Volatility is back!

Back again

Hello traders,

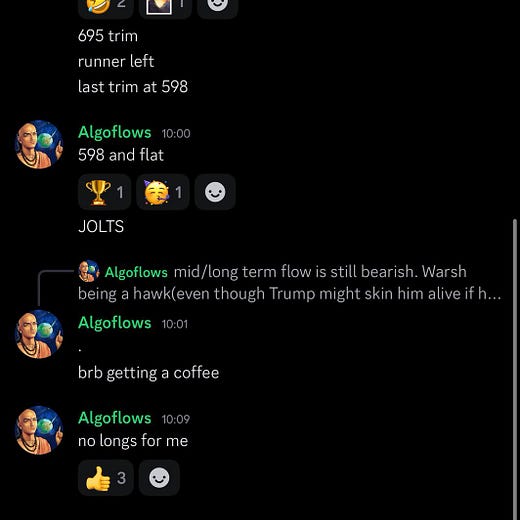

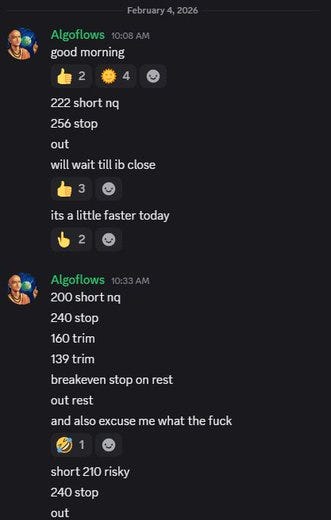

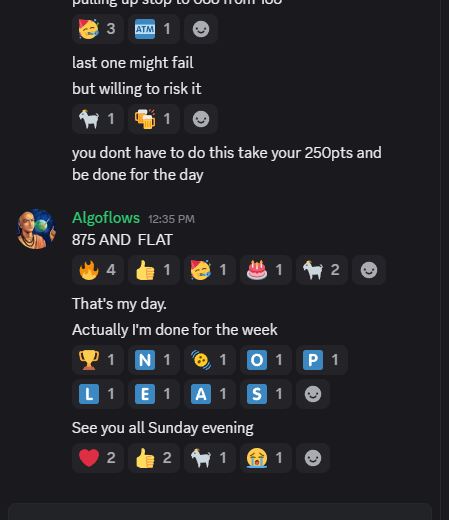

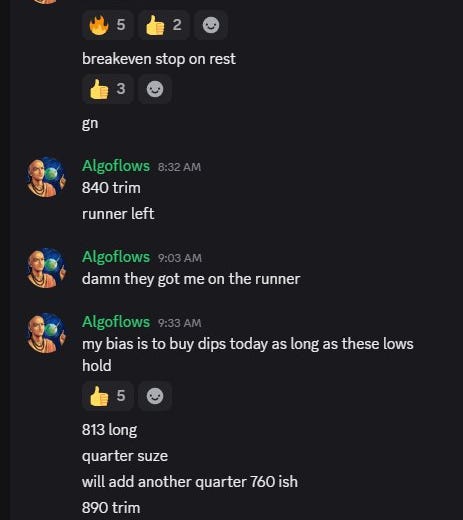

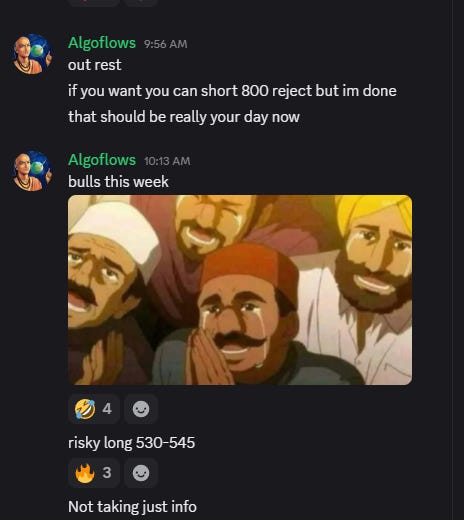

Last week we had one of the most volatile weeks in the recent history outside of the Liberation day week in the markets. We were on the right side of the volatility most of the times and reaped great rewards for it. Some snippets here.

Realtime Discord access with equity positions tracker(new website rolling out to select subscribers), intraday orderflow & option dealer summaries included with the paid newsletter membership . Click here to subscribe.

Our equity ideas were a glimmer of green in the sea of red.

Are We all Fucked?

That is exactly what you would feel if you opened the finance news-cycle over the last few weeks.

But is it really true?

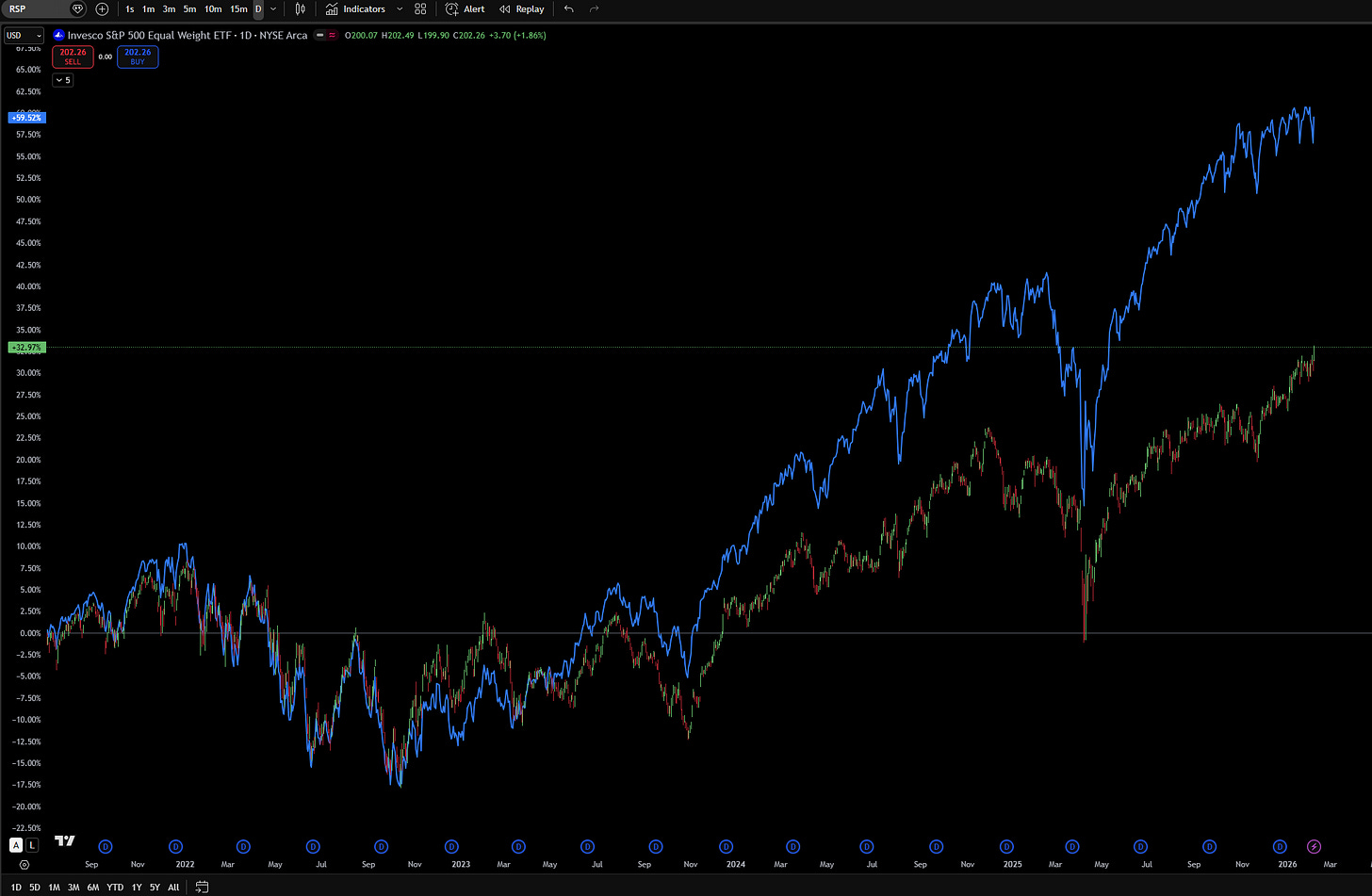

Equal weight S&P just made new all time highs and the S&P is off only a couple hundred bps from its own all time highs.

Then why is it that everyone is screaming from the top of their lungs as if a crash is coming?

The answer is leverage, it is always fucking leverage. People are levering themselves to the tits on Crypto-AI-Datacenter complex without looking at how the individual companies are performing, looking at you OKLO 0.00%↑ and IREN 0.00%↑ .

Last few weeks have shown you what you own is garbage and what is not.

There is no shame in riding garbage to the top but as the music stops, you should exit it. Full stop.

The other question is the AI capex spend. More on that below.

The $670 Billion Question

There’s an old saying in tech: “We tend to overestimate what we can accomplish in one year and underestimate what we can accomplish in ten.”

This week, one of the main stories was the wild Capex numbers by big tech.