Weekly Market Outlook 1/19/2026

What is a Red week for Green Land

Hello traders,

I hope all of you are enjoying your long weekend and use the extra day off to get some rest and time off-screens.

To start off, our gambit to short Nasdaq futures on Friday and buy QQQ puts has so far worked well.

We are at a juncture in the markets where a lot of people would ask you to buy a certain tech names because they are “beaten-down” or at “good value”. This newsletter is not adding any major US tech names other than the ones we own. We are still building position in China-tech but for now, we will not add any US large cap tech outside of our core holdings.

(more on the market posture later in the newsletter)

Realtime Discord access with equity positions tracker (new website rolling out to select subscribers), intraday orderflow & option dealer summaries included with the paid newsletter membership . Click here to subscribe.

The financial landscape for the week of January 19, 2026, is characterized by a violent convergence of high-velocity macro factors that signal a profound regime shift in global asset allocation. While U.S. markets observe the Martin Luther King, Jr. holiday on Monday, the electronic futures complex and international bourses are actively repricing risk assets against a backdrop of escalating geopolitical friction, a pivotal battle for the stewardship of the Federal Reserve, and a decisive "Great Rotation" within the equity market structure.

The Macro-Strategic Landscape: Four Pillars of Volatility

Geopolitical Fragmentation: The weaponization of trade policy involving Greenland and the potential deployment of the EU’s “Anti-Coercion Instrument” is ruffling a lot of feathers in the backdrop of Davos summit.

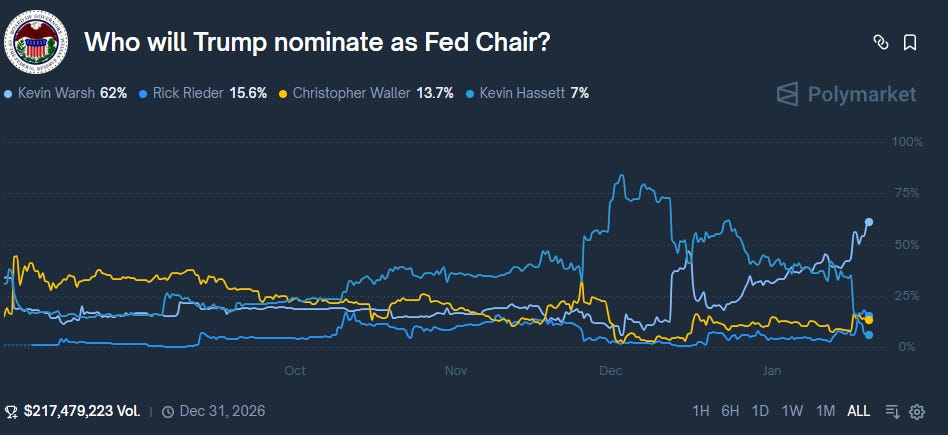

Monetary Policy Uncertainty: The race between Kevin Warsh and Kevin Hassett for the Fed Chairmanship.This staffing move doubles as a referendum on monetary doctrine, forcing a choice between the “Productivity Dove” and the “Administrative Loyalist” that will set the terminal rate for the rest of the decade.

The Capital Rotation: The “Great Rotation” is driven by a recognition that the valuation spread between mega-cap technology and the rest of the market has reached unsustainable extremes, precisely as the U.S. economy shows signs of a mid-cycle re-acceleration (GDP forecasted at 4.3%).

Commodity Supercycle: Supply constraints in energy and metals, exacerbated by geopolitical risk premiums, are colliding with renewed demand, creating a setup described as the “Rubber Band Theory” in crude oil markets.

The Greenland Tariff Shock: Escalation and Mechanism

President Trump’s declaration of a 10% tariff on goods from eight European nations;including Denmark, the United Kingdom, France, Germany, Sweden, and the Netherlands, effective February 1, 2026, represents a stark escalation in the use of economic statecraft. The administration has explicitly linked these tariffs to the refusal of European allies to facilitate the U.S. acquisition of Greenland, citing “national security” and the strategic importance of the Arctic in a multipolar world.

The Escalation Ladder: Escalation and Mechanism

The ultimatum is structured with a punitive escalator designed to force capitulation. The initial 10% levy is set to rise to 25% by June 1, 2026, if a “deal for the complete and total purchase of Greenland” is not reached. This mechanism creates a ticking clock for European exporters. A 25% tariff would be prohibitive for low-margin European exports like German automobiles or French industrial machinery, potentially pushing the Eurozone, already grappling with stagnation, into a deep recession.

Market Implications

Currency Markets: The Euro (EUR) is under pressure as traders price in the economic drag of tariffs. Conversely, the U.S. Dollar (USD) sees safe-haven flows despite the potential inflationary impact of the tariffs on the U.S. consumer.

Equity Volatility: European indices (DAX, CAC 40) have sold off sharply, dragging U.S. futures lower in pre-market trading as the risk of a retaliatory trade war rises.

The European Response: The “Big Bazooka” (Anti-Coercion Instrument)

The European Union’s reaction has been swift, unified, and potentially historic. Brussels is reportedly preparing to deploy its “Anti-Coercion Instrument” (ACI) for the first time. Often referred to by trade policy experts as the EU’s “big bazooka,” the ACI was legislated in late 2023 specifically to deter economic bullying by third countries.

Mechanism of the ACI

Unlike standard retaliatory tariffs, which are often slow to implement and sector-specific, the ACI allows for a comprehensive and rapid asymmetric response. It empowers the EU Commission, following a determination of “economic coercion,” to take sweeping countermeasures. The definition of economic coercion under the ACI, a third country applying measures to interfere with the sovereign choices of the EU or its member states, fits the Greenland ultimatum precisely.

Potential Countermeasures under ACI

The ACI provides the EU with a vast arsenal of economic weapons that go far beyond simple tariffs:

Market Access Restrictions: The EU can limit U.S. companies’ access to the single market of 450 million consumers, potentially blocking the sale of U.S. software or digital services.

Public Procurement Bans: American firms could be barred from bidding on lucrative public procurement contracts within the EU, affecting defense contractors and infrastructure firms.

Intellectual Property Suspension: In a “nuclear option,” the EU could suspend the protection of U.S. intellectual property rights within the bloc. This would strike at the heart of America’s knowledge economy, threatening the royalty streams of pharmaceutical and technology giants.

Financial Services Restrictions: The EU could target the U.S. services surplus by restricting banking activities or digital service provision, a direct threat to U.S. financial institutions operating in London, Frankfurt, and Paris.

The activation of the ACI would signal a shift from a “trade skirmish” to a full-blown economic conflict, potentially fragmenting the Western alliance structure just as unity is required to address challenges in Eastern Europe and the Middle East.

The Battle for the Federal Reserve: Defining the Reaction Function

As the term of Chair Jerome Powell nears its expiration in May 2026, the race to succeed him has become a proxy war for the future direction of U.S. monetary policy. The contest has narrowed primarily to two candidates: Kevin Warsh and Kevin Hassett, with the political dynamics shifting rapidly in Warsh’s favor following recent comments by President Trump.