Trading in the Absence of Truth

And Weekly Market Outlook

Hello traders,

Hope you had a great weekend.

Financial markets enter the second week of December 2025 confronting a fundamental challenge: the deterioration of the federal government’s economic data infrastructure. The 43-day government shutdown that ended in mid-November has created what analysts describe as an information deficit, forcing investors to rely on private-sector indicators and qualitative assessments rather than traditional government statistics as the Federal Reserve prepares for its last policy meeting of the year.

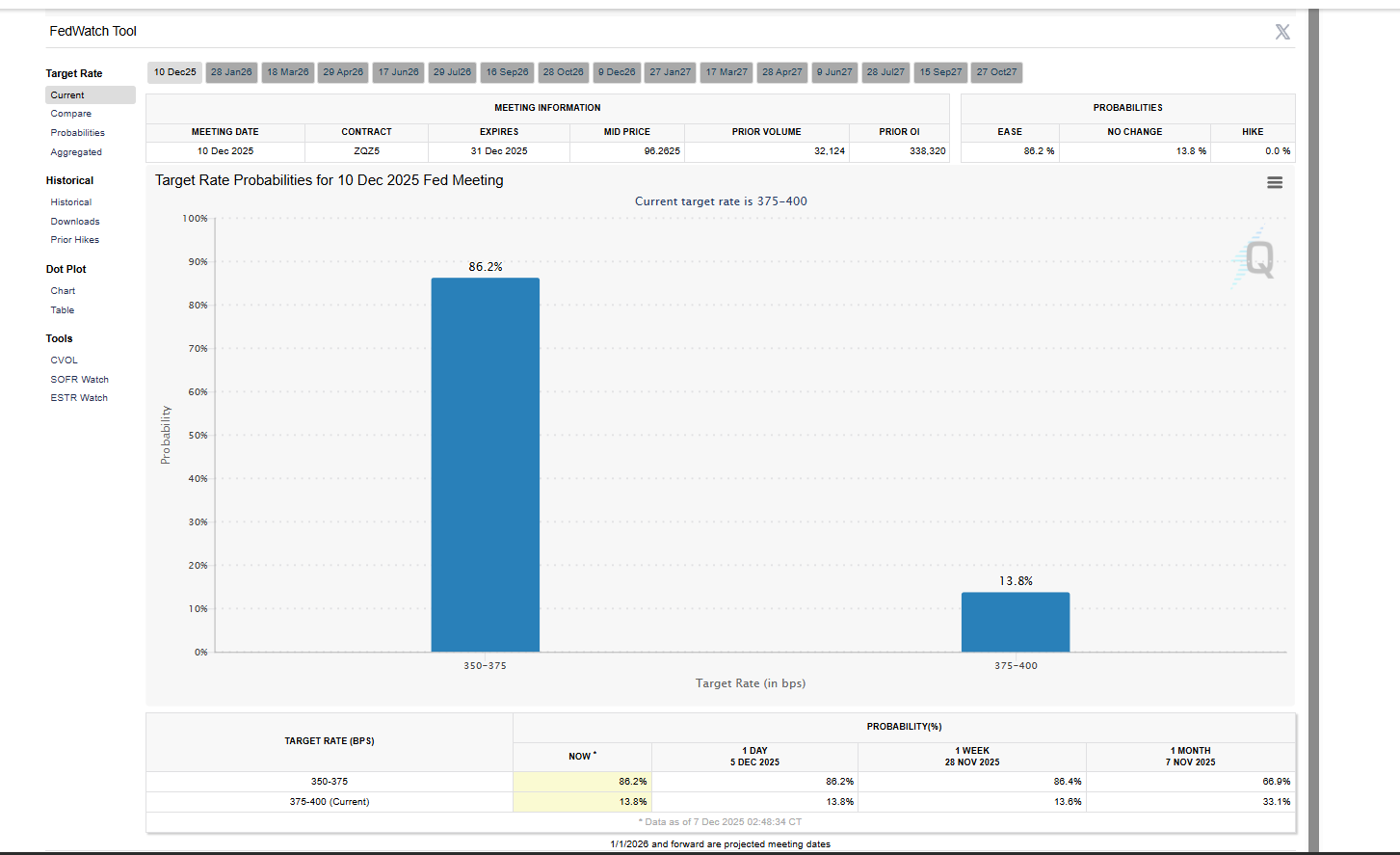

The prevailing consensus assigns an 86% probability to a 25-basis-point rate reduction at Wednesday’s Federal Open Market Committee meeting. Yet this confidence rests not on robust economic data but on expectations that the Federal Reserve, under Jerome Powell’s leadership, will yield to political pressures from the incoming administration. Kevin Hassett, widely expected to be nominated as Mr. Powell’s successor, has advocated for aggressive monetary easing and unorthodox housing policies that would represent a profound shift in the central bank’s traditional independence.

Algoflows Capital is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Realtime Discord access with equity positions tracker, intraday orderflow & option dealer summaries included with the paid newsletter membership . Click here to subscribe.

Geopolitical risk premiums appear compressed, meanwhile, despite persistent Middle East tensions following June’s limited military exchange between Israel and Iran. Market participants have largely priced in regional stability, even as intelligence reports indicate accelerated Iranian nuclear enrichment and Russian military technology transfers to Tehran. The leaked 28-point Ukraine peace proposal suggests a pragmatic, power-based approach to European security that could remove a key source of volatility while raising long-term questions about Western alliances.

In equity markets, a nascent rotation from momentum to value stocks has stalled, with small-cap shares and domestic industrial companies rallying anew. Technology sector positioning has grown more complex as competition intensifies between artificial intelligence leaders. This analysis outlines a framework I use for navigating these crosscurrents, emphasizing private-sector data sources, hard assets, and select equities positioned to benefit from structural trends.

I. The Federal Data Reliability Crisis

The most significant yet underappreciated variable this week is the degradation of America’s statistical reporting apparatus. Markets depend on timely, accurate information. When data quality deteriorates, mispricing and volatility typically follow.

The Imputation Problem

The Bureau of Labor Statistics produces the Consumer Price Index and Producer Price Index through rigorous survey collection. Field agents furloughed during the shutdown did not collect price data from retailers or conduct rental surveys. Consequently, October and November figures are being calculated through statistical imputation, a process that uses algorithms to estimate missing values based on historical patterns.

This methodology creates a circular feedback loop. If models assume inflation remains stable, they will produce stable readings regardless of underlying conditions. The November CPI report, delayed until December 18, will effectively reflect a modeled version of the pre-shutdown economy. While Federal Reserve officials understand these limitations, algorithmic trading systems that react to headline numbers may not, potentially generating sharp but unwarranted market moves that sophisticated investors should treat as noise rather than signal.

Labor Market Indicators

Tuesday’s Job Openings and Labor Turnover Survey release reflects September labor conditions, predating both the shutdown’s full impact and recent artificial intelligence-driven workforce reductions at major corporations. Private payroll data and corporate layoff announcements suggest employment is cooling more rapidly than the official unemployment rate indicates. The gap between the household survey, which captures gig economy workers, and the establishment survey, which can double-count multiple jobholders, may be at historically wide levels.

Strategic Implication: I discount official government data by roughly half and focus instead on private-sector indicators: aggregated credit card spending, trucking tonnage volumes, and commodity basis spreads. Any violent market reaction to the delayed CPI print later this month likely represents an opportunity to trade against the initial move.

The Trade Policy Legal Challenge

As data quality falters, the legal architecture of U.S. trade policy faces its most significant test in decades. The Supreme Court will soon rule on the Trump administration’s use of the International Emergency Economic Powers Act to impose reciprocal tariffs without congressional approval. The administration argues that trade deficits constitute a national emergency; plaintiffs, including major importers, contend this represents an unconstitutional seizure of legislative power.

November’s oral arguments revealed a deeply divided court. Textualist justices questioned the boundless definition of “emergency,” while executive-power advocates warned against constraining presidential foreign policy authority.

Scenario Analysis: A ruling upholding the tariffs would entrench the domestic manufacturing trade, boosting the dollar as the U.S. imports deflation and exports inflation. Conversely, a decision striking down the tariffs could trigger chaos: import prices would collapse, creating deflationary pressure while forcing the Treasury to refund billions in tariff revenue. Yet administration officials have already indicated they would use alternative statutory authority to maintain the tariff regime, suggesting investors should treat this policy as a durable feature, not a temporary anomaly.

II. Monetary Policy Regime Change

Wednesday’s FOMC meeting ostensibly concerns a 25-basis-point rate cut. In practice, it likely marks a transition point for central bank independence.

The Powell Conundrum

Mr. Powell enters this meeting with diminished authority. President Trump has signaled his intention to replace him with Mr. Hassett, who enjoys a 73% to 86% probability of nomination according to betting markets. This creates a prisoner’s dilemma: holding rates steady would demonstrate independence but invite White House retaliation, while cutting rates would appear to capitulate to political pressure.

Most analysts expect Mr. Powell to choose the path of least resistance, reducing the fed funds rate to the 3.50%-3.75% range while citing progress on inflation. The true signal will emerge in the Summary of Economic Projections. If the committee’s 2026 “dot plot” shifts upward, indicating fewer anticipated cuts, it would represent subtle resistance to the incoming administration’s stimulus preferences.

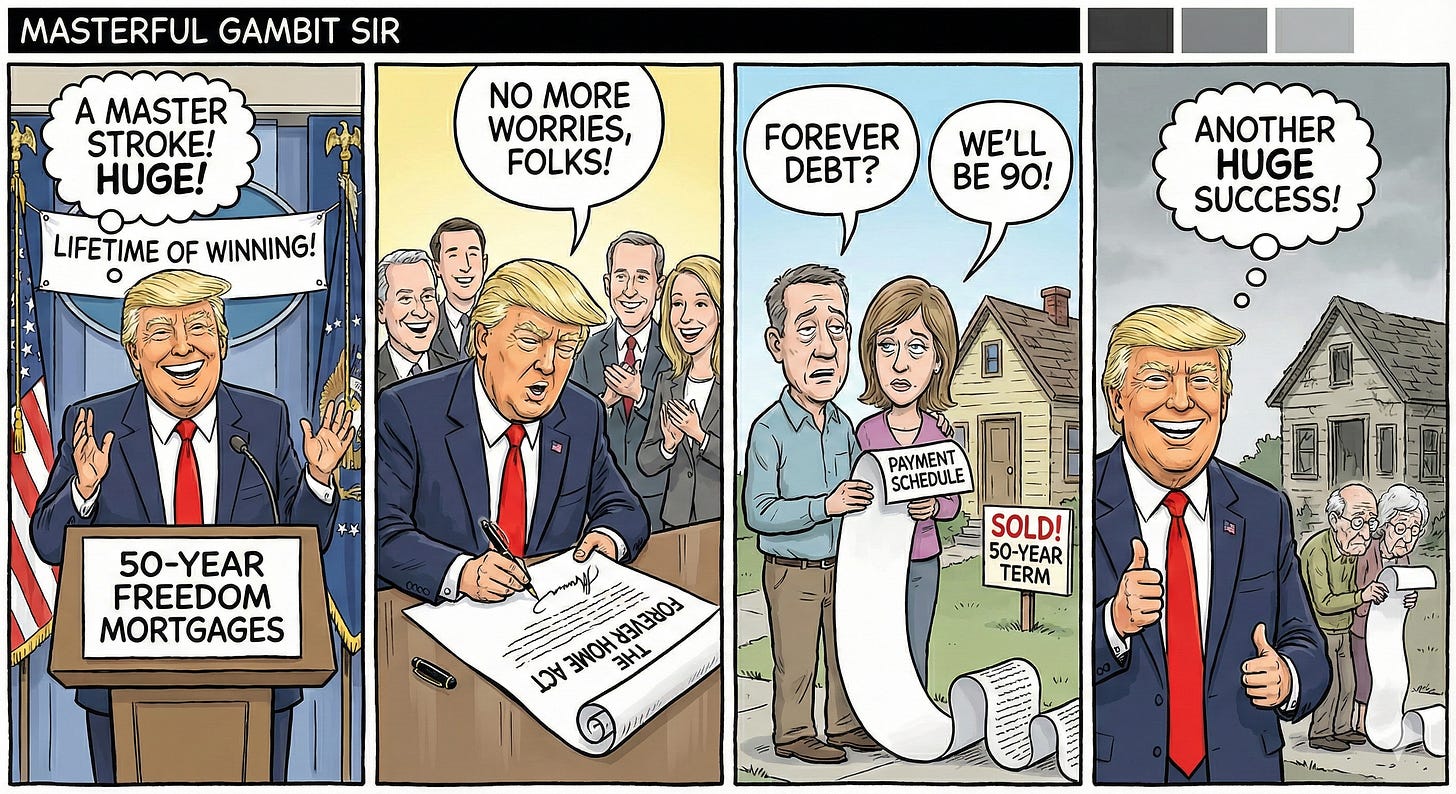

The 50-Year Mortgage Proposal

Mr. Hassett’s economic philosophy emphasizes supply-side stimulus over traditional austerity. His most radical proposal, floated recently through informal channels, would introduce a 50-year mortgage product.

This policy should be analyzed as a macroprudential tool rather than merely housing finance reform. Extending mortgage terms to 50 years would reduce monthly payments, theoretically improving affordability without reducing prices. However, amortization schedules would delay principal reduction for two decades, essentially converting homeowners into renters with call options on property appreciation. The private market would demand substantial term premiums to hold such long-duration paper in an era of fiscal expansion, implying the Federal Reserve would become a permanent buyer of these securities. This would effectively normalize quantitative easing as a structural feature of housing policy rather than an emergency measure.

Investment Implications: Such a regime would likely prove bullish for hard assets such as gold and Bitcoin while pressuring long-term Treasury yields higher as bond vigilantes demand compensation for debasement risk.

Bond Market Dynamics

The 10-year Treasury yield has remained stubbornly above 4.0% despite Fed easing signals, indicating the market is pricing in these longer-term inflation concerns. This week’s auctions will test demand.

Tuesday’s 10-year note sale will reveal whether foreign buyers and primary dealers demand a discount, or “tail,” to hold U.S. paper. Thursday’s 30-year bond auction represents a “Hassett risk” event, as long-duration instruments are most sensitive to the inflation implications of the proposed mortgage policy. A weak auction could push yields toward 4.25% and destabilize the equity rally.

The most logical macro expression of this view remains the “steepener” trade: shorting the long end of the curve while owning the short end, anticipating that Fed cuts will drop front-end yields while inflation risks lift long-end rates.

III. Geopolitical Realignment

As Western policymakers debate interest rates, the global order is reshaping around raw power dynamics rather than institutional rules.

Middle East: Fragile Equilibrium

Market participants have largely priced out regional war risk following June’s limited Israeli operation against Iranian nuclear facilities. This complacency may prove misplaced. While Israeli forces demonstrated tactical superiority using F-35 squadrons and autonomous drone swarms to penetrate Iranian airspace, the campaign did not deliver a strategic knockout blow.

Iran has since hardened defenses, reportedly training with Russian-made FPV drones and laser systems that complicate future strike calculations. More concerning, intelligence suggests Tehran has accelerated uranium enrichment in response, potentially crossing European diplomatic red lines that would trigger a second, more comprehensive Israeli attack.

The ultimate black swan remains closure of the Strait of Hormuz, through which 20 million barrels of daily oil production flow. In June, Iran’s parliament authorized closing the waterway, and while the supreme leader has not acted, the legal authority exists. If a renewed U.S. sanctions campaign threatens Iran’s oil exports, Tehran’s incentive to close the strait increases: if it cannot export oil, why should others? Unlike the Red Sea, which shippers can bypass, no practical alternative exists for Gulf oil transportation.

Ukraine: The Realist Turn

The leaked 28-point Trump administration peace plan confirms a pivot to pragmatic power politics. The proposal would require Ukraine to cede Crimea, Luhansk and Donetsk; renounce NATO aspirations; cap its military at 600,000 personnel; and accept gradual sanctions relief in exchange for security guarantees. For markets, this represents a potential peace dividend.

European energy assets would benefit from reduced risk to Ukrainian gas transit infrastructure and possible restoration of Russian gas flows to German industry, supporting shares in companies such as BASF and ThyssenKrupp. Defense contractors may face near-term multiple compression as hot war premiums evaporate, though European rearmament will likely continue as Eastern European nations realize they cannot rely exclusively on U.S. security guarantees.

IV. The Hard Asset Thesis

When government data becomes unreliable, central banks face politicization and geopolitical instability persists, capital migrates to assets resistant to debasement and sanctions.