Weekly Market Outlook 01/04/2026

Hello traders,

Wishing you all a Happy New Year. Thanking you all for your support and reading my thoughts on the markets over the past year. Wishing everyone another excellent year of outsized returns.

Now, let’s get to business.

1. THE CONVERGENCE OF REGIME CHANGE AND MONETARY FRAGILITY

The global financial architecture enters the first full trading week of 2026 confronting a geopolitical shock of a magnitude not seen since the late 20th century, coinciding precariously with a pivotal inflection point in United States monetary policy. As markets reopen on Monday, January 5, institutional allocators are forced to recalibrate risk models that were largely predicated on a “status quo” continuation of late-2025 trends. Instead, the sudden and dramatic United States military intervention in Venezuela: codenamed “Operation Absolute Resolve”. has shattered the geopolitical calm, injecting a profound volatility variable into energy markets, sovereign debt spreads, and the broader risk premium for emerging markets.

This kinetic event, resulting in the extraction of Venezuelan President Nicolás Maduro to the Southern District of New York, serves as a violent bookend to a holiday period that had already displayed signs of exhaustion in the equity complex. The much-anticipated “Santa Claus Rally” failed to materialize in the final week of 2025, leaving major indices like the S&P 500 (ES) and Nasdaq 100 (NQ) consolidating near all-time highs but showing distinct technical divergences. While the first trading day of 2026 (Friday, January 2) saw a tentative recovery with the S&P 500 advancing 0.60% and the Nasdaq 100 gaining 1.05%, the underlying breadth remains suspect, driven primarily by idiosyncratic headlines in the AI sector rather than broad-based accumulation.

Realtime Discord access with equity positions tracker, intraday orderflow & option dealer summaries included with the paid newsletter membership . Click here to subscribe.

Simultaneously, the “Kyiv Peace Pivot” is unfolding in Eastern Europe. A high-stakes summit of National Security Advisors from the “Coalition of the Willing” convened in Kyiv on January 3 to formalize a 28-point peace plan, creating a complex juxtaposition: potential de-escalation in Europe against rapid escalation in South America. This dichotomy creates a “barbell” risk environment where defense primes, energy volatility, and sovereign-grade collateral become the primary vehicles for hedging, while high-beta technology and consumer discretionary sectors face headwinds from a resurgence in the 10-year Treasury yield, which has reclaimed the psychologically significant 4.20% level.

The macroeconomic backdrop for these geopolitical fireworks is a Federal Reserve that has shifted its narrative from aggressive easing to a cautious “pause.” The upcoming December Employment Situation Report (NFP), scheduled for release on Friday, January 9, serves as the final arbiter for the January 27-28 FOMC decision. With the consensus forecast for job growth narrowing to a tepid +55,000 and average hourly earnings projected to rise 0.3% month-over-month, the specter of “stagflation-lite”; slowing growth with sticky wage inflation:threatens to trap the Fed in a “higher for longer” stance despite the geopolitical turbulence.

2. GEOPOLITICAL DEEP DIVE: THE NEW ERA OF INTERVENTIONISM

2.1 Operation Absolute Resolve: Structural Shift in Global Energy Security

On the morning of January 3, 2026, the geopolitical risk calculus for the Western Hemisphere changed fundamentally. U.S. forces, including elements of the 160th Special Operations Aviation Regiment and Delta Force, executed a direct military extraction of Venezuelan President Nicolás Maduro and First Lady Cilia Flores from the Miraflores Palace in Caracas. This operation, termed “Operation Absolute Resolve,” was framed by President Donald Trump as a necessary action to dismantle a “narco-terrorist” regime and secure critical energy resources for the Western world.

The “Trump Premium” and Energy Market Mechanics The immediate reaction in energy markets is likely to be characterized by extreme confusion, creating a “bull trap” for those operating on superficial narratives. President Trump’s declaration that the U.S. will temporarily “run” Venezuela to facilitate a transition and “get the oil flowing” aims to project a bearish supply shock: suggesting that Venezuela’s massive reserves (over 300 billion barrels, the largest in the world) will flood the market and depress prices.

However, a granular analysis of the Venezuelan infrastructure reality suggests the opposite in the short-to-medium term:

Infrastructure Decay vs. Potential: Venezuela’s current production hovers around 1 million barrels per day (bpd), a fraction of its early-2000s peak of over 3 million bpd. The degradation of PDVSA (the state oil company) infrastructure is profound. Industry experts estimate that restoring production to 4 million bpd would require capital expenditures exceeding $100 billion and a timeline spanning roughly a decade. There is no “switch” to flip; the recovery will be a grinding, capital-intensive process.

Immediate Supply Shock Risk: The transition period presents acute risks of asymmetrical warfare. Pro-regime remnants, potentially aided by embedded Cuban or Russian operatives, possess the capability to sabotage pipelines, refineries, and export terminals. Furthermore, the legal vacuum created by the removal of the head of state freezes current export contracts, particularly those involving “grey market” shipments to China and India.

The China Disconnect: Venezuela currently exports approximately 600,000 bpd to China, largely as repayment for billions in loans. A U.S.-controlled transitional government is highly likely to nullify these “oil-for-loans” agreements, declaring them odious debt incurred by an illegitimate regime. This forces Beijing into the spot market to replace this heavy crude supply, ironically tightening the global sour crude market even as the U.S. promises abundance.

Sovereign Risk and Emerging Markets The audacity of the operation: the first direct removal of a Latin American head of state since the invasion of Panama in 1989 which forces a repricing of sovereign risk across the region. Leaders in Colombia, Mexico, and Brazil have expressed “deep concern” regarding the violation of international law. Investors must now factor in a “sovereignty risk premium” for assets in countries politically aligned against Washington, potentially widening spreads on EM hard currency debt and putting pressure on currencies like the Colombian Peso and Brazilian Real.

2.2 The Kyiv Peace Summit: A Fracture in the Alliance?

While Washington turned its gaze south, a critical diplomatic summit occurred in Kyiv on January 3. National Security Advisors from the “Coalition of the Willing” a subset of NATO and EU partners: met with Ukrainian officials to discuss a controversial peace plan.

The “Land for Peace” Dilemma The peace plan under discussion reportedly involves significant concessions. The U.S. proposal suggests Ukraine may need to cede territory currently occupied by Russia: approximately 20% of the country, including the 5,600 sq km captured by Russian forces in 2025 alone. in exchange for peace. This proposition is politically toxic for President Zelenskyy, who continues to maintain that borders must not be changed by force.

European Divergence: A rift is emerging between the U.S. administration, which seeks a rapid conclusion to the conflict to focus on domestic and hemispheric issues, and European capitals (London, Warsaw, Baltic states) that view territorial concessions as an existential threat to the European security order.

The “Backstop” Security Architecture: To mitigate the risk of future Russian aggression, the plan proposes a multilateral framework where European-led troops would deploy in Ukraine as a “tripwire” force, backed by a U.S. strategic deterrent. This shift from a unified NATO posture to a “Coalition of the Willing” implies a fragmentation of the alliance, potentially weakening the Euro (EUR) in the medium term as defense burdens shift decisively to European budgets.

2.3 The Middle East: The Preemptive Strike Calculus

The geopolitical risk matrix is further complicated by developments in the Levant. Intelligence reports circulating on January 1 indicate that Israel is mobilizing special rapid intervention units along the Lebanese border, signaling readiness for a “preemptive” operation against Hezbollah.

Hezbollah’s Reconstitution: Israeli defense assessments suggest Hezbollah has used the recent ceasefire to reconstitute its Radwan Force and rebuild missile stockpiles in southern Lebanon. The IDF conducted 17 airstrikes on January 2, the most extensive wave in months, targeting training facilities and weapons depots.

The “Second Strike” Scenario: Reports indicate that Prime Minister Netanyahu and President Trump have discussed a “second strike” on Iran, focusing on nuclear facilities. While the Venezuela operation dominates the current news cycle, the trigger for a massive spike in oil prices (WTI > $80) remains in the Persian Gulf. Any Israeli ground incursion into Lebanon would likely catalyze this risk, counteracting any bearish sentiment from the Venezuela “supply glut” narrative.

3. MACROECONOMIC FRAMEWORK: THE FEDERAL RESERVE & DATA GAUNTLET

3.1 The Federal Reserve: Pause, Not Pivot

The Federal Reserve enters 2026 with a target rate range of 3.50%-3.75%, having executed three consecutive 25 basis point cuts in late 2025. However, the narrative of a seamless “soft landing” is fraying. The minutes from the December 9-10 FOMC meeting reveal a committee deeply divided on the path forward.

The Hawk/Dove Split The minutes highlight a significant schism. “Hawkish” participants argued for holding rates steady to ensure inflation returns durably to the 2% target. Surprisingly, usually dovish members like Chicago Fed President Austan Goolsbee, along with Jeffrey Schmid, preferred no change to the target range at the December meeting, suggesting a growing consensus for a pause to assess the impact of prior easing. This hawkish dissent from key members complicates the pivot narrative.

The “Pause” Consensus Current pricing in the Fed Funds Futures market suggests the Fed will hold rates steady at the January 27-28 meeting. This “pause” is predicated on the need to assess the cumulative impact of the 2025 cuts and the inflationary implications of the new administration’s tariff policies. The Fed is effectively in “data dependency” mode, making every data release a binary volatility event for markets.

3.2 The Treasury Market: The 4.20% Danger Zone

The 10-year U.S. Treasury yield closed the week at 4.20%, rising 3 basis points on Friday and up 13 basis points over the past month. This resurgence in yields is a critical headwind for equity valuations.

Valuation Compression: A sustained move above 4.25% begins to severely compress the Equity Risk Premium (ERP). With the S&P 500 trading at elevated multiples, the yield support for such valuations erodes rapidly as the risk-free rate rises.

Supply Indigestion: The Treasury is scheduled to auction a massive slate of debt this week, including 3-month and 6-month bills, and 3-year notes. The sheer volume of issuance required to fund the fiscal deficit: exacerbated by potential costs associated with the Venezuelan reconstruction effort; puts structural upward pressure on the entire yield curve.

The Inflation Expectation: With average hourly earnings forecast to rise 3.6% year-over-year , wage inflation remains uncomfortably high for a Fed targeting 2%. If the Venezuela operation leads to a short-term spike in gasoline prices due to uncertainty, headline CPI (due Jan 13) could surprise to the upside, forcing the Fed to abandon its dovish bias.

3.3 Economic Calendar Analysis: The Week Ahead

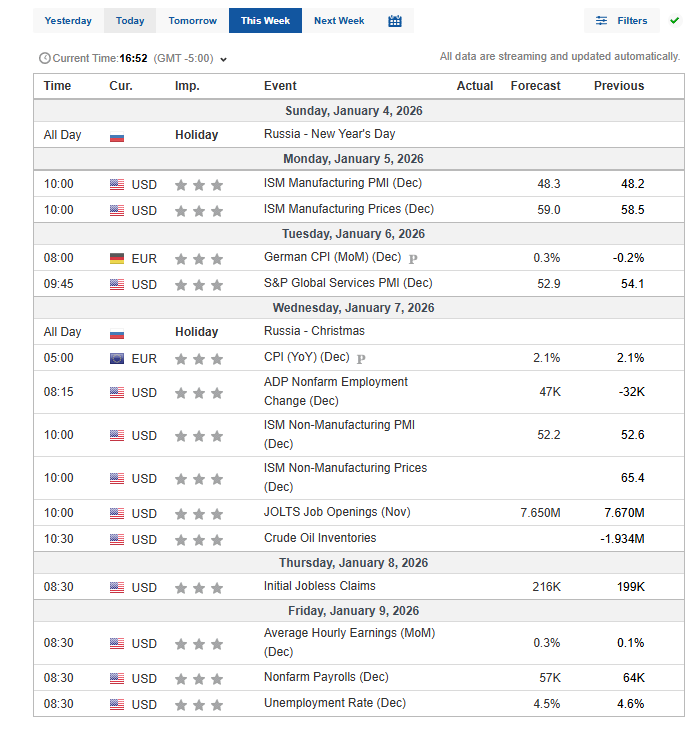

The economic calendar for the week of January 5 is back-loaded, culminating in the critical Employment Situation Report. However, early-week data will set the tone for GDP expectations.

4. MARKET ANALYSIS: ASSET CLASS TECHNICALS & FLOWS4.1 Index Futures: S&P 500 (ES) & Nasdaq 100 (NQ)

Market Context: The “Santa Claus” Failure The S&P 500 and Nasdaq posted double-digit gains in 2025, marking the third consecutive year of green finishes: a run likened to the 2019-2021 period. However, the “Santa Claus Rally”typically the last five days of December and first two of January failed to materialize in late 2025, with indices logging declines in the final four sessions. While January 2 saw a bounce (ES +0.60%, NQ +1.05%), this price action occurred on low holiday volume and faces immediate validation tests.