Alibaba International Digital Commerce Group (AIDC) grew by a robust 19%.14 This growth was fueled by heavy strategic investments in "quick commerce" and user acquisition initiatives. These investments are yielding tangible results, contributing to a 25% year-over-year increase in monthly active consumers on the Taobao app in the first three weeks of August.5

Strategic Margin Compression: As a direct result of these deliberate investments, profitability metrics were impacted in the short term. Adjusted EBITDA decreased by 14%, reflecting the company's focus on scaling its quick commerce business and the significant capital expenditures directed towards AI and cloud infrastructure, which amounted to approximately $5.4 billion (RMB 38.6 billion) in the quarter alone.5

Primary Growth Vectors & Strategic Initiatives

Alibaba's future growth is anchored in its aggressive and well-funded pursuit of leadership in AI and its strategic revitalization of its commerce platform.

Massive Investment in AI & Cloud: Alibaba is making a definitive, large-scale bet on the future of AI. The company has publicly committed a staggering $53 billion (RMB 380 billion) over the next three years to build out its cloud and AI infrastructure, an amount that surpasses its total investment in the area over the past decade.6 This is not a theoretical investment; it is already producing tangible results, as seen in the 26% revenue acceleration in the cloud division. The company is pursuing a full-stack strategy, developing everything from its own advanced AI chips to circumvent U.S. export restrictions to its powerful, open-source foundational model, Qwen3, positioning itself as an end-to-end leader in the AI value chain.6

Winning the Instant Commerce Battle: The strategic reorganization that combines Taobao, Tmall, and the on-demand delivery service Ele.me into a single, "comprehensive consumption platform" is a direct and powerful response to evolving consumer preferences for speed and convenience.5 The substantial investment in this area is both a defensive necessity against rivals like Meituan and JD.com and an offensive maneuver to capture the highest-frequency consumer touchpoint. This creates a powerful flywheel effect, driving user engagement and creating cross-selling opportunities across its entire ecosystem.

Aggressive and Unwavering Shareholder Returns: Alibaba is underscoring its confidence in its strategy and future cash flow generation with one of the most aggressive capital return programs in the Asian technology sector. The company has a massive share repurchase program with $19.3 billion in remaining authorization and has also initiated a dividend.5 In fiscal year 2025 alone, it repurchased $16.5 billion worth of shares, reducing the outstanding share count by 5.1%.6 This provides a strong signal of management's belief in the company's intrinsic value and creates a solid floor for the stock price.

Valuation Case

Alibaba's current valuation represents a profound disconnect from its fundamental value and long-term growth prospects. The company trades at a forward P/E ratio of approximately 14x and a TTM P/E of around 15-17x.11 This is a mere fraction of its historical average P/E ratio, which has been over 32x.29 The stock is also significantly cheaper than its primary global peer, Amazon, which trades at a forward P/E of roughly 36x.11 Furthermore, its Price-to-Sales (P/S) ratio of approximately 2.3x is dramatically below its historical median of 7.3x, indicating a severe compression of its valuation multiple.30

The current market price appears to assign little to no standalone value to Alibaba's rapidly growing and market-leading cloud and AI business. A sum-of-the-parts analysis would suggest significant hidden value. As the Cloud Intelligence Group continues to grow at a 20%+ clip and improves its profitability, the market will be forced to recognize its intrinsic worth. A fast-growing, dominant cloud business, analogous to Amazon Web Services, typically commands a high valuation multiple on its own. The market is currently valuing Alibaba as a slow-growth, legacy e-commerce retailer, not as the dominant cloud and AI player it is rapidly becoming. As the cloud and AI segment becomes an increasingly large contributor to both revenue and profits, its superior growth characteristics will inevitably force a re-evaluation and an upward re-rating of the consolidated company's stock multiple.

2. Meituan-Class B (3690.HK)

Investment Thesis & Market Position

Meituan is the undisputed leader in China's local commerce and services landscape, operating a "super-app" that has become an indispensable part of daily life for hundreds of millions of consumers. The bull case for Meituan is centered on its ability to withstand a period of intense, but ultimately unsustainable, competition in its core food delivery business, leveraging its dominant market share, superior operational efficiency, and powerful network effects to emerge even stronger. While near-term profitability is being impacted by strategic investments to defend its turf, the company's long-term growth prospects are robust, driven by the continued expansion of its high-margin in-store, hotel, and travel businesses, as well as the scaling of new initiatives. Its attractive valuation relative to global peers offers a compelling entry point into a high-quality market leader.

Meituan's business model is built around a comprehensive, technology-driven platform for a wide range of local consumer retail and services.31 The company's operations are divided into two main segments. The first is

Core Local Commerce, which includes its foundational on-demand food delivery service, Meituan Instashopping (on-demand retail), in-store services (such as restaurant vouchers and beauty appointments), and hotel and travel bookings.31 The second segment is

New Initiatives, which covers businesses like community group buying (Meituan Select) and on-demand groceries.31 Revenue is generated through a mix of transaction commissions, delivery fees, advertising and marketing services for merchants, and subscriptions.31

Meituan's market position in its core business is one of clear dominance. It commands an estimated 60-70% share of China's massive food delivery market, creating powerful network effects that keep both customers and merchants loyal to its platform.15 This super-app ecosystem, which connects millions of consumers with local businesses for a myriad of services, makes it a central player in China's internet landscape, though it faces intense competition from rivals like Alibaba's Ele.me and, more recently, JD.com, which have entered the food delivery space.8

Q2 2025 Financial & Operational Review

Meituan's second-quarter 2025 financial results starkly illustrate the impact of the ongoing price war in the food delivery sector. The company reported total revenue of RMB 91.8 billion, an 11.7% year-over-year increase, which fell slightly short of market expectations.8 However, the top-line growth came at a significant cost to profitability. Net profit plunged by 97% from the prior year to just RMB 365.3 million, and adjusted net profit fell by a staggering 89% to RMB 1.49 billion, both figures missing consensus forecasts by a wide margin.8

The company attributed this dramatic decline in profitability directly to "irrational competition" in the food delivery industry.8 This forced Meituan to significantly increase its spending on sales and marketing, which surged by 51.5% year-over-year, representing an additional RMB 7.7 billion in expenditure compared to the same period last year.33 This spending was necessary to match aggressive subsidies and discounts offered by competitors and to defend its market share.

The impact was most visible in its Core Local Commerce segment. While the segment's revenue grew by a respectable 7.7% to RMB 65.3 billion, its operating profit margin plummeted from 25.1% in the prior year to just 5.7%.33 The New Initiatives segment also saw its operating losses widen by 43.1% to RMB 1.88 billion, partly due to investments in overseas expansion.33 Despite the severe impact on profitability, Meituan maintained a solid financial position, with a strong net cash balance and operating cash flow of RMB 4.8 billion for the quarter, providing ample "ammunition" to navigate the current competitive challenges.33

Primary Growth Vectors & Strategic Initiatives

Despite the near-term challenges, Meituan's long-term growth drivers remain firmly intact and are being strengthened by strategic investments.

Defending the Core and Outlasting Competitors: Meituan's primary strategy is to leverage its scale and operational expertise to defend its market-leading position in food delivery. CEO Wang Xing has stated that the company will prioritize investment to expand market share in the short term rather than pursue profitability, signaling a commitment to winning this war of attrition.32 The logic is that for competitors like Alibaba and JD.com, food delivery is an entry point to a broader platform strategy, whereas for Meituan, it is the core business. This singular focus, combined with its established logistics network of over 5 million daily active delivery drivers, gives it a significant operational advantage.69 The expectation is that competition will eventually rationalize, at which point Meituan's dominant share will translate into substantial and sustainable profits.32

High-Margin Growth in Hotel & Travel: While food delivery is in a price war, Meituan's in-store, hotel, and travel businesses are thriving and represent a key long-term profit engine. In Q2 2025, this category achieved record-breaking performance, setting new highs in both the number of active merchants and Gross Transaction Value (GTV).70 The company is successfully leveraging AI-powered tools, like "Meituan Jibai," to provide hotel merchants with intelligent pricing and inventory management solutions, deepening its role as a critical digital partner for the travel industry.70

The Power of the Super-App Flywheel: Meituan's greatest long-term advantage is its "flywheel effect." The high-frequency nature of its food delivery service drives immense traffic to its app, which it then successfully cross-sells into higher-margin services like hotel bookings and in-store dining vouchers.70 This is powerfully illustrated by its Meituan Membership program, which saw 10 million net members upgrade their tiers in Q2 alone, and its partnership with Marriott Bonvoy, which led to an 88% year-over-year increase in bookings for Marriott hotels on its platform.70 This interconnected ecosystem creates a powerful and defensible moat.

Valuation Case

Meituan's shares have been under pressure due to the concerns over the food delivery price war, creating what appears to be an attractive valuation for a market leader. The company trades at a forward P/E of approximately 17.6x and an EV/Sales multiple of 1.9x.31 This represents a significant discount to many global peers in the platform and delivery space.

The current valuation is heavily influenced by the near-term margin compression. The bull case argues that this is a temporary, strategic investment phase. Once the competitive environment in food delivery normalizes, Meituan's profitability is expected to recover significantly. Management has reiterated a long-term profit margin target for the food delivery business, suggesting a clear path back to strong earnings.32

Given the company's dominant market position, the powerful network effects of its super-app, and the strong growth momentum in its high-margin travel and in-store segments, the current valuation offers a compelling risk/reward profile. Investors are essentially able to acquire a stake in a high-quality, market-leading growth company at a price that reflects temporary competitive pressures rather than its long-term earnings power.

3. JD.com Inc-Class A (9618.HK / JD.N)

Investment Thesis & Market Position

JD.com is China's largest retailer by revenue, distinguished by its asset-heavy, technology-driven business model centered on a world-class, self-owned logistics network.34 The bull case for JD.com rests on three pillars: the resilient growth and improving profitability of its core JD Retail business, which benefits from a reputation for authenticity and speed; the long-term value creation potential of its strategic investments in new businesses like food delivery and international expansion; and a compellingly low valuation that does not fully reflect the strength of its underlying assets and market position. The company's unparalleled supply chain capabilities provide a deep and durable competitive moat that is now being leveraged to drive growth in high-margin service revenues.

JD.com's business model has evolved from a pioneering e-commerce platform into a leading technology and service provider with its supply chain at the core.75 Its portfolio spans several key segments:

JD Retail, the company's primary revenue driver, which offers a vast range of products through a direct sales model and a marketplace for third-party sellers 34;

JD Logistics, its supply chain management and logistics delivery arm, which serves both JD.com and external clients 34;

JD Health, its digital healthcare subsidiary 34; and a

New Businesses segment that includes initiatives like on-demand food delivery and international operations such as Ochama in Europe.75

JD.com is one of the two dominant B2C online retailers in China, alongside Alibaba's Tmall, making it a major force in the country's digital economy.34 It is China's largest retailer by revenue, ranking 44th on the Fortune Global 500 list for 2025.35 Its key differentiator from Alibaba is its direct-sales model, which gives it end-to-end control over its supply chain, from warehousing to last-mile delivery. This has allowed JD.com to build a strong reputation for authentic products and exceptionally fast and reliable shipping, a key competitive advantage in the Chinese market.27 The company has also forged powerful strategic partnerships with Tencent and Walmart, further strengthening its competitive position.34

Q2 2025 Financial & Operational Review

JD.com delivered a robust performance in the second quarter of 2025, demonstrating strong momentum in its core business and successful user acquisition from its new initiatives. Total net revenues reached RMB 356.7 billion ($49.8 billion), a significant 22.4% year-over-year increase, marking the highest growth rate in three years and exceeding market expectations.9

The performance was strong across its segments:

Core Retail Strength: The JD Retail segment reported net revenues of RMB 310.1 billion, a strong 20.6% increase from the prior year.9 Profitability in this core segment also showed significant improvement, with the operating margin reaching 4.5%, a historic high for a promotion quarter.9 The company's gross margin expanded for the thirteenth consecutive quarter on a year-over-year basis, a clear testament to its improving operational efficiency and supply chain strength.9

New Businesses Driving Growth: Revenues from new businesses, primarily driven by the company's aggressive push into food delivery, jumped by an impressive 199% year-over-year.35 These new initiatives are successfully driving user growth, with quarterly active customers and user shopping frequency both increasing by over 40% YoY.35

Strategic Investment Impacting Net Income: The heavy investments in these new business initiatives, particularly the significant marketing expenses associated with the food delivery launch, impacted the company's consolidated bottom line. Non-GAAP net income attributable to ordinary shareholders was RMB 7.4 billion, a decrease from RMB 14.5 billion in the prior year, reflecting this strategic spending.9

Primary Growth Vectors & Strategic Initiatives

JD.com's long-term growth is being fueled by the continued optimization of its core retail business and the strategic expansion of its logistics capabilities and new services.

Unmatched Logistics and Supply Chain: JD's core competitive advantage is its logistics network. The company operates over 1,600 warehouses with a total gross floor area of 32 million square meters.76 It is continuously investing in technology to enhance this advantage, such as its independently developed "Zhilang" intelligent warehousing solution, which is now being deployed at scale nationwide to significantly increase operational efficiency.77 This logistics prowess not only supports its retail business but is also a rapidly growing, high-margin service offered to external clients.

Global Logistics Expansion: JD Logistics is aggressively expanding its "Global Smart Supply Chain Network." It plans to double its overseas warehouse capacity by the end of 2025 and is building a network that integrates overseas warehouses, international transit hubs, and local distribution networks.9 Recent initiatives include the launch of its "JoyExpress" self-operated delivery brand in Saudi Arabia and the opening of a new warehouse in the UAE, providing strong support for international trade and cross-border e-commerce.74

Synergistic New Business Growth: The company's push into new areas like food delivery is designed to be synergistic with its core business. The initiative is successfully driving new user traffic to the platform, with a notable increase in cross-selling into JD's supermarket, lifestyle services, and electronics categories.36 During the recent JD 618 Grand Promotion, the food delivery business saw its daily order volume exceed 25 million, demonstrating rapid adoption and the potential to create a powerful new growth engine that reinforces the entire JD ecosystem.9

Valuation Case

JD.com's stock currently trades at a valuation that appears to significantly undervalue the strength and potential of its core assets. The stock trades at a forward 12-month P/E ratio of approximately 8.0x to 12.0x, which is well below the internet commerce industry average and represents a significant discount to both its domestic and global peers.28

This low valuation seems to be driven by market concerns over the near-term profitability impact of its heavy investments in new businesses like food delivery and international logistics.38 However, this perspective overlooks the long-term strategic value of these investments. The core JD Retail business is demonstrating accelerating growth and record profitability, providing a stable and expanding cash flow base to fund these new initiatives.

The company's logistics and property assets alone represent substantial, tangible value that may not be fully reflected in the current stock price. As the new businesses achieve scale and their synergies with the core retail platform become more apparent, the market is likely to re-evaluate the company's long-term earnings power. The current discounted valuation offers an attractive entry point for investors to gain exposure to a high-quality, market-leading retailer with a world-class logistics moat and multiple avenues for future growth.

4. Kanzhun Ltd - ADR (BZ.O)

Investment Thesis & Market Position

Kanzhun is the largest online recruitment platform in China by MAU, having successfully disrupted the traditional job board industry with its innovative, mobile-native "Direct Recruitment Model".16 The bull case for Kanzhun is centered on its powerful network effects, superior user experience driven by AI-powered recommendations, and a highly efficient and profitable business model. The company is demonstrating strong, high-quality growth, characterized by an expanding user base, rising monetization, and significant margin expansion. With a solid balance sheet and a clear strategy for returning capital to shareholders, Kanzhun offers a compelling investment opportunity in the ongoing digitization of China's vast recruitment market.

Kanzhun's business model, operated through its flagship BOSS Zhipin app, is a transformative departure from traditional online recruitment platforms.39 Its key innovations include being mobile-native, which enables real-time interaction; being recommendation-based, using AI algorithms and big data to deliver accurate and tailored job and candidate matches; and facilitating direct chats between job seekers and "Bosses" (hiring managers and executives).39 This model improves recruitment efficiency by allowing both parties to confirm intentions and suitability before a formal interview, a feature that has proven highly attractive to both job seekers and enterprise users, particularly small and medium-sized enterprises (SMEs).39

This innovative model has propelled Kanzhun to a leadership position in China's online recruitment market.16 As of December 31, 2024, the platform had a massive user base of 211.9 million verified job seekers and 30.2 million verified enterprise users, creating a vibrant and diverse ecosystem that covers all user types (from blue-collar to white-collar) and company sizes.40 This scale generates powerful network effects: more job seekers attract more enterprises, and more enterprises attract more job seekers, creating a virtuous cycle that strengthens its competitive moat and drives rapid expansion.39

Q2 2025 Financial & Operational Review

Kanzhun reported a strong set of financial results for the second quarter of 2025, showcasing accelerating revenue growth and remarkable improvements in profitability. Revenues for the quarter were RMB 2.1 billion ($293.5 million), an increase of 9.7% year-over-year, driven by growth in the number of paid enterprise customers.17

The company's profitability metrics were particularly impressive, highlighting the operating leverage inherent in its business model:

Income from operations surged by 81.6% year-over-year to RMB 651.2 million ($90.9 million).17

Net income grew by a robust 70.4% year-over-year to RMB 711.2 million ($99.3 million), resulting in a net profit margin exceeding 33%.17

Adjusted net income increased by 30.9% to RMB 940.9 million ($131.3 million), with the adjusted net margin expanding significantly to 44.8% from 37.5% in the prior-year period.17

This substantial margin expansion was achieved through disciplined cost management. Sales and marketing expenses decreased by 23.0% year-over-year, and R&D expenses also declined, demonstrating increasing platform efficiency and the strength of its network effects, which reduce the need for heavy marketing spend to acquire users.17 Operationally, the platform's user base continued to expand, with average MAUs reaching 63.6 million, a 16.5% year-over-year increase.17

Primary Growth Vectors & Strategic Initiatives

Kanzhun's growth is being driven by the continuous expansion of its user base, improving monetization, and the deepening integration of AI into its platform.

User Base Expansion and Penetration: The company continues to successfully expand its user base, having added over 30 million new verified users in the first seven months of 2025.43 Growth is particularly strong in the blue-collar, lower-tier city, and SME segments, which represent a vast and previously underserved market.43 As the recruitment market in China continues to recover, the number of paying enterprise customers is growing, reaching 6.5 million in the twelve months ending June 30, a 10% year-over-year increase.43

AI-Powered Efficiency and Innovation: Kanzhun is a technology-first company and is continuously leveraging AI to enhance its platform. It is using AI to improve the accuracy of its recommendation engine, which is critical for user experience and retention.39 It is also deploying AI tools to improve job seeker safety by identifying risks and inappropriate language, and to enhance the efficiency of its customer service operations.43 These AI investments are not just improving the product but are also driving monetization, as AI-powered tools help recruiters make more proactive and suitable purchases, leading to increased repeat purchases.43

Shareholder-Friendly Capital Allocation: Kanzhun has demonstrated a strong commitment to returning value to its shareholders. The company recently adopted an annual dividend policy, declaring a cash dividend of approximately $80 million, and upsized and extended its share repurchase program to $250 million.16 These actions are supported by a strong cash position of RMB 16.0 billion and robust operating cash flow, and they signal management's confidence in the company's long-term growth and profitability.40

Valuation Case

Kanzhun's valuation appears reasonable given its market leadership and high-quality growth profile. The company trades at a forward P/E ratio of approximately 21.7x.44 While this is not as low as some of the larger-cap Chinese tech names, it is justified by the company's superior growth rates and expanding margins.

The company's long-term growth strategy is clear and effective, focusing on the three key drivers of enterprise user growth, an improved paying ratio, and long-term growth in average revenue per paying user (ARPPU).40 The platform's powerful network effects and efficient, AI-driven business model provide a strong foundation for sustainable growth and profitability.

The recent financial results, which show accelerating revenue growth combined with significant margin expansion, demonstrate that the company's differentiated approach to online recruitment is yielding excellent results. The ability to reduce marketing expenses while still growing the user base strongly suggests that the platform is becoming increasingly efficient, positioning it well for continued success and value creation in the competitive Chinese recruitment market.

5. Baidu Inc-Class A (9888.HK / BIDU.O)

Investment Thesis & Market Position

Baidu is undergoing a profound strategic transformation, evolving from its legacy as China's dominant search engine into a global pioneer in artificial intelligence and autonomous driving. The bull case for Baidu is a long-term one, centered on the immense, and currently undervalued, potential of its AI-driven businesses. While its core online marketing business faces near-term headwinds, its AI Cloud division is delivering explosive growth and capturing a leading market share. Simultaneously, its Apollo Go robotaxi service is establishing itself as a global leader in autonomous mobility. This strategic pivot to high-growth, technology-intensive sectors positions Baidu to capitalize on the next wave of technological disruption, offering significant long-term value that is not reflected in its current depressed valuation.

Baidu's business is composed of two main segments: Baidu Core and iQIYI.78 iQIYI is a leading online entertainment video service. Baidu Core, which accounts for the majority of revenue, is further divided into three growth engines. The first is the

Mobile Ecosystem, which includes its flagship Baidu App, the ERNIE Bot conversational AI assistant, and its legacy search and online marketing services.78 The second, and most critical for the bull case, is

AI Cloud, which offers a full suite of cloud services (IaaS, PaaS, SaaS) differentiated by its powerful AI solutions.78 The third is

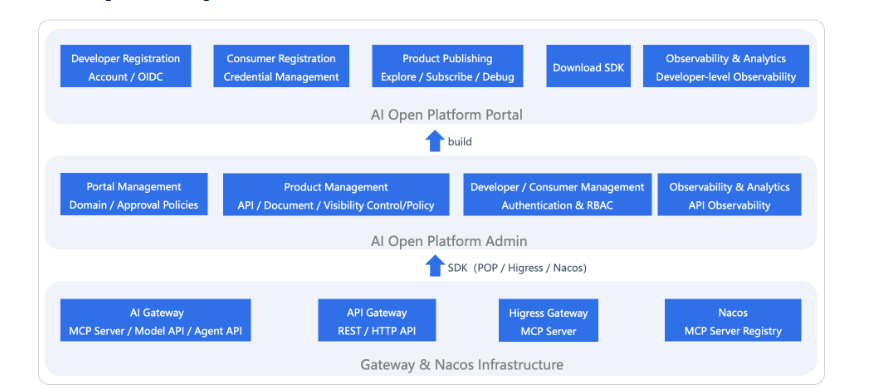

Intelligent Driving & Other Growth Initiatives, which is headlined by the Apollo Go autonomous ride-hailing service and also includes Xiaodu smart devices and AI chips.78 Baidu is one of the few companies in the world to offer a full, four-layer AI stack, from cloud infrastructure and its deep learning framework (PaddlePaddle) to its foundational models (ERNIE) and applications.78

Baidu holds a dominant position in China's search engine market, but its future lies in AI.46 It is a recognized leader in autonomous driving through its open-source Apollo platform.45 In the crucial AI public cloud market in China, Baidu has secured the number one ranking, underscoring its leadership in this high-growth sector.7 It competes with other Chinese tech giants like Alibaba and Tencent in the cloud and AI space, and globally with companies like Google and Microsoft in AI research and autonomous driving technology.26

Q2 2025 Financial & Operational Review

Baidu's second-quarter 2025 financial results reflect the ongoing transition in its business model, with pressure on its legacy advertising business being partially offset by strong growth in its AI initiatives. Total revenues for the quarter were RMB 32.7 billion ($4.57 billion), a decrease of 4% year-over-year.18

The segment breakdown reveals this strategic shift:

Baidu Core: Revenue from Baidu Core was RMB 26.3 billion, a 2% decrease year-over-year.18 This was a result of two diverging trends.

Online Marketing Revenue declined by 15% to RMB 16.2 billion, reflecting the structural challenges in the digital advertising market and the impact of AI-generated content compressing ad space.7 In stark contrast,

Non-Online Marketing Revenue surged by 34% year-over-year to RMB 10.0 billion, driven almost entirely by the strong performance of the AI Cloud business.18iQIYI: Revenue from the video streaming service declined by 11% to RMB 6.6 billion.19

Despite the top-line decline, the company managed its costs effectively. Net income attributable to Baidu was a solid RMB 7.3 billion ($1.02 billion).19 The company's balance sheet remains strong, with a net cash position of $21.66 billion as of June 30, 2025, providing ample resources to fund its long-term AI investments.48

Primary Growth Vectors & Strategic Initiatives

Baidu's future is unequivocally tied to the success of its AI and autonomous driving ventures, which are emerging as powerful, long-term growth engines.

AI Cloud as the New Growth Engine: Baidu's AI Cloud business is the linchpin of its transformation. The segment's 34% year-over-year revenue growth in Q2, reaching over RMB 10 billion for the first time, demonstrates its powerful momentum.48 This growth is driven by its full-stack AI solutions, particularly its Qianfan Model-as-a-Service (MaaS) platform, which hosts over 100 mainstream AI models, including Baidu's own open-sourced ERNIE series.7 By offering cost-efficient tools that reduce inference costs for enterprises by up to 80%, Baidu is positioning itself as a cost leader and accelerating the adoption of AI across industries.7 The AI Cloud now accounts for 38% of Baidu Core revenue, up from 25% in 2023, showcasing its rapid ascent as the company's primary growth driver.7

Pioneering the Robotaxi Revolution with Apollo Go: Baidu's autonomous driving division, Apollo Go, is a global leader in the nascent robotaxi industry. In Q2 2025, the service delivered 2.2 million fully driverless rides, a remarkable 148% year-over-year surge.49 The service is expanding rapidly, now operating in 16 cities and pursuing international expansion through strategic partnerships with global ride-hailing platforms like Uber and Lyft.7 While the business is currently capital-intensive and not yet profitable, its leadership position, technological prowess, and massive long-term market opportunity represent a significant, and likely undervalued, call option on the future of mobility.

AI-Driven Reinvention of Search: Baidu is also leveraging its AI expertise to reinvent its core search business. By integrating its ERNIE Bot and other generative AI features into the Baidu App, the company aims to transform the user experience from a simple search box to a versatile, multi-round conversational assistant.78 This AI transformation is designed to increase user engagement—Baidu App MAUs grew 5% to 735 million in Q2—and create new monetization opportunities over the long term.19

Valuation Case

Baidu's stock is trading at a valuation that reflects the challenges in its legacy advertising business while largely ignoring the immense growth potential of its AI initiatives. The company trades at a P/E ratio of approximately 10-12x forward earnings.50 This is a significant discount to both its historical valuation and its global technology peers.

The current market valuation presents a compelling opportunity for long-term, patient investors. The investment case is that as the AI Cloud and Intelligent Driving segments continue to scale and become a larger portion of the company's overall revenue and profit mix, the market will be forced to re-rate the stock to reflect its new identity as a leading AI company rather than a legacy search provider. The company's dominant market position in AI Cloud in China, its global leadership in autonomous driving, and its massive AI patent portfolio provide a strong foundation for long-term value creation that is not being recognized at the current share price.7

6. NetEase Inc (9999.HK / NTES.O)

Investment Thesis & Market Position

NetEase is a global gaming and internet technology powerhouse, with a proven track record of developing and operating some of the world's most popular and long-lasting games. The bull case for NetEase is built on its formidable in-house game development capabilities, which consistently produce high-quality, original content, and its successful and accelerating global expansion strategy. The company is capitalizing on its strong gaming IP to drive growth in both PC and mobile gaming worldwide, while its other businesses, like NetEase Cloud Music and Youdao, provide additional avenues for value creation. With a strong financial performance, a robust pipeline of new games, and a reasonable valuation, NetEase offers a pure-play exposure to the highly profitable global gaming market.

NetEase's business is centered around several core segments, with online gaming being the most significant.51 The

Games and related value-added services segment develops and operates a wide range of popular PC and mobile games, including flagship MMORPGs like Fantasy Westward Journey and hit titles like Identity V and Naraka: Bladepoint.51 The company also has a strong track record of operating licensed games from international partners, such as Blizzard Entertainment, in China.51 Other key segments include

NetEase Cloud Music, one of China's leading music streaming platforms; Youdao, an online education technology platform; and Innovative businesses and others, which includes its private-label e-commerce platform Yanxuan.79

NetEase is one of the largest internet and video game companies in the world.52 It possesses one of the largest in-house game R&D teams, which is a key competitive advantage, allowing it to create superior gaming experiences and control its own intellectual property.79 It is a primary competitor to Tencent in the Chinese gaming market and is increasingly competing on the global stage with international gaming giants. The company has also been active in acquiring and investing in international game development studios, such as Grasshopper Manufacture and Quantic Dream, to bolster its global content creation capabilities.52

Q2 2025 Financial & Operational Review

NetEase delivered a solid financial performance in the second quarter of 2025, driven by the strength of its core gaming business. Net revenues for the quarter were RMB 27.9 billion ($3.9 billion), representing a 9.4% increase compared to the same quarter of 2024.20

The key driver of this growth was the Games and related value-added services segment, which saw its net revenues increase by a strong 13.7% year-over-year to RMB 22.8 billion ($3.2 billion).21 This growth was fueled by higher net revenues from both its self-developed titles, like

Identity V, and newly launched games, such as Where Winds Meet and Marvel Rivals, as well as its portfolio of licensed games.21

The company's profitability remained robust. Gross profit for the quarter was RMB 18.1 billion ($2.5 billion), an increase of 12.5% year-over-year.21 Net income attributable to the company's shareholders was RMB 8.6 billion ($1.2 billion), while non-GAAP net income was RMB 9.5 billion ($1.3 billion).21 The company maintained disciplined control over its operating expenses, which decreased slightly compared to the prior year, further supporting its strong bottom-line performance.21

Primary Growth Vectors & Strategic Initiatives

NetEase's future growth is underpinned by its powerful content creation engine and its strategic focus on global markets.

Global Expansion and New Launches: NetEase is successfully executing its global expansion strategy, with new game launches gaining significant traction in international markets. In Q2 2025, titles like FragPunk, Dunk City Dynasty, and MARVEL Mystic Mayhem all achieved high rankings on download charts in North America and other regions upon their global release.21 This demonstrates the company's growing ability to create content that resonates with a global audience. Furthermore, the company has a rich global pipeline of new titles, including its original RPG

Sea of Remnants and plans to bring its domestic hit Sword of Justice to the global market, providing a clear runway for future international growth.21Sustained Strength of Evergreen Franchises: A key strength of NetEase is its ability to create and maintain long-lasting gaming franchises that generate stable, recurring revenue for years. In Q2, established titles like Sword of Justice, Once Human, Identity V, and Eggy Party all saw renewed momentum and high rankings on top-grossing charts following content updates and anniversary events.21 Its flagship title,

Fantasy Westward Journey Online, reached a new all-time high in peak concurrent players in August, showcasing the incredible longevity of its core IP.21Successful Relaunch of Blizzard Titles: The company has successfully re-established its partnership with Blizzard Entertainment in China. The relaunch of titles like Hearthstone and the upcoming launch of a new China-exclusive server for World of Warcraft have been met with strong community engagement and are already contributing to top-line growth.21 This recaptures a significant and highly dedicated player base in the Chinese market.

Valuation Case

NetEase offers investors a compelling opportunity to invest in a pure-play global gaming leader at a reasonable valuation. The company's consistent ability to generate hit games through its powerful in-house R&D capabilities provides a durable competitive advantage.

The company's strategy of balancing the operation of long-lasting, highly profitable domestic franchises with an aggressive and increasingly successful push into international markets provides a balanced and robust growth profile. The recent financial results, which show double-digit growth in its core gaming segment and strong profitability, confirm that this strategy is working effectively.

Given its proven content creation capabilities, accelerating global momentum, and strong financial position, NetEase is well-positioned to continue delivering value to shareholders. Its valuation, when compared to other global gaming giants, appears reasonable, making it an attractive investment for those seeking exposure to the long-term growth of the interactive entertainment industry.

7. Full Truck Alliance (YMM.N)

Investment Thesis & Market Position

Full Truck Alliance (FTA) operates China's leading digital freight platform, effectively functioning as the "Uber for trucks" in the world's largest logistics market.80 The bull case for FTA is built on its dominant market position, the powerful network effects of its platform, and its highly scalable and profitable business model. The company is successfully digitizing China's vast and traditionally inefficient full-truckload (FTL) and less-than-truckload (LTL) markets, driving significant efficiency gains for both shippers and truckers. With a rapidly growing user base, accelerating monetization, and strong margin expansion, FTA offers a unique and compelling investment in the structural digitization of China's logistics industry.

FTA's platform connects millions of shippers with truckers to facilitate freight shipments of all types and distances.80 The company was formed in 2017 through the merger of the two leading platforms, Yunmanman and Huochebang, creating a nationwide logistics network with significant economies of scale.80 Its core service is

freight matching, which it monetizes in several ways: a freight listing service where frequent shippers pay membership fees; a freight brokerage service where FTA acts as a broker for transactions; and, most importantly, an online transaction service where it collects transaction fees from truckers on fulfilled orders.80 In addition to its core matching services, the company offers a growing suite of

value-added services, including credit solutions, insurance, and electronic toll collection (ETC) services, which increase user stickiness and provide additional revenue streams.80

FTA is the clear leader in its market, having built a vibrant ecosystem of millions of users. This scale creates a powerful network effect: the vast number of shippers on the platform attracts a large pool of truckers, which in turn provides shippers with more choice and competitive pricing, further reinforcing the platform's value proposition.80 The platform's digital solutions offer significant advantages over traditional logistics, including a wider choice of carriers, faster matching times (averaging just 14 minutes from order placement to contract), and quality service with FTA acting as a mediator in disputes.54

Q2 2025 Financial & Operational Review

Full Truck Alliance reported an excellent second quarter for 2025, with strong growth across all key operating and financial metrics, demonstrating the continued momentum of its business. Total net revenues for the quarter were RMB 3.24 billion ($452.2 million), a 17.2% increase year-over-year.22

The company's profitability showed even more impressive growth, highlighting the scalability of its platform model:

Net income surged by 50.5% year-over-year to RMB 1.26 billion ($176.6 million).22

Non-GAAP adjusted net income rose by 39.3% year-over-year to RMB 1.35 billion ($188.7 million).22

This strong performance was driven by robust growth in platform activity:

Fulfilled orders on the platform reached a record 60.8 million, an increase of 23.8% from the prior year.22

Average shipper MAUs grew by 19.3% to a record 3.16 million.23

The number of shipper members surpassed 1.2 million, also an all-time high, with a strong retention rate of over 80%.56

The key driver of the revenue growth was the transaction service segment, which saw its revenue surge by 39.4% year-over-year to RMB 1.33 billion, benefiting from increases in order volume, penetration rate, and per-order fees.23

Primary Growth Vectors & Strategic Initiatives

FTA's growth is being driven by the ongoing digitization of the logistics industry, the expansion of its user base, and the increasing adoption of its transaction and value-added services.

Structural Digitization of a Massive Market: FTA operates in China's logistics market, which is valued at ¥7 trillion and accounts for a significant portion of the national economy.54 The FTL and LTL markets, which are FTA's core focus, are projected to grow at a healthy CAGR of 5.9% and 6.9%, respectively, through 2030.54 As the clear digital leader, FTA is capturing a disproportionate share of this growth as the industry continues to shift from inefficient, offline processes to standardized and intelligent digital platforms.

Expanding Monetization and User Engagement: The company is successfully expanding its monetization efforts. It has been gradually introducing and increasing commissions for transactions across a growing number of cities, a move that has not negatively impacted customer loyalty.54 The rapid 39.4% growth in its transaction service revenue demonstrates the success of this strategy.23 Furthermore, the company is growing its shipper membership programs, like the "288-membership," which now has over 300,000 active members and enhances user stickiness.56

AI-Driven Efficiency Gains: FTA is increasingly leveraging its vast and proprietary transaction data to deploy AI-driven solutions across its platform.56 AI is being used to improve everything from the core matching algorithms to internal processes like sales and customer service. This technology enablement enhances the overall user experience and improves the platform's operational efficiency, leading to a higher fulfillment rate, which reached a historical high of 40.7% in Q2, up nearly 7 percentage points year-over-year.56

Valuation Case

Full Truck Alliance's stock presents a compelling investment opportunity, with a valuation that appears attractive relative to its strong growth and profitability. The company has a forward P/E ratio of approximately 2.30, which suggests the stock is attractively priced relative to its earnings growth expectations.57

The company has a strong track record of execution, consistently delivering robust growth in users, transaction volume, and revenue. The business model is highly scalable, as evidenced by the fact that net income is growing much faster than revenue (50.5% vs. 17.2% in Q2). The company also offers a modest dividend, demonstrating a commitment to returning capital to shareholders.57

Analyst sentiment is overwhelmingly positive, with 13 buy ratings and only 2 hold ratings, and an average target price that suggests a potential upside of nearly 20% from current levels.57 Given its dominant market position, the powerful tailwind of logistics digitization, its proven ability to monetize its platform, and its attractive valuation, YMM is well-positioned to continue delivering strong returns for investors.

8. KE Holdings Inc-CL A (2423.HK / BEKE.N)

Investment Thesis & Market Position

KE Holdings (Beike) is the leading integrated online and offline platform for housing transactions and services in China, operating a dominant "phygital" model that is reshaping the country's massive real estate industry.81 The bull case for Beike is built on its unparalleled scale, its industry-standard Agent Cooperation Network (ACN), and its successful diversification into high-growth adjacent markets like home renovation and rentals. Despite near-term headwinds from the Chinese property market, Beike's asset-light platform model, strong network effects, and counter-cyclical growth in its emerging businesses position it to be a long-term winner and a primary beneficiary of any market stabilization or recovery.

Beike's business model is unique, combining an online platform with a vast offline network. It owns and operates Lianjia, China's leading real estate brokerage brand, which serves as the foundation and an integral part of its broader Beike platform.58 The Beike platform is an open, third-party platform that connects customers with a wide network of real estate agents, including those from Lianjia and other affiliated brokerage brands.81 The core of this model is the ACN, which facilitates information sharing and collaboration among agents, improving efficiency and service quality.81 The company operates across four main segments:

Existing home transaction services, New home transaction services, Home renovation and furnishing, and Emerging and other services, which includes home rentals.81

Beike is the largest online real estate transaction platform in China, a position it has solidified through its pioneering ACN.81 It has been compared to a combination of Zillow (for its online platform) and Redfin (for its brokerage arm) in the U.S..81 Its scale is immense, with over 60,000 stores and more than 550,000 agents on its platform as of mid-2025.24 This scale creates a powerful competitive moat, as the value of the network for both agents and consumers increases with each new participant.

Q2 2025 Financial & Operational Review

KE Holdings reported a resilient financial performance for the second quarter of 2025, demonstrating the strength of its business model amidst a challenging real estate market. Net revenues were RMB 26.0 billion ($3.6 billion), an 11.3% increase year-over-year.24

The company's Gross Transaction Value (GTV) grew by 4.7% to RMB 878.7 billion, with GTV from new home transactions growing at a faster pace of 8.5% compared to existing home transactions at 2.2%, showcasing the company's ability to outperform the broader market.24

Profitability was impacted by the market environment and strategic investments. Net income declined by 31.2% to RMB 1.3 billion, and adjusted net income fell by 32.4% to RMB 1.8 billion.24 This was partly due to a decrease in the operating margin, which contracted to 4.1% from 8.6% in the prior year.25

A key highlight of the quarter was the strong performance of its diversification strategy. Net revenues from non-housing transaction services (such as rentals and renovation) reached a record high of 41% of total net revenues, indicating the success of these new growth drivers.25

Primary Growth Vectors & Strategic Initiatives

Beike's long-term growth is being driven by the expansion of its platform network, its successful diversification into new services, and its commitment to shareholder returns.

Platform and Network Expansion: Beike continues to successfully expand its open platform model. In Q2 2025, the number of active non-Lianjia agents on its platform increased by nearly 24% year-over-year.24 The total number of stores on the platform grew by 31.8% to over 60,000, and the number of agents increased by 21.6% to over 557,000.24 This continued expansion of its network deepens its competitive moat and enhances the value proposition for all platform participants.

Diversification into Rentals and Renovation: The company's strategic push into adjacent services is proving to be a powerful growth engine, providing a counter-cyclical buffer against the volatility of the home transaction market. In Q2 2025, net revenues from home rental services surged by an impressive 78.0% year-over-year to RMB 5.7 billion, driven by the expansion of its "Carefree Rent" model.24 This rapid growth in a more stable, recurring-revenue business is a key part of the bull case.

Enhanced Shareholder Returns: Beike has demonstrated a strong commitment to returning capital to its shareholders. The company recently announced a significant expansion of its share repurchase program, increasing the authorization from $3 billion to $5 billion and extending it through August 2028.25 As of the announcement, the company had already repurchased approximately $2.18 billion worth of its shares. This aggressive buyback program, supported by the company's solid balance sheet, signals management's strong confidence in the long-term value of the business and provides a direct return to investors.

Valuation Case

KE Holdings' valuation appears attractive, especially considering its dominant market position and the long-term potential of China's housing services market. The company is trading at a P/E Non-GAAP (FY1) of 22.6x.59

The current valuation is heavily influenced by the cyclical downturn in the Chinese property market. However, this overlooks the resilience of Beike's platform model and the rapid growth of its counter-cyclical businesses. The company's ability to grow its GTV and revenue even in a tough market demonstrates its ability to gain market share and outperform its peers.24

The bull case is that Beike is a long-term structural winner in a massive industry. As the property market eventually stabilizes and recovers, Beike's transaction-based revenues will see a significant cyclical uplift. In the meantime, the rapid growth of its rental and renovation businesses is creating a more diversified and resilient revenue base. The current valuation offers an opportunity to invest in the clear market leader at a price that reflects near-term cyclical headwinds rather than its long-term structural growth potential.

Part III: Thematic Insights & Comparative Landscape

The AI Revolution: From Infrastructure to Application

Artificial Intelligence represents the most significant technological paradigm shift impacting the Chinese technology sector, and it has become the central pillar of the long-term growth strategy for the portfolio's largest companies. A comparative analysis reveals distinct but complementary strategies among the key players, suggesting the development of a comprehensive national AI ecosystem rather than a zero-sum competitive battle.

The sector's approach to AI can be broadly categorized into