Weekly Market Outlook 10/12/2025

Tariffs back on the table.

Hello all,

Last week we finally got some volatility going and the S&P/Nasdaq had a 2.7%/3.5% down day on Friday after President Trump’s remarks on China regarding tariffs.

Last week, the newsletter talked about Zcash cryptocurrency and in one of the most tumultuous week for crypto(where we saw some tokens crash 90%) we are up 74% on the trade.

Realtime Discord access with intraday orderflow & option dealer summaries included with the paid newsletter membership . Click here to subscribe.

The Dragon and the Eagle: A High-Stakes Game of Chicken

The primary catalyst for last week’s market turmoil was a sharp re-escalation in the US-China trade conflict. On Friday, President Trump announced via social media his intention to increase tariffs on Chinese imports to 100%, a significant jump from the current 30% rate, with an effective date of November 1st. This move was a direct retaliation to China’s decision earlier in the week to tighten its export controls on rare earth minerals and associated refining technologies, a move aimed at the heart of the US technology and defense sectors. The market’s reaction was swift and severe. Equity indices unwound a month’s worth of gains in a single trading session, and a wave of deleveraging washed over all asset classes, with cryptocurrency markets being particularly affected.

The prevailing analytical framework for this confrontation is that it represents a calculated “escalate to de-escalate” strategy. This view is supported by the historical precedent of the April 2025 “Liberation Day” event, where a similarly unexpected tariff announcement caused a sharp but temporary market downturn before leading to a 90-day pause for negotiations. The current situation appears to follow a similar script: both sides are posturing to maximize their leverage ahead of a planned summit between President Trump and President Xi in South Korea. The November 1st deadline for the new tariffs provides a one-month window for diplomacy, and President Trump’s subsequent retraction of his threat to cancel the summit reinforces the notion that negotiation, not open conflict, is the desired end-state.

This strategic game is defined by the unique leverage each nation wields. China’s primary weapon is its near-monopolistic control over the processing of rare earth elements, which are indispensable for a vast array of modern technologies, including semiconductors, electric vehicles, and advanced military hardware. The US, in turn, holds leverage through its control of critical semiconductor technology and its unparalleled access to the world’s largest consumer market and the global financial system. However, the evidence suggests that China’s state-controlled economy may be better positioned to absorb economic pain than the more market-driven US economy, especially with American midterm elections just one year away. The fact that Chinese exports have remained robust despite years of existing tariffs lends credence to this argument, suggesting China may have the stronger hand in this negotiation.

While the base case remains a negotiated de-escalation, this strategy is fraught with peril. The market is attempting to price in a rational outcome where both sides make concessions to avoid a mutually destructive trade war. This model, however, relies on both leaders being unconstrained and purely rational actors. Domestic political pressures in both nations could force a more hardline stance than is economically optimal. In the US, the upcoming election cycle may incentivize a show of strength, while in China, President Xi must project an image of unwavering resolve. A misinterpretation of the other’s red lines or an unforeseen domestic event could easily lead to an accidental, cascading escalation from which neither side can retreat without significant political cost. The sharp sell-off on Friday indicates that the market is not fully discounting this possibility. Therefore, while the most probable outcome is a deal, the tail risk of a full-blown trade war has materially increased, ensuring that volatility will remain elevated.

The Powell Pivot: The Fed’s Labor Market Put

Underpinning the market’s resilience is a fundamental shift in the Federal Reserve’s policy stance. Since the Jackson Hole symposium, Fed Chair Powell has been unequivocal: the primary risk to the US economy is a deterioration in the labor market, not a resurgence of inflation. The Fed’s official position now frames the recent bout of inflation as a “one-time price shock” linked to supply chain disruptions, rather than a persistent trend that requires a hawkish policy response. This pivot has effectively created a “Fed put” on the labor market and, by extension, on risk assets. The central bank has signaled its readiness to act preemptively to support employment, even at the risk of letting inflation run slightly above its target.

The market has fully internalized this dovish message. Fed Funds futures are currently pricing in a 98.3% probability of a 25-basis-point interest rate cut at the upcoming Federal Open Market Committee (FOMC) meeting on October 29th. This near-certainty of monetary easing provides a powerful buffer against negative macro news. The ongoing US government shutdown, while creating headline noise and delaying some economic data, may ironically give the Fed additional justification for a “precautionary” cut, citing heightened economic uncertainty.

However, the Fed’s dovish framework is not without its vulnerabilities. The entire strategy is predicated on the assumption that inflation will remain contained. This assumption could be severely tested by a geopolitical shock. The ongoing conflicts in the Middle East and Eastern Europe are primarily supply-side risks for energy and other commodities. A sudden escalation, such as a breakdown of the fragile ceasefire between Israel and Iran or a series of successful Ukrainian strikes on Russian energy infrastructure, could trigger a sharp spike in global energy prices. Such an event would present the Fed with a stagflationary dilemma: cut rates to support a weakening labor market, thereby risking an un-anchoring of inflation expectations, or hold rates steady (or even hike) to fight the new wave of inflation, thereby risking a full-blown recession. The market’s current comfort with the Fed’s dovish stance represents a key vulnerability, and a geopolitical flare-up could shatter this consensus, forcing a rapid and painful repricing of policy expectations.

Global Flashpoints: Simmering Tail Risks

Beneath the primary market drivers of US-China trade and Fed policy, several geopolitical hotspots continue to simmer, representing significant tail risks.

In the Middle East, a fragile ceasefire forged in mid-2025 between Iran and Israel remains in place, but the underlying tensions are far from resolved. Earlier in the year, Israel conducted a series of significant military strikes against Iranian nuclear and military facilities. These actions, while setting back Iran’s nuclear program by several years, also had the effect of normalizing direct military engagement between the two regional powers. The situation is further complicated by the recent reimposition of UN “snapback” sanctions, triggered by European powers in response to Iran’s nuclear activities. These sanctions are designed to squeeze Iran’s economy and curtail its oil revenues, though China continues to act as a buyer of last resort for Iranian crude, often utilizing “dark fleets” to circumvent international restrictions. The de-escalation of direct conflict has removed a significant geopolitical risk premium from crude oil prices, but the situation remains a tinderbox, capable of igniting at any moment.

In Eastern Europe, the Russia-Ukraine war has settled into a grinding war of attrition, now in its fourth year. With its conventional forces bogged down in Ukraine, Russia has increasingly resorted to “gray zone” tactics to exert pressure on the West. These actions include repeated, deliberate incursions of Russian drones into the airspace of NATO member states, a campaign of intimidation designed to test the alliance’s resolve and deter continued military support for Kyiv. Concurrently, the conflict has entered a new phase with reports that the United States is providing intelligence to facilitate Ukrainian drone strikes against critical Russian energy infrastructure, including refineries and export terminals. This development transforms the conflict from a regional one into a direct threat to global energy supply, representing a persistent source of potential price volatility.

The Message from the Bond Market: A Critical Divergence

The behavior of the US Treasury market in response to the latest tariff threat provides a crucial signal about the market’s underlying fears. On Friday, the yield on the 10-year Treasury note fell sharply from approximately 4.14% to 4.05%, a classic “flight-to-safety” bid as investors sought the relative security of government bonds and priced in a higher probability of a growth slowdown.

This reaction stands in stark contrast to the market’s response during the April “Liberation Day” event. In that instance, a similar tariff shock caused Treasury bonds to sell off aggressively, sending yields higher. The interpretation at the time was that the unpredictable nature of US policy was undermining the country’s creditworthiness, leading to capital flight and a weaker dollar.

The bond market is currently trying to determine which effect of a trade war will be dominant: the inflationary impact of higher import prices or the deflationary impact of a global growth slowdown. Friday’s rally in bonds suggests that, for now, the market is more concerned about a genuine economic downturn. This is a critical distinction. If Treasury yields remain low or fall further this week, it would validate the “growth scare” narrative and provide further justification for the Federal Reserve’s dovish pivot. However, if yields begin to rise sharply, particularly in conjunction with a falling stock market and a weak dollar, it would signal a return of the more pernicious “capital flight” narrative from April. The direction of Treasury yields this week is therefore arguably the most important macro signal for investors to monitor.

Looking ahead, the US Treasury is scheduled to auction 13-week, 26-week, and 6-week bills on Tuesday, October 14th. While these are short-term instruments, the level of demand at these auctions will provide a real-time gauge of investor appetite for US sovereign debt amidst the heightened uncertainty.

The Week Ahead: Data & Event Horizon

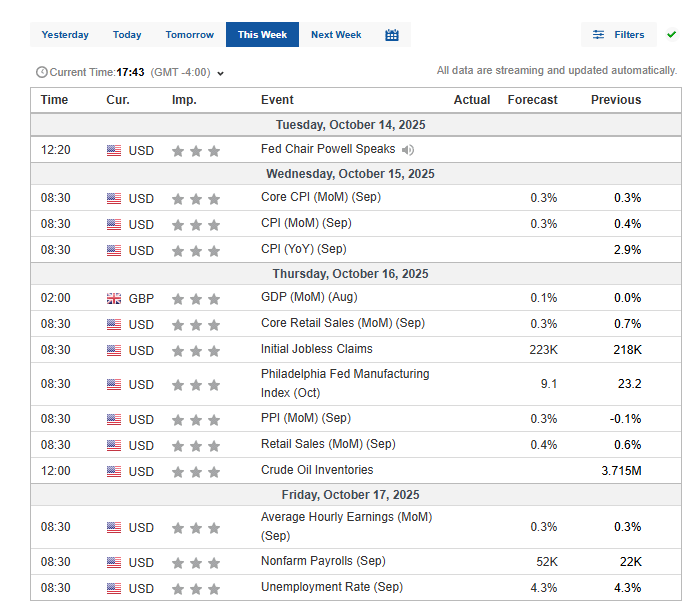

This week’s economic calendar is dense with tier-one data releases that have the potential to either validate the Federal Reserve’s dovish stance or force a hawkish reassessment. The market’s reaction function will be highly sensitive to any surprises, particularly on the inflation front. The main event of the week will be Fed Chair Powell’s scheduled speech on Tuesday, which he will likely use to reinforce the central bank’s message ahead of the late-October FOMC meeting.

So what does this mean for you?