Weekly Market Outlook 04/13/2025

Hist(oric/rionic) Week

Hello traders,

We had one of the craziest weeks in the history of the markets this past week.

As mentioned in last week’s plan, Trump enacted a 90 day pause on Tariffs.

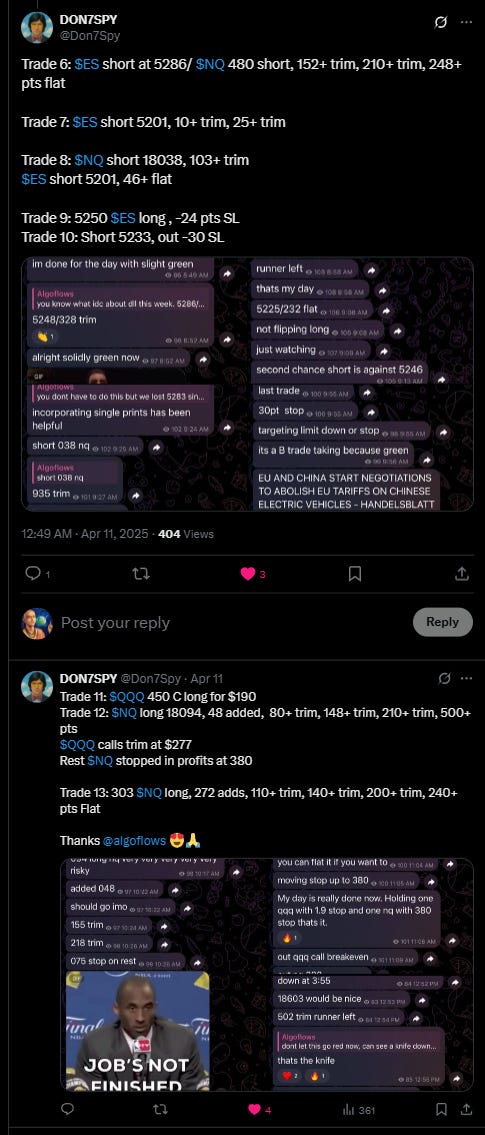

Just a quick recap of select trades from last week.

Sunday/Monday:

Tuesday:

Wednesday:

Thursday:

Friday:

Moving on,

Yesterday, we got an update from the Trump admin that semiconductors, electronics including mobile phones are exempt from the Tariffs.

All good and we float up to infinity….

Not so fast bucko

Howard Lutnick, Commerce Secretary under President Donald Trump, indicated on Sunday that the temporary exemptions from reciprocal tariffs for certain electronics may soon end, with targeted tariffs for these products on the horizon.

“They’re exempt from the reciprocal tariffs, but they’re included in the semiconductor tariffs, which are coming in probably a month or two,” Lutnick stated on ABC News’ “This Week.”

He clarified, “So this is not like a permanent sort of exemption. [Trump’s] just clarifying that these are not available to be negotiated away by countries.”

Lutnick emphasized, “These are things that are national security that we need to be made in America.”

Lutnick’s remarks dampen expectations that consumer electronics manufactured in China, including computers, laptops, smartphones, and flat-panel TVs, would remain exempt from Trump’s 145% reciprocal tariffs—levies that increase costs for U.S. importers and are typically passed on to consumers.

His comments further muddy the waters of Trump’s tariff policy, which has seen frequent revisions. Democratic lawmakers on Sunday described these shifts as creating “chaos” and a “crisis of credibility” for the administration.

UPDATE AS OF 3:36 PM ET:

WHAT A SHITSHOW.

WALL OF TEXT INCOMING, YOU CAN SKIP TO LEVELS AT THE END IF YOU WANT TO.

The defining feature of the current market environment is the unprecedented shift in U.S. trade policy. The implementation of sweeping tariffs, culminating in rates reaching 125% on Chinese goods and a baseline 10% on most other imports (subject to potential 90-day negotiation windows for non-China partners), has fundamentally altered the global economic landscape. This policy shock dwarfs previous trade skirmishes and introduces multiple layers of uncertainty that will dominate market narratives in the coming weeks and months.

Tariff Shockwaves: The Inflationary Overhang and Growth Fears

The immediate and most pressing concern stemming from the tariffs is their potential inflationary impact. While last week's Producer Price Index (PPI) surprisingly showed a month-over-month decline of 0.4% for March5, this data predates the full implementation of the most severe tariff hikes. Market participants largely dismissed the PPI data as a reflection of a bygone, lower-tariff world.

The critical question now is how quickly and significantly these new import duties will translate into higher consumer prices. Federal Reserve officials are already adjusting their forecasts. New York Fed President John Williams explicitly stated that he expects the current trade policies to accelerate inflation this year, potentially pushing it into the 3.5% to 4% range. This represents a substantial increase from the Fed's preferred measure, the Personal Consumption Expenditures (PCE) Price Index, which stood at 2.5% year-over-year in February10. Williams further anticipates a significant economic slowdown, forecasting real GDP growth to fall "somewhat below 1%" and the unemployment rate to rise from its current 4.2% to between 4.5% and 5%. This paints a concerning picture of potential stagflation – rising prices coupled with stagnant or falling economic output.

The impact is not expected to be uniform. Industries heavily reliant on global supply chains, particularly those sourcing components or finished goods from China, face the most direct pressure. The technology sector, a cornerstone of the Nasdaq 100, is particularly exposed. Conversely, domestically focused industries or those potentially benefiting from import substitution could theoretically see relative strength, although the broader dampening effect on consumer purchasing power from higher prices remains a significant headwind for almost all sectors.

Furthermore, the risk of retaliation hangs heavy. China has already responded with tariff hikes, and the European Union has signaled its intent to do the same. An escalating tit-for-tat trade war could severely depress global trade volumes, further undermining economic growth projections worldwide. Goldman Sachs explicitly modeled scenarios where a global GDP deceleration resulting from trade conflicts could push Brent crude down significantly. The uncertainty surrounding the scope and duration of these tariffs, alongside the potential for sudden policy reversals or escalations, creates an environment where risk premiums are likely to remain elevated.

Bond Market Vigilance: Yields as Policy Barometer

The U.S. Treasury market reacted violently to the initial tariff announcements last week, sending yields sharply higher. The benchmark 10-year Treasury note yield ended the week at 4.48%, its highest point since mid-February, while the 2-year note settled at 3.96% and the 30-year bond reached 4.85%. This spike, occurring despite the seemingly benign PPI data, underscored the market's forward-looking concern about tariff-fueled inflation and potentially larger government deficits if economic activity slows significantly.

Market commentators suggested this bond market "rebellion" directly influenced policy, potentially prompting the administration's subsequent clarification regarding the 90-day negotiation window for non-China partners. Whether accurate or not, it highlights the Treasury market's critical role as a signaling mechanism and its potential to constrain policy actions.

Entering this week, bond yields remain elevated. The focus will be on:

Economic Data Reaction: How will yields respond to key releases like Retail Sales and Jobless Claims? Stronger-than-expected data could push yields higher on reinforced inflation fears, while weak data might temper the rise but raise growth concerns.

Treasury Auctions: While no major coupon-bearing auctions are scheduled for the April 14-18 period according to available calendars, ongoing Treasury bill auctions and market sentiment towards U.S. debt will be monitored. The resilience shown in last week's 10-year auction suggests underlying demand persists, but sentiment can shift rapidly.

Yield Curve Dynamics: The 10-year/2-year spread remains a focal point. While it ended last week slightly positive after a period of inversion, the curve's shape is still viewed by many as a recessionary indicator. A further steepening driven by rising long-term yields (inflation fears) differs significantly from a steepening driven by falling short-term yields (Fed cutting expectations). Currently, the former seems more dominant.

The high level of yields directly impacts borrowing costs across the economy, from mortgages to corporate debt, potentially acting as a further brake on economic activity – a feedback loop the Fed will be watching closely.

Federal Reserve's Tightrope Walk: Data Dependency in High-Uncertainty Era

Susan Collins, president of the Boston Federal Reserve, stated that "markets are continuing to function well" and noted that "we’re not seeing liquidity concerns overall." However, she emphasized the central bank's readiness, saying it "does have tools to address concerns about market functioning or liquidity should they arise." Reflecting on previous actions, she told the Financial Times, "We have had to deploy quite quickly, various tools" to manage turbulent market conditions. She affirmed, "We would absolutely be prepared to do that as needed."

The Federal Reserve finds itself in an increasingly difficult position. The dual mandate of maximum employment and price stability is being pulled in opposing directions by the new tariff regime. As articulated by NY Fed President Williams, the tariffs are expected to increase both inflation and unemployment – a stagflationary outcome that complicates traditional monetary policy responses.

Key considerations for the Fed outlook this week:

Acknowledging Tariff Impact: Officials like Williams are openly discussing the inflationary and growth-damping effects. This transparency is crucial for market understanding, but it doesn't simplify the policy choice. Raising rates to combat tariff inflation could exacerbate the economic slowdown, while cutting rates to support growth could allow inflation expectations to become unanchored.

Data Dependency Amplified: The Fed's commitment to data dependency becomes even more critical. This week's Retail Sales and Jobless Claims data will be intensely scrutinized for early signs of consumer retrenchment or labor market stress directly attributable to the tariff environment.

Inflation Expectations Management: Williams stressed the importance of preventing longer-run inflation expectations from becoming "unmoored". The Fed will use its communication tools (speeches by officials Harker, Bostic, and Hammack this week) to reiterate its commitment to the 2% inflation target, even as near-term readings are likely to be distorted upwards by tariffs.

Balance Sheet Policy: The FOMC recently decided to slow the pace of its balance sheet reduction ("quantitative tightening" or QT). Williams characterized this as a technical adjustment to ensure smooth market functioning and maintain ample reserves, explicitly stating it has "no implications for our intended stance of monetary policy". However, in a volatile market, any Fed balance sheet action draws scrutiny.

Rate Path Uncertainty: Market expectations for rate cuts have been volatile. While the Fed's March projections suggested potential cuts later in 2025, the tariff situation introduces significant upside risk to the inflation forecast, potentially delaying or reducing the scope for easing. Futures markets will continue to reprice Fed expectations based on incoming data and Fed rhetoric.

The Fed is likely to remain in a holding pattern on rates in the immediate term, preferring to gather more data on the real-world impact of the tariffs before committing to a policy path adjustment. Their commentary will be crucial in managing market expectations during this period of heightened uncertainty.

This newsletter was bullish entering into last week and the stance has been vindicated by both Spooz and Q’s up 5.7% and 7.2% respectively.

Barring more news, this momentum should be carried forward this week.

AAII sentiment levels are at historic lows and as history indicates, over the rolling 12 months, markets have been way higher (9% average). S&P also had some very real bottom signs put in last week with it opening negative 200bps and closing out at highs. This usually is an indicator of a bottom, however this is a news-driven market so we cannot bet the farm on this statistic alone.

So the newsletter is cautiously bullish this week, (more real time updates would be sent on Telegram to paid subscribers)

Weekly Levels:

Subscribers are urged to use the tradingview indicator to plot the levels.

Keep reading with a 7-day free trial

Subscribe to Algoflows Capital to keep reading this post and get 7 days of free access to the full post archives.