Weekly Market outlook 1/5/2025

Powell's delicate dance

Hello Traders,

Hope you had a great weekend and some time away from the screens.

Important: Do not wish people a Happy New Year after 3rd January.

Recap of select trades of the previous week.

Classic Knife catch.

Knife Catch 2.0

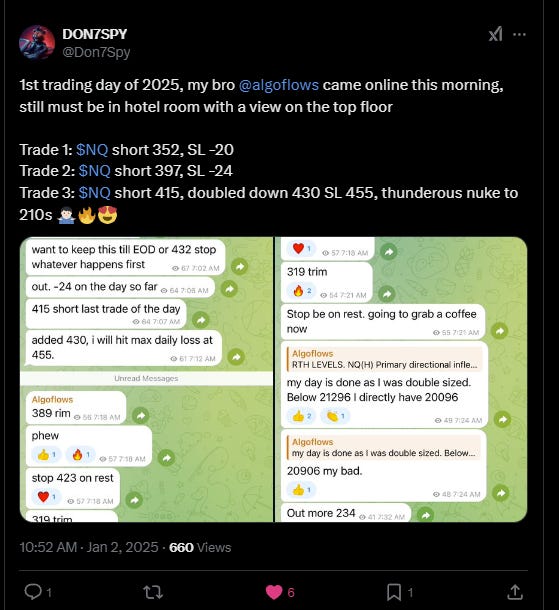

Tilt-Lite day.

Back to regular programming.

Moving on,

This week we have the NFP# coming in on Friday. The Fed has been crystal clear as to how they want the unemployment rate to stick to their very narrow range of 4.1-4.3%.

Any hint of weakness in the labor market and the Fed may have to backpeddle into becoming slightly more dovish(and that is all that the market needs to float upwards)

However, if the economy keeps chugging along, the Fed’s going to want fresh evidence of disinflation before feeling comfortable about any rate-cutting moves. If those signs don’t materialize, this most recent Fed gathering could ultimately look like a mistake in judgment. But for now, the ball is in the economy’s court: either it shows enough resilience to maintain the Fed’s hawkish tilt, or it starts to crack just enough to bring dovish sentiment roaring back.

What does this mean in layman terms?

Imagine you punt your entire bet365 account on a 8 leg parlay on one layup and 7 underdogs and now you are waiting for those 7 underdog results.

On the equities side, ACHR 0.00%↑ mentioned in August has shown a decent performance

The stock has almost tripled and the 2026 5c are at 6.3 mid from 0.75 with still a year+ left on them.

This year, I would share more such individual stock ideas as and when I spot good opportunities.

Levels for the week:

Subscribers are urged to use the tradingview indicator to plot the levels.