Weekly Market Outlook 2/15/2026

Happy Valentine’s Day

Hello traders,

Hope you had a lovely Valentine’s day and are enjoying your long weekend.

A quick recap of the last week.

Realtime Discord access with equity positions tracker(new website rolling out to select subscribers), intraday orderflow & option dealer summaries included with the paid newsletter membership . Click here to subscribe.

COLD CPI, A CONCERN?

The week that just ended on February 14, 2026, seriously challenged the popular belief that everything is going smoothly in the markets. For the past few months, low volatility had investors feeling comfortable, but that comfort zone is cracking. Right now, we’re dealing with three major problems all at once: inflation that’s cooling down but still stubborn in key areas, big tech stocks showing weakness, and geopolitical tensions that have gone from diplomatic talk to actual military action.

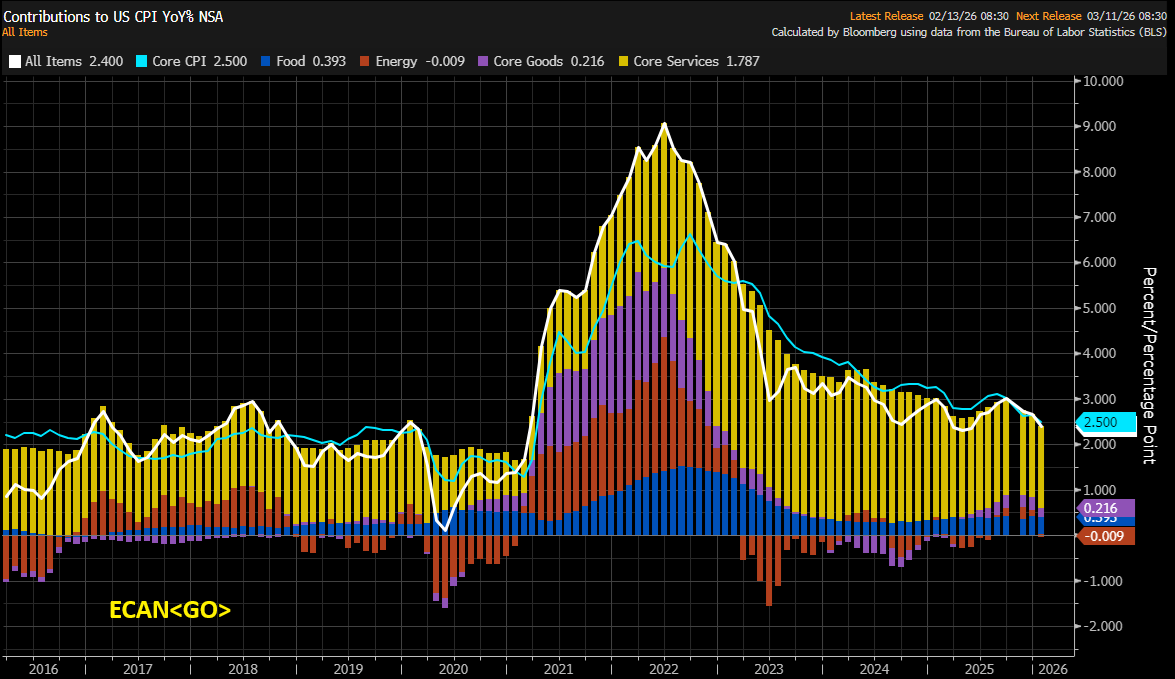

When the January 2026 Consumer Price Index came out, it highlighted a key disconnect. The headline numbers suggest inflation is still coming down, but if you look under the hood at core services and shelter costs, they’re staying stubbornly high. Making this worse, we now have a new tariff system that the Federal Reserve Bank of New York says is passing almost 90% of costs directly to American consumers. This creates a kind of stagflation tax that the Fed can’t really fix with their normal tools.

At the same time, something weird is happening with geopolitical risk. Usually when tensions rise, oil prices spike. But West Texas Intermediate crude ended the week around $62.89, dropping over 2.7% on Friday alone. This happened even though Israel and Iran are on the brink of a nuclear confrontation and the United States has set a hard June deadline for ending the Russia-Ukraine conflict. The market seems more worried about demand falling (because of tariffs hurting the economy) than about supply disruptions from wars. This mismatch in pricing is one of the biggest risk opportunities heading into next week.

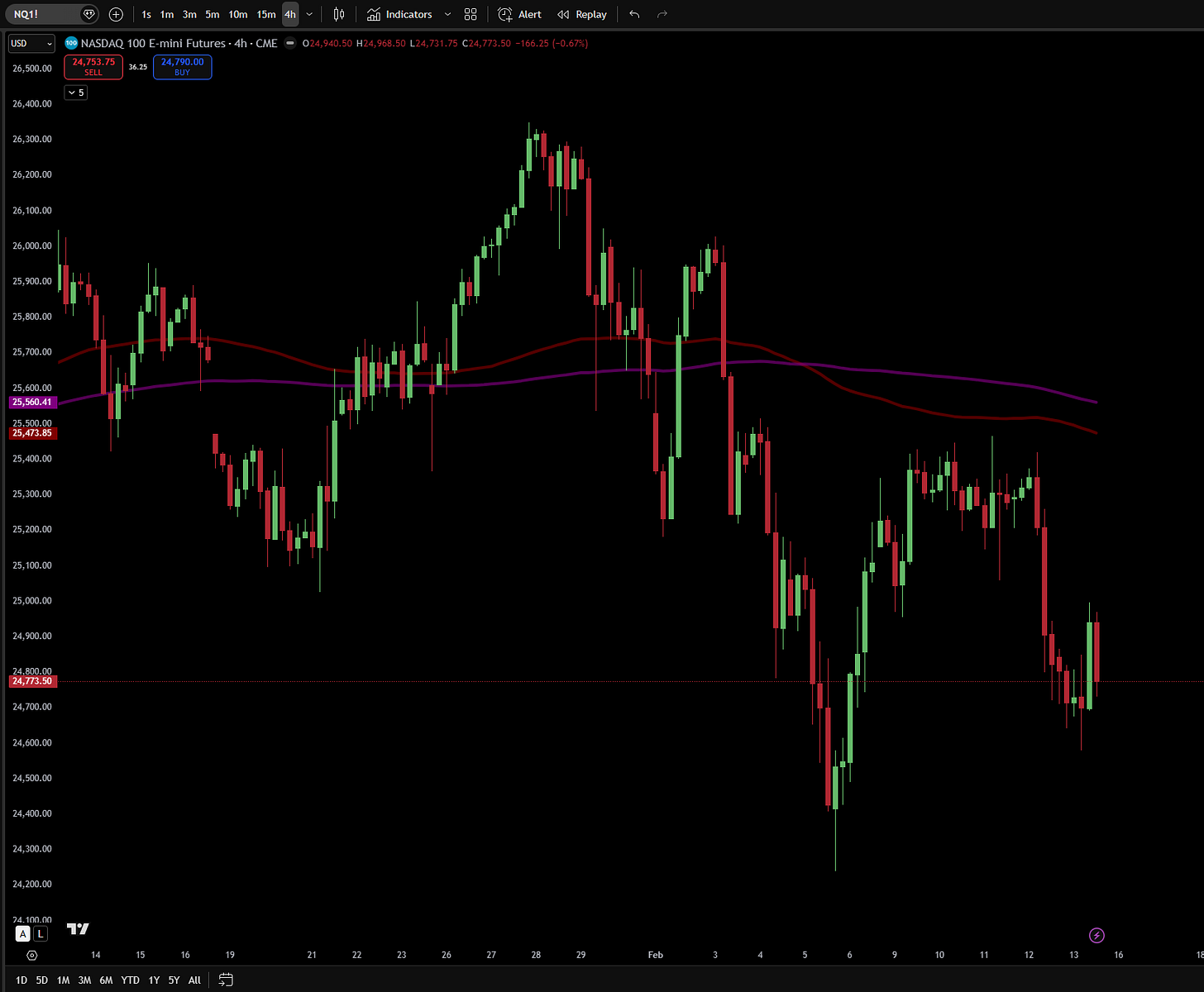

Looking at stocks, the Nasdaq 100 is showing classic signs that big investors are selling. The index failed to get back above its 100-day moving average, and major names like Apple and AppLovin got hammered on earnings. This suggests we might be shifting from a “buy the dip” mentality to “sell the rally.”

With Kevin Warsh being nominated as the next Federal Reserve Chair and the Fed minutes coming out on February 18, we’re set up for volatility to spike. The easy money trades of 2024-2025, where you just bought index funds and AI stocks, are giving way to a market where you need to actually pick good stocks and worry about borrowing costs and geopolitical risks.

Understanding the Economy: The Inflation-Tariff Trap

The Inflation Problem: Breaking Down January 2026 CPI

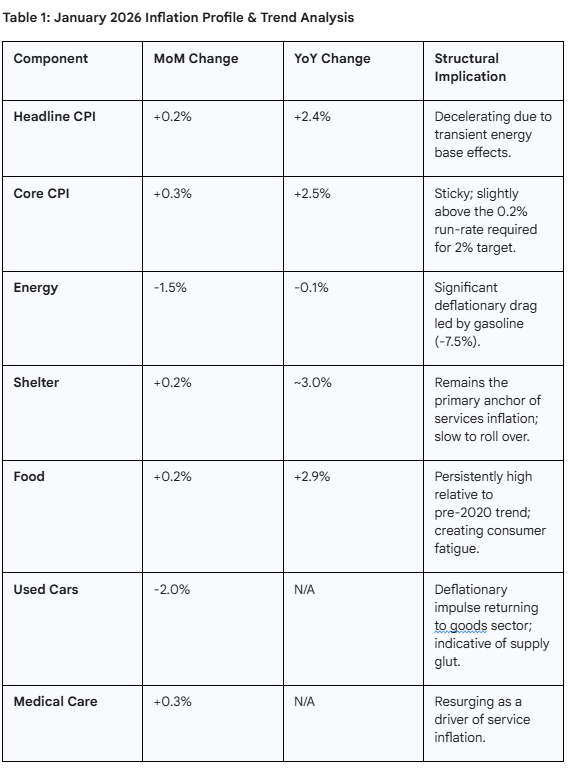

When the Bureau of Labor Statistics released the January 2026 inflation data on February 13, the market had trouble figuring out what it meant. Headline CPI rose 0.2% from the previous month and 2.4% from a year ago. That 2.4% is the lowest annual reading since May. On the surface, this looks good and supports the idea that inflation is cooling. But when you dig into the Core CPI (which excludes food and energy), you see structural problems that justify why some Fed officials are worried.

The good headline number was mostly created by falling energy prices, which dropped 1.5% in January. Gasoline prices crashed 7.5%, and that’s a volatile component that hid the persistent inflation pressure in services. When you strip out energy, the picture looks much worse. Shelter costs, which make up the biggest chunk of the CPI basket, rose 0.2%. While that’s better than the 0.4-0.5% monthly increases we saw before, it’s still mathematically hard to get back to a 2% overall inflation target without shelter costs falling faster.

The “supercore” inflation metric, which is services excluding energy and housing and is the Fed’s preferred way to track wage-driven inflation, keeps getting pushed up by rising costs in medical care, recreation, and airline fares.

This data backs up what Fed officials like Christopher Waller and Lisa Cook have been saying. They argue that risks are tilted toward higher inflation, which means we need to keep rates “higher for longer” even though the market is pricing in rate cuts. The split between the goods sector (where prices are falling because supply chains are fixed) and the services sector (where prices are rising because of wages and insurance costs) creates an economy that’s hard to manage with just one interest rate.

The Tariff Problem: Measuring the Real Impact

A big variable that the market isn’t pricing in properly for 2026 is the return of aggressive trade protectionism. A major study from the Federal Reserve Bank of New York in February 2026 measured the impact of the 2025 tariff regime and proved that the political talking points are wrong. Foreign exporters aren’t absorbing the tariff costs. American companies and consumers are paying nearly 90% of it.

The average tariff rate on U.S. imports shot up from a low 2.6% at the start of 2025 to 13% by year-end. That’s a five-times increase in the tax on imports, comparable to the trade wars of the 1930s in terms of percentage, though it’s happening in a much more globalized economy now. The New York Fed’s data shows that about 86% of tariff costs get passed through to import prices. So for every 10% tariff, import prices rise by 8.6%.

This structural shift has serious implications for the current market:

Profit Margin Squeeze & Earnings Risk: American companies, especially in industrial and retail sectors, face a tough choice. Either absorb these costs (which means lower earnings per share) or pass them to consumers (which means people buy less). Walmart reports earnings next week and will be a key test of this dynamic. If they signal they can’t pass costs on, the entire retail sector could get repriced lower.

Monetary Policy Conflict: The Federal Reserve can’t easily cut rates to boost growth if inflation is being artificially propped up by tariff-driven price increases. This “stagflation” impulse (lower growth because of higher costs) makes it harder for the incoming Fed Chair to navigate. It effectively raises the “floor” for inflation, making the 2% target impossible to reach without causing a severe recession.

Federal Reserve Policy Outlook: The Warsh Era Begins

Kevin Warsh being nominated to replace Jerome Powell adds a new layer of uncertainty to policy. The market sees Warsh as pragmatic but historically hawkish when it comes to fiscal irresponsibility and government overspending. His appointment signals we might shift away from the “flexible average inflation targeting” approach toward a more rigid defense of the currency and long-term fiscal stability.

At the January FOMC meeting, the Fed held rates steady at 3.50% to 3.75%, which is significantly lower than the 2023-2024 peak, showing that the Fed had done substantial easing throughout 2025. But the January pause wasn’t unanimous, revealing a divided committee. Dissenters like Stephen Miran argued for aggressive cuts (up to 100 basis points), saying tariffs haven’t had much impact. This view directly contradicts what the New York Fed found. Meanwhile, hawks like Alberto Musalem from the St. Louis Fed said further easing would be “unadvisable” given that the labor market refuses to weaken.

Key Event Ahead: FOMC Minutes (Feb 18): The minutes from the January meeting come out Wednesday, February 18, and people will be looking closely at how deep this division runs. If the minutes show growing agreement that the “neutral rate” has shifted higher because of fiscal deficits and tariffs, the bond market might have to reprice where rates will end up in 2026, which could trigger a sell-off in shorter-term bonds.

Stock Market Structure & Sector Analysis

The stock markets are showing classic late-cycle behavior: narrowing breadth, defensive rotation, and high sensitivity to liquidity withdrawal. The gap between the S&P 500 and the Nasdaq 100 is the defining feature of current market structure.

Index Performance: ES and NQ