Weekly Market outlook 10/27

War and PCE

Hello traders,

I hope you had a great weekend and are well rested for the coming week.

A quick recap of last week’s select ideas.

Entered short on NQ at 521 with a 14-point stop, looking to ride the downside if momentum held. Initial plan was to secure early gains and manage the rest conservatively. Trimmed +20 points early to lock in some profit and immediately set a stop on the remaining position to reduce risk.

As the move continued, trimmed an additional +40 points, leaving a small runner with the stop now at breakeven. Idea was to let the runner ride overnight, with minimal exposure, and potentially capture further downside if the trend persisted.

Next morning, the runner hit +100 points, closing out the position. This trade idea centered on tight risk management, taking early trims, and then setting up for an overnight hold with the breakeven stop as insurance. Result: secured initial gains and allowed the rest to maximize profit on the extended move.

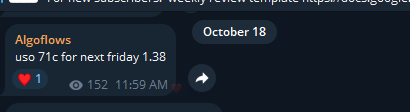

CL longs paired with USO call options from the previous Friday were up nicely.

These calls went to 3.35 last I checked on Wednesday.

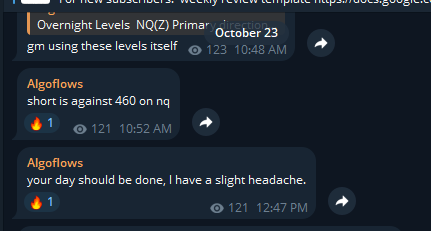

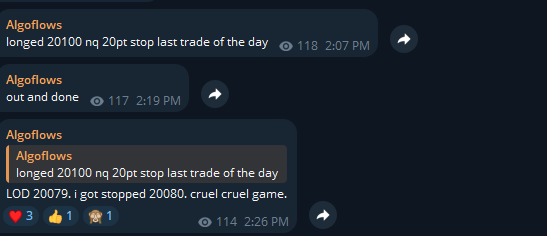

From then on on Wednesday I had a heartbreaking long at 20100 with a 20pt stop, NQ marked its low of day at 20079 and then proceeded to run up 600 points.

Reeling from this missed trade, I had a forgettable Thursday where I hit my MDD in the first hour of the day.

Friday was a much better day with being able to capture most of the NQ downside.

Moving on,

This week we are having a slew of tech earnings, with the bigwigs MSFT, GOOGL, META, AMZN, AAPL and AMD reporting this week.

Other than that we also have PCE and Non-Farm Payrolls this week. PCE is fed’s preferred gauge of inflation and Powell and co. would be closely watching that number.

Markets have been in peak bullish territory for quite sometime now and maybe a small dip before the election is due. However, our annualized forecast has consistently stayed bullish and there is no change to it unless 5600 breaks decisively on ES.

Paid subscribers are requested to join the telegram at their earliest convenience. Link is shared in your welcome email.

Levels for the week:

Subscribers are urged to use the tradingview indicator to plot the levels.