Weekly Market Outlook 10/19/2025

My way or the Xi-way

Hello traders,

Last week we had excellent volatility and that made intraday trading extremely fruitful.

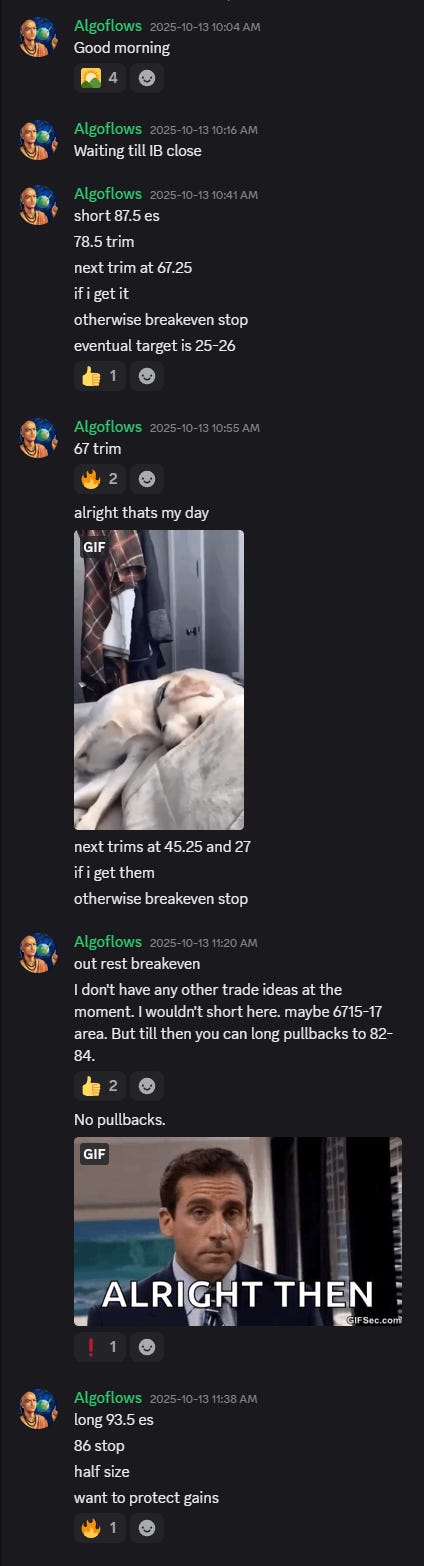

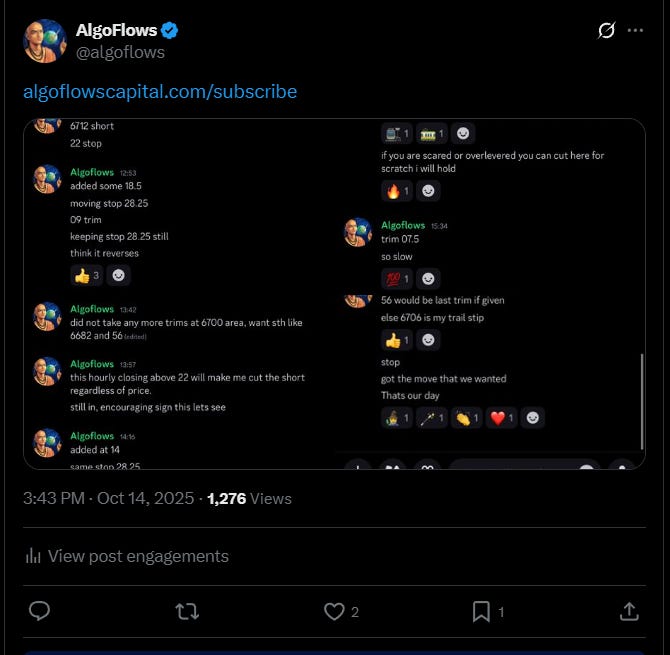

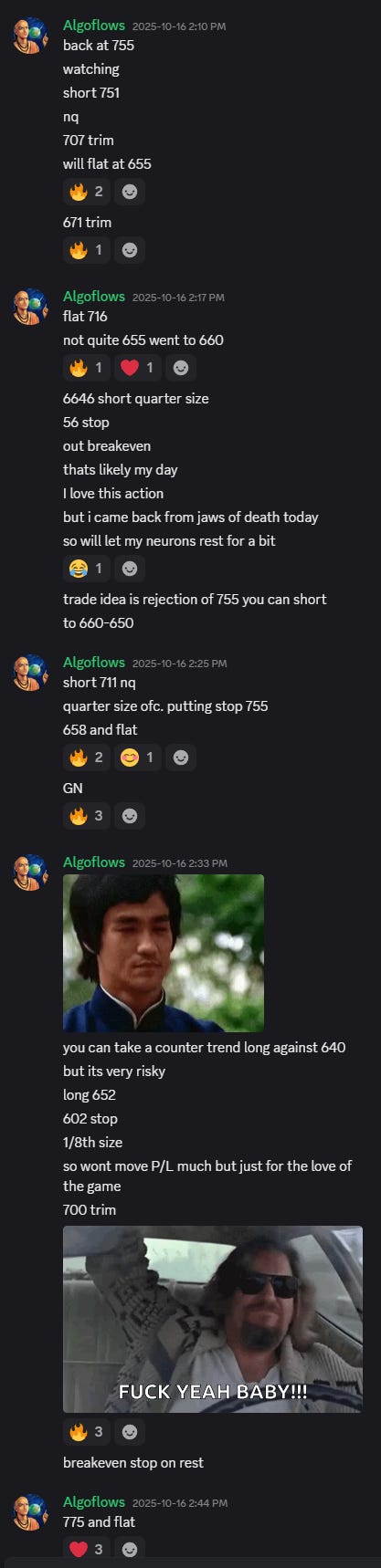

Recap of select trades of last week

Realtime Discord access with intraday orderflow & option dealer summaries included with the paid newsletter membership . Click here to subscribe.

Thursday we risked DLL and came out on top.

The U.S.-China Power Game:

The trade relationship between the two largest economies has deteriorated sharply, and the clash has exposed a key U.S. vulnerability: sensitivity to equity markets. After China restricted rare earth exports, the U.S. threatened a 100% tariff on all Chinese goods, then quickly shifted to de-escalatory language, and stocks snapped back. The move underscored a structural imbalance. With nearly 40% of U.S. equities held by households, market drops hit wealth, consumer confidence, and approval ratings, which matters with midterms a year out. Prioritizing “stabilizing global markets” after a 3% decline shows how tied policy has become to stock prices. Beijing sees this pressure point and can play harder. A U.S. threat to curb Chinese cooking oil imports is mostly symbolic since China has not shipped any to the U.S. in months. A Chinese cut to U.S. soybean purchases would create real strain for American farmers, a key political bloc. Fresh talks are planned, but China enters with the stronger hand.

Inflation’s Persistent Shadow

The week’s economic calendar is dominated by the release of the September Consumer Price Index (CPI) on Friday, October 24, a report that will directly test the Federal Reserve’s dovish narrative. The previous report for August was hotter than expected, with the annual inflation rate accelerating to 2.9%, the highest since January, and the monthly rate rising 0.4%. Core CPI, which strips out volatile food and energy prices, remained elevated at 3.1% year-over-year.

Market expectations, as reflected in the Cleveland Fed’s Inflation Nowcasting model, are braced for another firm print, projecting September’s year-over-year CPI at 2.99% and Core CPI at 2.95%. The scheduling of this critical report for Friday morning creates a unique risk dynamic. A significant deviation from consensus will occur just hours before the close of US equity and bond markets for the week, increasing the likelihood of exaggerated moves.

Middle East Tinderbox

The security situation in the Middle East has become critical. The U.S.-brokered ceasefire in Gaza has effectively collapsed, with Israel launching a “wave of attacks” in southern Gaza after accusing Hamas of violations, and subsequently halting aid deliveries into the territory. Israeli Prime Minister Benjamin Netanyahu has adopted a hardline stance, vowing to “achieve all war objectives” and explicitly linking the conflict to a broader confrontation with Iran and its regional proxies. This follows the “12-day war” in June 2025, which established a dangerous precedent for direct military exchanges between Israel and Iran. Tensions are further inflamed by Iran’s recent execution of individuals accused of spying for Israel’s Mossad intelligence agency.

The Ukraine Diplomatic Push

High-stakes negotiations are underway to end the war in Ukraine, with the U.S. taking a central role. President Trump has re-engaged with what appears to be a renewed enthusiasm to broker a deal. However, the diplomatic path is fraught with obstacles. Russian President Vladimir Putin is reportedly demanding full control of the Donetsk region as a precondition for a settlement, a non-starter for Kyiv. President Trump’s own position has been inconsistent; after initially signaling openness to providing Ukraine with long-range Tomahawk missiles, he appeared to reverse course following a phone call with Putin, instead pushing for a bilateral summit in Budapest

EARNINGS: FOURTH GEAR

Key earnings this week:

Tuesday: A packed day of earnings begins with reports from industrial giant 3M (MMM) and consumer staple Coca-Cola (KO) before the bell. After the close, the market will focus on streaming leader Netflix (NFLX) and automaker General Motors (GM). For Netflix, the narrative has shifted from pure subscriber growth to monetization. Analysts expect revenue to grow 17% to $11.5 billion, with a focus on the expansion of its advertising tier and margin improvement.

Wednesday: All eyes will be on Tesla (TSLA), which reports after the market closes. The company already announced record Q3 deliveries of nearly 500,000 vehicles, boosted by the expiration of a $7,500 EV tax credit. However, the focus will be on profitability, with analysts forecasting a year-over-year decline in automotive gross margins to 16% and EPS contracting to around $0.52. Also reporting are tech bellwethers IBM and Lam Research (LRCX). IBM is expected to show continued momentum from its watsonx AI platform, with consensus EPS at $2.43.

Thursday: The travel and technology sectors are in the spotlight. Before the open, American Airlines (AAL) and Southwest Airlines (LUV) will provide updates on consumer travel demand. American has guided for a potential quarterly loss, citing softness in the domestic market, while Southwest is also expected to report a significant drop in earnings. After the close, chipmaker Intel (INTC) and automaker Ford (F) will report. Intel’s results will be a key test of its turnaround strategy, with investors watching for progress in its foundry business and data center segment. Ford is expected to post strong results after reporting an 8.2% rise in Q3 U.S. sales, including record sales of its electrified vehicles.

Actionable ideas for the week

The two core futures markets I would want to look at are