Weekly Market Outlook 10/5/2025

shutdown vibes

Hello traders,

The biggest news of the preceding week was that the US government has shut down for the time being and hence we will not receive bulk of the economic data that we rely on to gauge the health of the economy and consequently the markets.

The domestic narrative was dominated by two powerful, interconnected forces: a Federal Reserve signaling a clear and decisive pivot towards monetary easing, and the U.S. government shutdown that has enveloped policymakers and investors in a fog of economic uncertainty. This combination has created a unique environment where the central bank is preparing to act based on a perceived economic reality for which it is rapidly losing the official metrics to measure.

Realtime Discord access with intraday orderflow & option dealer summaries included with the paid newsletter membership . Click here to subscribe.

The Federal Reserve’s Decisive Easing Stance

The Federal Reserve has firmly shifted its policy bias from tightening to easing, a move that has become the single most important driver for financial assets. The FOMC initiated this new cycle at its September 17 meeting with a 25 basis point reduction in the federal funds rate, bringing the target range down to 4.00% - 4.25%. This was the first rate cut since December 2024 and was explicitly justified by a change in the Committee’s risk assessment. The official statement noted that while inflation remains “somewhat elevated,” the “downside risks to employment have risen,” signaling a greater concern for the labor market side of its dual mandate.

This initial move has conditioned the market to expect more. As of the end of the week, fed funds futures priced in a near-certainty of an additional 25 basis point cut at the upcoming October 28-29 meeting. The CME FedWatch tool showed probabilities hovering between 95% and 99% for such a move. Furthermore, the probability of a third cut by the end of the year stood at nearly 90%, indicating that investors are positioning for a sustained easing cycle.

This market pricing has been validated and encouraged by a chorus of dovish official commentary. In a particularly impactful speech, Fed Vice Chair Michelle Bowman warned of “emerging signs of fragility” in the U.S. labor market and urged the Fed to make “decisive and proactive” rate cuts, cautioning that the central bank might already be “behind the curve”. This sentiment was echoed in Chair Jerome Powell’s post-meeting press conference, where he acknowledged that job gains have slowed and that the two sides of the dual mandate are now “somewhat in tension”. This official rhetoric has effectively given a green light to markets to price in further accommodation.

The Fed is making this pivot against a complex inflation backdrop. The central bank’s preferred inflation gauge, the core Personal Consumption Expenditures (PCE) price index, showed continued moderation in August, coming in line with expectations and reinforcing the disinflationary narrative. However, other measures remain stubbornly high. The August Consumer Price Index (CPI) remained at 2.9% year-over-year, while core CPI, which excludes food and energy, was at 3.1%. Both figures are still significantly above the Fed’s 2% target. This creates a policy “headache”: the need to cut rates to support a weakening labor market at a time when inflation has not yet been fully vanquished, raising the risk of re-acceleration.

The Government Shutdown’s Economic Fog

Compounding the Fed’s policy challenge is the U.S. government shutdown, which commenced at 12:01 a.m. on October 1 after lawmakers failed to pass a funding agreement. The immediate market impact has been the creation of a data blackout, as key statistical agencies like the Bureau of Labor Statistics (BLS) have ceased operations.

The most significant casualty of this shutdown was the scheduled October 3 release of the monthly Non-Farm Payrolls (NFP) report, arguably the most critical piece of economic data for the U.S. economy. The absence of this “gold standard” labor market data leaves a significant void. If the shutdown persists, the release of other crucial reports will also be jeopardized, most notably the September CPI and PPI inflation data, currently scheduled for October 15 and 16, respectively.

In this data vacuum, both the market and the Fed are forced to rely on less comprehensive, private-sector proxy data. For example, the ADP private payrolls report, which was released as scheduled, showed a decline of 32,000 jobs in September, extending a recent run of weak labor market indicators. While this report bolstered the narrative of a cooling job market, it is not a perfect substitute for the more detailed and widely followed BLS survey.

This situation places the Federal Reserve in an extremely difficult position. For years, the institution has built its credibility on a “data-dependent” approach to monetary policy, emphasizing that its decisions are guided by the latest economic statistics. Now, a political event has removed the primary official data point—the NFP report—needed to justify its next widely expected policy action. If the Fed proceeds with an October rate cut, it will be acting without its key piece of confirmatory evidence, opening itself to criticism that it is acting on incomplete information or, worse, bowing to political or market pressure. Conversely, if the Fed were to pause due to the lack of data, it would violently contradict deeply entrenched market expectations, potentially triggering a severe risk-off event. The central bank is caught in a policy trap, created by the intersection of political dysfunction and its own carefully crafted communication strategy.

The market’s current sanguine reaction to the shutdown, viewing it as a short-term political drama, belies a more dangerous, non-linear risk. While the initial economic impact may be modest, the effects will compound the longer it persists. The data blackout will worsen, business and consumer confidence will erode, and the economic drag from furloughed workers and suspended government services will become more pronounced. There exists a tipping point at which the market’s perception will abruptly shift from “temporary inconvenience” to “material threat to GDP.” The current complacency is pricing in a swift resolution, creating a significant downside vulnerability should that assumption prove incorrect.

Bitcoin: The Digital Safe Haven

Bitcoin emerged as one of the week’s strongest performers, capitalizing on the unique macroeconomic and political environment. The cryptocurrency rallied sharply from below $117,000 at the start of the week to trade above $122,000, reaching its highest valuation since mid-August and approaching its record high near $124,000.

The primary catalyst for this surge was the U.S. government shutdown. As faith in the stability and functionality of government institutions wavered, a narrative took hold positioning Bitcoin as an alternative, non-sovereign safe-haven asset—a hedge against political dysfunction and potential long-term fiat currency debasement. This theme was powerfully reinforced by the concurrent decline in U.S. Treasury yields and the market’s expectation of further monetary easing from the Federal Reserve. A lower-rate environment reduces the opportunity cost of holding non-yielding assets like Bitcoin and gold, increasing their relative attractiveness.

The technical breakout for Bitcoin was both powerful and significant. The price decisively cleared the key resistance level around $117,300 on October 1, breaking out of a multi-week consolidation range. The move was impulsive and reportedly accompanied by a surge in volume and short liquidations, indicating strong conviction from buyers. This former resistance zone around $117,300 is now expected to act as the first major level of technical support on any corrective pullbacks. The path appears open for a retest of the recent highs near $124,000, with technical analysts eyeing upside targets in the $127,000 region.

The week’s price action reveals a market operating with a “barbell” mentality. A traditional risk-on/risk-off framework fails to capture the nuance of the capital flows. Instead, investors appear to be allocating capital to two distinct and seemingly contradictory poles. On one end of the barbell are speculative, long-duration growth assets, exemplified by the Nasdaq-100, which are direct beneficiaries of the promise of lower interest rates and future liquidity. On the other end are “anti-establishment” or institutional-hedge assets, like Bitcoin, which benefit from a decline in confidence in the stability of traditional government and financial structures. Conspicuously absent from this allocation are assets directly tied to the immediate, real-world economy, such as crude oil, which were sold aggressively.

This suggests a complex risk posture where investors are simultaneously betting on a Fed-fueled rally in financial assets while hedging against the very political and economic dysfunction that is compelling the Fed to act.

Another analogous trade idea is Zcash (ZECUSDT)

Privacy coins like Monero and Zcash are the hedge against bitcoin, however Monero is not easily tradable for majority of the global population and trading copious amounts of Monero is likely going to put you on lists that you don’t want to be a part of.

100-200bps of NAV risk on this trade is ideal, anything above it is pushing your luck.

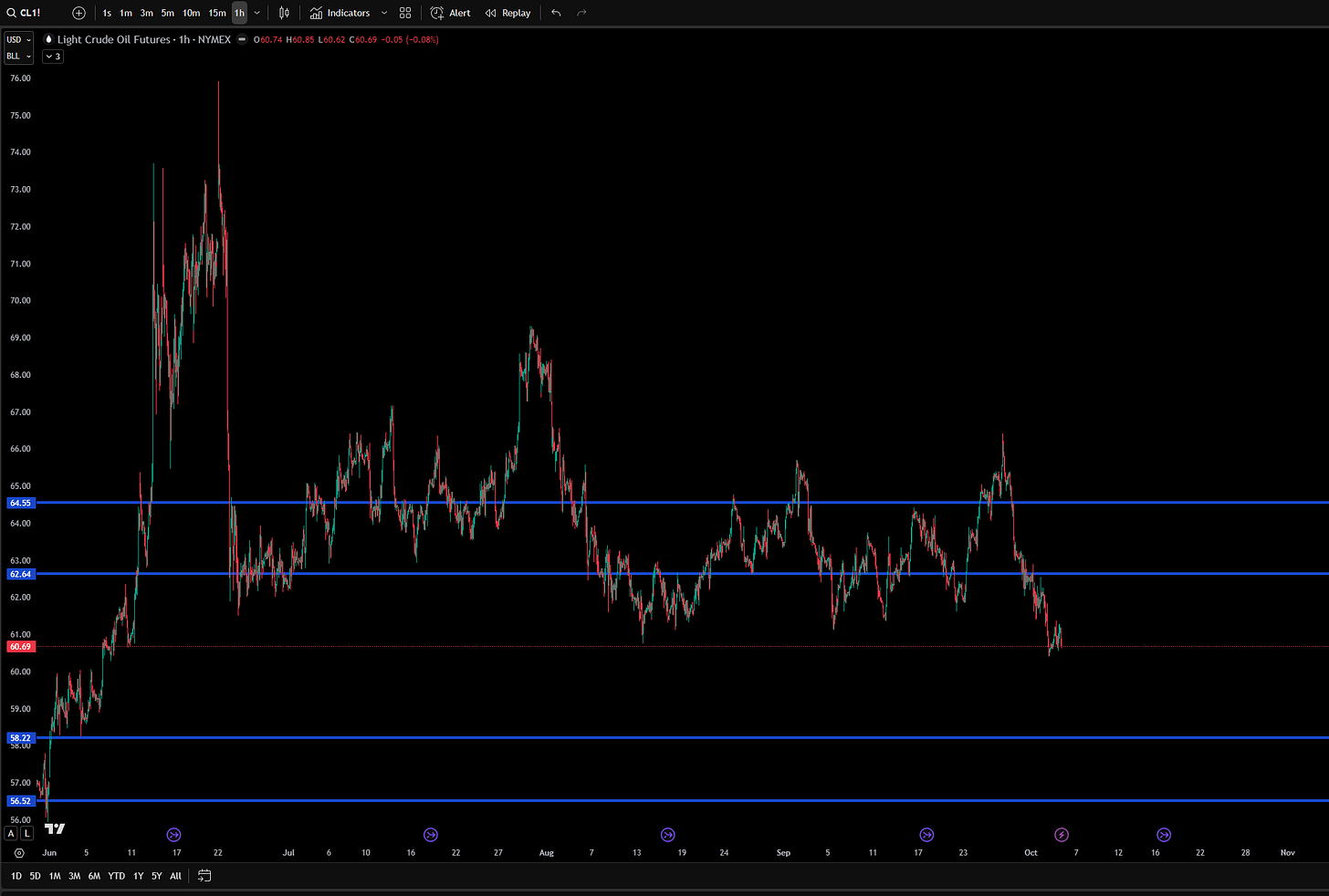

WTI Crude Oil: The Supply Dam Breaks

In the most dramatic move of the week, WTI crude oil futures experienced a catastrophic collapse. After closing the prior week at $63.45, the front-month contract opened Monday near $65 but proceeded to fall precipitously for four straight sessions, bottoming out at $60.40 on Thursday before a marginal rebound to settle at $60.88 on Friday. The weekly loss exceeded 7%, marking the largest one-week decline since late June and wiping out months of gains.

This price collapse was driven by a sudden and severe paradigm shift in the market’s fundamental assessment, moving from a focus on supply tightness to acute fears of an emerging oversupply. This sentiment was ignited by several key developments:

OPEC+ Policy Shift: Reports emerged suggesting that OPEC+, led by Saudi Arabia, was considering accelerating its schedule of production increases in a bid to reclaim market share, potentially adding between 274,000 and 500,000 barrels per day to the market in November.

U.S. Inventory Builds: The weekly Energy Information Administration (EIA) report was unequivocally bearish, showing builds in U.S. commercial inventories of crude oil, gasoline, and distillates, signaling softer demand and refining activity.

Demand Destruction Fears: The U.S. government shutdown added a significant layer of demand-side concern, with traders fearing that a prolonged shutdown could curb economic activity and, therefore, fuel consumption. This was compounded by seasonal factors, such as refinery maintenance, which temporarily reduces crude demand.

The technical picture for crude oil is now decisively bearish. The week’s price action constituted a major technical breakdown, slicing through multiple layers of prior support with ease. The area between $63.00 and $65.00, which had served as a floor for the market, has now been transformed into a formidable ceiling of resistance. The weak bounce on Friday suggests that sellers remain in firm control, and any rallies are likely to be met with fresh selling pressure.

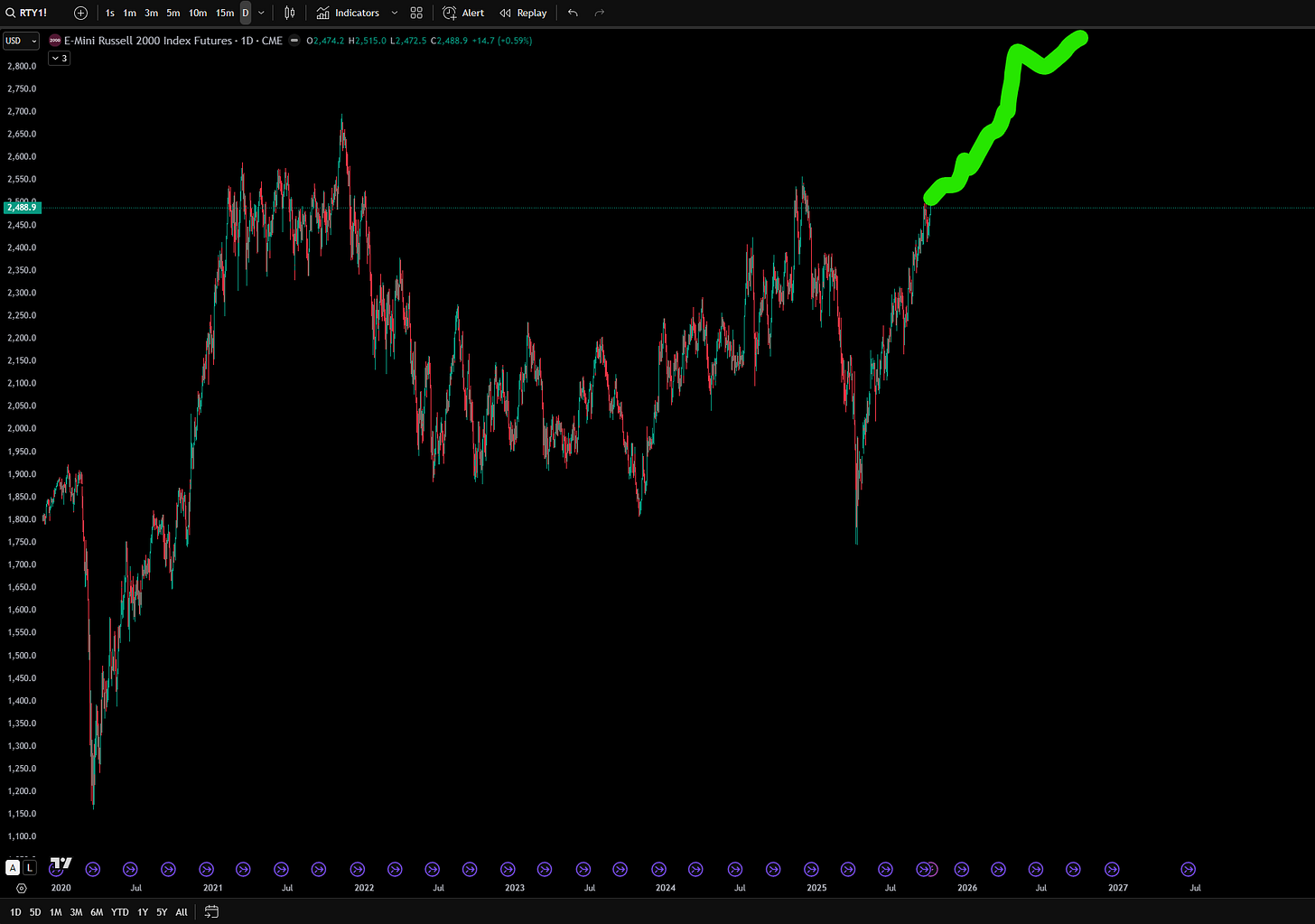

Small Cap Sluggishness: Is it Time?

RTY has been slowly perking up since the ratecut and the consensus trade is to long RTY against the Spooz and Qs until EOY.

Bull case for RTY (Russell 2000 / small-caps) under the prospective rate cuts:

Lower rates reduce borrowing costs for small / mid-cap firms. Many have higher leverage and weaker balance sheets. Rate cuts improve interest coverage and free up cash flow.

Discount rate effect: future earnings get higher present value when rates fall. Small caps with higher growth optionality benefit more from multiple expansion.

Reversal of yield curve flattening: cuts steepen the curve, pushing capital toward equities and risk assets from bonds.

Liquidity injection / easing bias supports risk appetite. Markets often rally ahead of cuts as traders front-run monetary easing.

Rate cuts often accompany aggressive policy pivot in weak macro regime. The recovery rebound could favor small, nimble companies over slow large caps.

Valuation repositioning: small-cap index may re-rate vs large cap if cyclical sectors outperform.

WEEKLY LEVELS

NOTE: SUBSCRIBERS ARE URGED TO JOIN THE DISCORD AT THEIR EARLIEST CONVENIENCE.

https://sidestack.io/algoflows

Sign in with your Substack email and click the link in your email and you are in.