Weekly Market Outlook 04/06/2025

We are gonna win so much you will get tired of winning

Hello traders,

President Donald Trump unleashed sweeping tariffs on global imports last week, sending markets into a tailspin and prompting retaliatory threats from major trading partners. The measure, dubbed "Liberation Day," imposes a baseline 10% duty on all U.S. imports with additional "reciprocal tariffs" reaching as high as 49% for certain nations.

The tariffs, which took effect April 5 for the baseline duties and April 9 for country-specific levies, represent the administration's most aggressive trade action to date. Officials say the measures address perceived trade imbalances by matching what they claim other nations impose on American goods.

China Hit Hardest as Trade Tensions Escalate

China faces the steepest effective tariff rate at 54%, combining the new 34% reciprocal duty with existing 20% tariffs implemented earlier in the administration. The measure targets America's second-largest import source, which supplied $439 billion in goods last year.

The administration eliminated the $800 "de minimis" exemption for Chinese and Hong Kong imports, effective May 2, directly impacting consumer platforms like Temu, Shein and AliExpress.

"These measures close critical loopholes exploited by Chinese manufacturers attempting to circumvent existing trade restrictions," a senior administration official said.

Beijing's Commerce Ministry promptly vowed "resolute countermeasures," announcing retaliatory duties on U.S. agricultural exports. State media characterized the move as "self-defeating bullying."

Southeast Asian Manufacturing Hubs Stunned

Smaller economies received unexpectedly harsh treatment, with Cambodia facing a 49% reciprocal tariff and Vietnam 46%, both atop the 10% baseline duty.

For Cambodia, which exported $12.7 billion to the U.S. in 2024 mostly in garments and footwear, the impact could be devastating to its export-dependent economy. Vietnam, which had benefited from supply chain shifts away from China, now sees its $136.6 billion export relationship with the U.S. imperiled.

"The severity of these tariffs caught us off guard," said a senior Vietnamese trade official, who requested anonymity. "This undermines our Comprehensive Strategic Partnership established just last year."

Europe Prepares Response as Tensions Mount

The European Union received a 20% reciprocal tariff on top of the baseline 10%, despite official WTO figures showing EU's average import duty at 2.7%. The White House claims the bloc's effective tariff rate on American goods reaches 39% when accounting for non-tariff barriers.

European Commission President Ursula von der Leyen called the action "a major blow to the world economy" during an emergency press conference. "We are finalizing a strong plan to protect European interests," she said.

Italian and Spanish producers of wine, olive oil and automotive components brace for substantial market disruption, with Italy's $2.2 billion wine export business particularly vulnerable.

North American Neighbors Get Partial Reprieve

In a strategic carve-out, Canada and Mexico avoided the new reciprocal tariffs and baseline 10% duty for goods compliant with the United States-Mexico-Canada Agreement. However, both nations remain subject to pre-existing 25% tariffs on steel, aluminum and certain automotive products implemented earlier this year.

Canadian Prime Minister Mark Carney announced 25% retaliatory duties on U.S. vehicles failing to meet USMCA requirements. "We will defend Canadian workers while seeking diplomatic resolution," he said.

Mexico's President Claudia Sheinbaum opted against immediate countermeasures, instead unveiling what she called a "comprehensive adaptation program" to mitigate economic fallout.

Markets Tumble on Trade War Fears

Wall Street recorded its worst trading day since June 2020 on April 3, with the S&P 500 dropping nearly 5% and the Nasdaq plummeting over 9%. The Dow Jones Industrial Average shed more than 1,200 points.

Companies heavily exposed to affected supply chains bore the brunt of investor anxiety. Apple fell over 9% intraday—its steepest decline since 2019—while Dollar Tree, which sources 32% of its merchandise from China, lost more than 10%.

"These tariffs present significant inflation risk at a time when the economy was already showing signs of cooling," said Maria Gonzalez, chief economist at Global Financial Partners. "The potential for a global trade war significantly raises recession probability."

JPMorgan raised its global recession forecast to 60% probability by year-end, up from 40% previously.

Economic Outlook Darkens

The administration frames "Liberation Day" as a correction to decades of trade imbalances that will revitalize domestic manufacturing and generate federal revenue. Treasury Department projections suggest the measures could yield $175 billion annually.

However, economists warn of stagflation risks as consumer prices rise while economic growth stalls. The Center for Strategic and International Studies projects GDP could contract by approximately 1%, representing about $300 billion in economic activity.

Consumer costs could increase between $1,000 and $3,800 per household annually according to various economic models, with the Conference Board reporting consumer sentiment at a 12-year low following the announcement.

As markets adjust to the new trade landscape, importers face difficult decisions about supply chain reconfiguration, price increases, or margin compression—with American consumers ultimately footing much of the bill.

Moving on,

Reviewing select trades of the week.

Monday:

Tuesday:

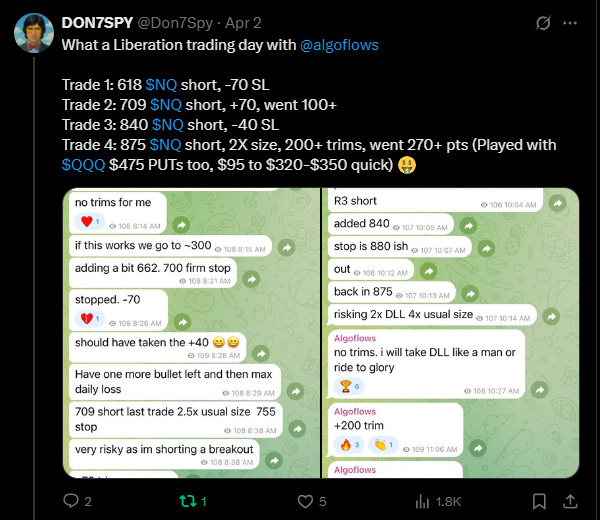

Wednesday (The Liberation day Short):

Thursday: My worst trading day of the year (so far) and wiped almost all weekly gains up to that point.

I would change nothing about Thursday (other than the outcome!). In poker terms, it was a Quad Ace and I got a bad beat.

My Markov chain model signalled a short term regime shift and the XGBoost model also pointed towards a reversal. Execution wise, I could have cut the position a bit sooner but we live and we learn.

The result of a stochastic process does not determine the quality of the decision. My model was balls to the wall long so I positioned myself such.

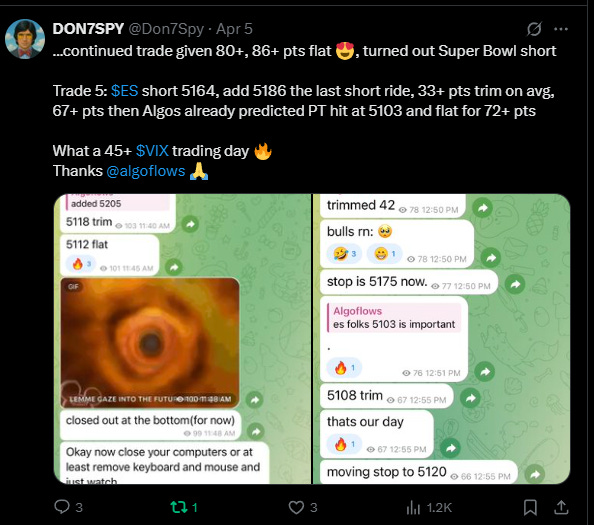

After a nice dinner on Thursday ( I do not believe in depriving yourself of nice things because the end result was off, as long as you followed a process, you win) and recalibrating myself we were back at it Friday and closed out the week with AM NQ longs and then ES shorts in the afternoon.

So What’s next Algo?

Markets do not tend to stay at extremes forever.

Volatilty tends to subside eventually and over the next 6 months, historical S&P returns have mostly been positive.

This week is poised for significant market turbulence, requiring us to adapt swiftly to unfolding developments as we track updates from key global players, most notably China. With China’s retaliatory tariffs scheduled to take effect on Thursday, the opportunity for negotiating a deal or securing a deferment is critically constrained, underscoring the urgency of the situation.

A few Truth’s the President posted on Truthsocial seem to indicate that he wants to cut a deal

And others look like he wants a full-blown Trade War.

If I had to hazard a guess, we could reach an interim postponement by Thursday or so causing a small to medium scale relief rally on US equities. But predicting anything the maverick President does is not quantitative.

We do also have CPI and PPI releases this week alongwith the FOMC minutes.

President Trump urged the Fed Chair Powell to cut rates on Truthsocial last week.

But if we see an uptick in core inflation, those hopes would be dashed quickly.

A slightly cooler or in-line CPI can also provide some succor to the markets especially RTY. Conversely, a hotter CPI print can be a gut punch for the markets and can send ES to 4766 or so.

Weekly Levels:

Subscribers are urged to use the tradingview indicator to plot the levels.