Weekly Market Outlook 11/24/2025

Long weekend vibes

Hello traders,

Hope you all had a great weekend.

I’m traveling this week and don’t have my trusty mechanical keyboard, so expect a shorter, more concise outlook.

Observations on Policy Reversal and Geopolitical Uncertainty

There are weeks when the market moves on noise, and there are weeks when the machinery itself is re-calibrated. Guess what just happened?

While liquidity is already thinning for the Thanksgiving holiday, two structural shifts occurred over the weekend that will likely define the trading landscape for Q1 2026. First, the Federal Reserve explicitly altered its reaction function. They effectively reinstated the “Fed Put” with a new strike price defined by labor stability rather than asset prices. Second, a geopolitical framework surfaced in Eastern Europe that threatens to flood the global market with supply-side deflation, specifically in energy.

The consensus is pricing a straightforward continuation of the “Trump Trade.” The plumbing suggests something far more complex is about to break.

Realtime Discord access with equity positions tracker, intraday orderflow & option dealer summaries included with the paid newsletter membership . Click here to subscribe.

A) The Williams Statement and Labor Market Precedence

For the entirety of autumn, the Federal Reserve maintained a hawkish posture. Despite unemployment ticking up to 4.44% and the Sahm Rule at 0.43 dangerously approaching its 0.50 recession threshold, officials continued to jawbone against rate cut expectations. This steepened the curve and compressed equity risk premiums. It created the classic setup for a policy error where the central bank overtightens into a slowdown.

That dynamic ended on November 21.

New York Fed President John Williams broke the pattern. By acknowledging “room for further adjustment,” he effectively decoupled the December rate cut from inflation data. The probability of a December cut jumped from 25% to 55% overnight.

The Implication for you: The “Fed Put” is back. However, Williams did not declare victory over the business cycle. He recognized the asymmetry of risks.

The Trade: The front end of the curve (2-Year Treasuries) must reprice lower. However, the long end (10Y/30Y) remains anchored near 4.0% due to fears of “fiscal dominance” and structural inflation.

The Curve: We expect the curve to steepen aggressively.

History Lesson: We have seen this movie before. The 1998 Greenspan pivot succeeded in the short term but fed the Dot Com excess. The 2018 Powell reversal preceded a 20% rally, but that rally died in a recession 18 months later. We are playing the rally, but watching the exit.

B) The Ukraine Framework as Great Power Settlement

A 28-point framework for a Ukraine armistice surfaced this weekend. The terms, which include freezing current lines, barring NATO membership, and capping military forces, are politically contentious. But as traders, we look at the barrels, not the borders.

This framework is effectively a dictated armistice that legitimizes territorial conquest to facilitate energy reconfiguration.

The Supply Shock: If implemented, Russian oil returning to global markets by mid-2026 would add 1 million barrels per day to an already projected IEA surplus.

The Price Target: This flood of supply would likely break OPEC+ cohesion. The marginal cost of production for U.S. shale shippers becomes the new floor. That floor is uncomfortably close to $60 per barrel.

The “Second Order” Trade: Everyone is shorting oil. That is crowded. The real beneficiaries are European Industrials. Companies like BASF, Siemens, and Schneider Electric would gain a permanent input cost advantage, reversing years of de-industrialization.

Risk Note: Current oil shorts assume perfect implementation. Any disruption to this peace framework represents underpriced tail risk.

The Fed Chair Succession Calculus

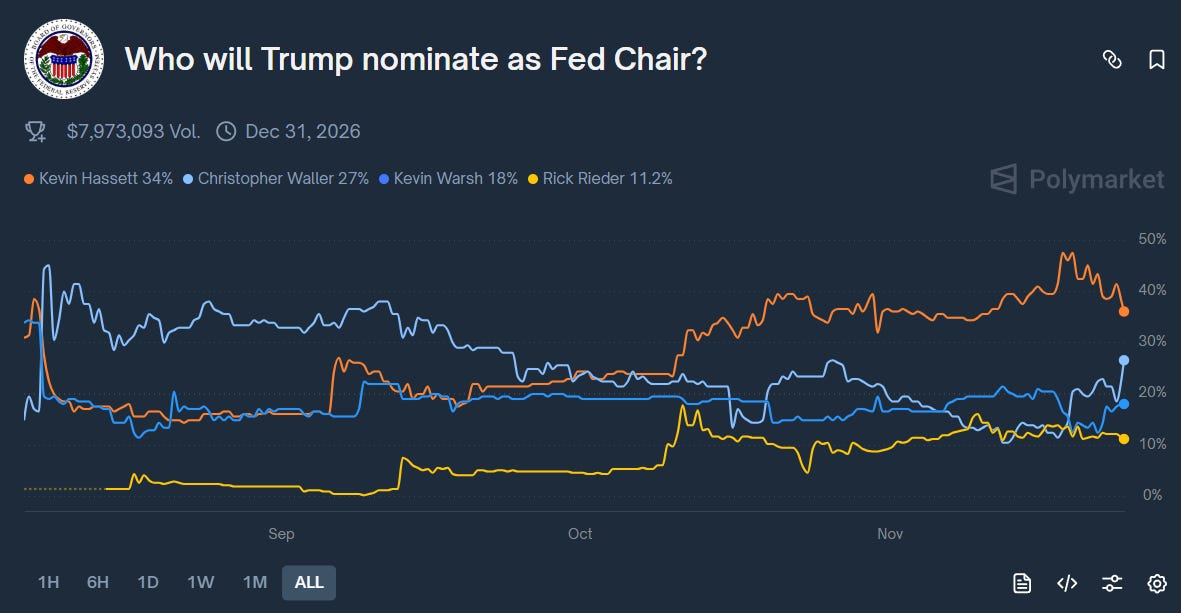

Powell’s term ends May 2026. The contest appears to be Kevin Hassett versus Christopher Waller.

Prediction markets currently assign a ~34% to 67% implied probability to Kevin Hassett for Fed Chair. The narrative is seductive as a Trump loyalist, supply-sider, and crypto-advocate takes the reins.

We believe this is a massive mispricing of political reality.

The Hassett Problem (Oil): Hassett is a supply-side purist. His policies would strengthen the dollar and facilitate the oil price collapse described above. Senate Republicans from energy-producing states (a critical voting bloc) will not confirm a Fed Chair who crushes their local economy.

The Hassett Problem (Crypto): Senate Democrats will not confirm a known crypto-holder.

The Waller Advantage: Christopher Waller is the continuity candidate. He is a pragmatist who allows for easing while preserving independence. He is the path of least resistance.

The Trade: The market is overweight “Hassett Hedges” (Long Bitcoin, Short Dollar). When reality sets in and Waller likely takes the lead, look for Dollar Strength and a reversion in yields.

The Rotation Imperative and Technical Conditions

The equity market shows rotation from narrow AI momentum to broader rate sensitive sectors. The Russell 2000 outperformed with 0.70 percent decline versus Tech’s 2.97 percent drop. The IWM/QQQ ratio shows double bottom formation. Small caps rely on floating rate debt, making them a rate cut derivative. If the Fed delivers, 242 retests 275 target. If the Fed disappoints, small caps face earnings compression from economic slowdown.

S&P 500 (ES)

Structural View: The 6596–6600 zone contains critical