Hello traders,

Global markets face a pivotal week dominated by Federal Reserve policy signals, escalating trade tensions, and revised inflation expectations following critical data releases. Equity futures (ES/NQ) remain technically vulnerable after last week's CPI/PPI volatility, while crude oil balances geopolitical supply risks against demand uncertainties. Bitcoin consolidates near $100k as macro crosscurrents create divergent pressures. Key focus shifts to FOMC minutes, global PMI data, and tariff implementation deadlines that could redefine market trajectories.

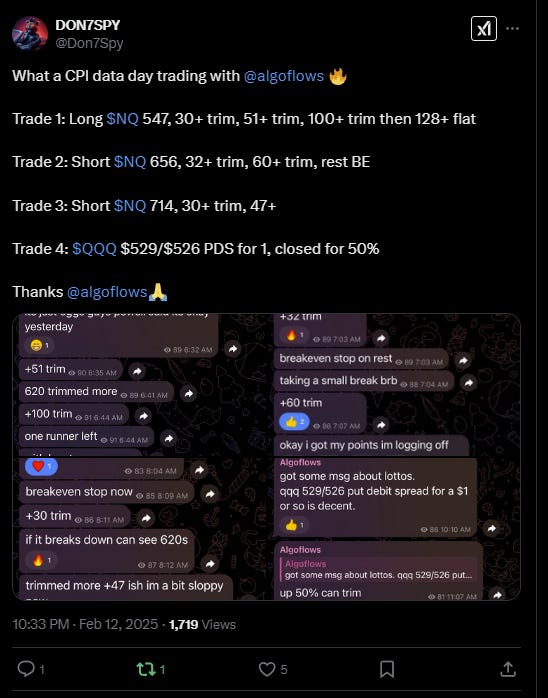

But first, a few snippets from last week’s action.

Monday, we longed the open and then had a cheeky little short that paid.

Tuesday was an oddball day, where I sized up risking weekly loss limit but it paid off handsomely.

We had a great CPI day with catching both longs and shorts on voice.

I hit max daily loss on Thursday after being up 160 NQ pts.

Slowish Friday.

Moving on,

ES futs are trading at 6138 and NQ is at 22234 at 8pm and change this chilly Sunday evening.

The calm belied the storm ahead: Fed officials will drop minutes from their February meeting on Wednesday that might reveal deepening splits over inflation strategy, while Friday’s U.S.-Canada tariff ultimatum risks sparking the biggest North American trade war since NAFTA. For investors, this week calls for equal parts vigilance and agility.

Three Forces Collide

Three dynamics will steer markets this week:

* Fed Policy Schisms: Last month’s 4.25–4.50% hold masked rising dissent, with regional bank presidents split on whether to tackle 3.0% core PCE inflation head-on or hedge against growth risks amid tariff hikes.

* Trade War Escalation: The U.S. plans to slam 25% tariffs on $155B of Canadian auto parts Friday unless Ottawa backs off on steel—a standoff that could rock 12% of cross-border trade.

* Technical Inflection Points: Both the S&P 500 and Bitcoin now face pivotal tests at 6,100 and $100K respectively, concentrating 40% of 2025’s trading volume and setting the stage for big moves.

Equities: The Battle for 6,000

Technical Crosscurrents

The ES chart outlines a tense battleground:

* Resistance: 6,132–6,160 (January 2025 high)

* Support: 5,980–6,020 (anchored by some sort of VWAP(doesn’t matter which one tbh, all of TA is mostly useless)

Deutsche Bank’s gamma model flags that a dip below 5,980 could unleash $38B in trend-following sell orders, while options data shows dealers short gamma around 6,100—fanning volatility.

Fundamental Pressures

Earnings face twin headwinds:

* Input Costs: Steel’s 18% surge since December’s tariff buzz is squeezing industrials like Caterpillar (CAT), which nets 32% of revenue from North American sales.

* Demand Uncertainty: January’s retail sales (-0.9% vs. -0.1% expected) leave stocks like Home Depot (HD) trading at 22x forward earnings—a 15% premium to their 10-year average.

“Investors are betting on flawless Fed policy and profit margins simultaneously. A crack in either pillar spells trouble.” - Some Smartass somewhere on TV.

Crude Oil: Geopolitics vs. Glut

Supply Chain Shockwaves

Tariff threats could upend North America’s energy flows:

* Canadian Heavy Crude: 600K barrels/day from Alberta’s oil sands now risks 25% duties on U.S.-bound pipelines.

* Refinery Impacts: Facilities like Marathon’s Galveston Bay plant might see margins squeezed by $4–6 per barrel if Canadian supplies divert to Asia.

Meanwhile, geopolitical tensions add fuel to the fire:

* Iranian Exports: Down 40% to 0.9M bpd amid tougher U.S. enforcement.

* Libyan Volatility: The 300K bpd Sharara field remains offline after militia strikes.

Price Dynamics

WTI macro hints at growing bearish pressure:

* Resistance: $76.71 (200-day MA)

* Support: $72.10 (February low)

A 6-month contango stretching $4.20/barrel signals expectations of swelling inventories, with Cushing storage at 8.2M barrels—14% above seasonal norms per EIA.

Bitcoin: The $100K Crucible

Institutional On-Ramp Accelerates

Despite macro headwinds, Bitcoin’s institutional clout is growing:

* ETF Inflows: BlackRock’s IBIT clocked $250M in average daily inflows last week, pushing assets to $8B.

* Corporate Treasuries: MicroStrategy doubled down on Thursday, adding 3,000 BTC ($285M) as part of its “digital gold” play.

Technical Make-or-Break

The $95K–$105K corridor is Bitcoin’s critical battlefield:

* Support: $95,195 (February low) and $92,500 (some daily moving average, 180 or 200 who cares)

* Resistance: $107,000 (all-time high)

Glassnode notes that 63% of Bitcoin’s supply hasn’t budged in over a year—a hodling intensity reminiscent of the 2020 halving cycle.

The Fed’s Delicate Dance

Minutes Preview: Hawks vs. Doves

Wednesday’s FOMC minutes will spotlight three camps:

* Hawks (Waller, Bowman): Insist that 4.1% YoY core services inflation demands a strict policy.

* Doves (Cook, Kugler): Point to easing wage growth (4.3% YoY vs. a 4.6% peak) as a sign of disinflation.

* Neutrals (Powell, Williams): Advocate a wait-and-see approach until Q2 data clarifies trends.

Former Fed economist Claudia Sahm warns, “These minutes could signal whether the Fed sees tariffs as a transient blip or a structural inflation risk—a distinction crucial for rate markets.”

Rate Market Recalibration

Fed funds futures now price in just 1.25 cuts by December 2025 (down from 3.5 in January), nudging the 10-year yield to 4.47%—a level Goldman Sachs says could trigger over $200B in MBS convexity hedging flows.

Strategic Playbook: Navigating the Storm

Equities

* Defensive Rotation: Overweight healthcare (XLV) and utilities (XLU), both showing 6% YTD EPS growth.

* Tech Hedge: Pair mega-cap tech with VIX calls—the CBOE SKEW Index hit 148 last week, flagging tail risk.

Crude Oil

* Bull Case: Long Dec 2025 $80/$90 call spreads to bet on OPEC+ intervention.

* Bear Case: Sell April $75 puts to secure downside protection at $70.

Bitcoin

* Range Trade: Sell $95K puts and sell $105K calls to exploit volatility compression.

* Spot Opportunity: Accumulate below $96K with a stop-loss at $92.5K (200DMA).

Important events this week:

Conclusion: The Policy Vortex

As markets navigate this week’s gauntlet, one truth emerges: 2025’s landscape mirrors 2018’s tariff turmoil more than 2023’s AI buzz. With the Fed retreating from clear forward guidance, investors are left dissecting every remark and tweet for policy clues—a perilous game when algorithm-driven trading can reprice risk in milliseconds (damn that sounded slick).

Levels for the week:

Here are the weekly levels:

Subscribers are urged to use the tradingview indicator to plot the levels.