Weekly Market Outlook 2/2/2025

Make America Manufacture Again

Hello traders,

If you read news over the weekend, this is how it felt like.

Before we get into Tariffs, let us recap last week.

We shorted the open on Sunday night and rode the short down and then were able to flip long after a few papercuts and then flip short again during Monday RTH session.

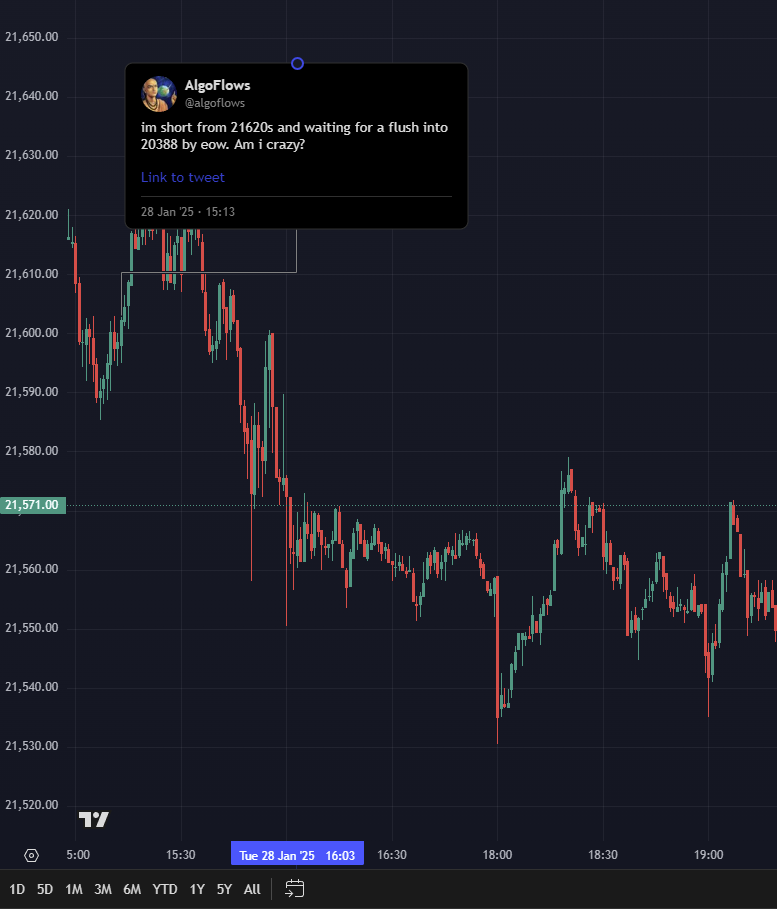

On Tuesday we were able to capture an EOD short that did decent(not everday is a 1000pt day)

On FOMC day, we were able to capture quite a few points on live stream and then ended up with a prescient sell call at 3:52pm

Thursday was a text-book trend down day until noon and we were able to capture it well.

I took the day off from trading on Friday and was focused on optimizing code all day.

This past week, we were also able to dip our toes in solana altcoins

We were able to scale out on the spike to 900% gain and now left with a moonbag which likely goes to zero due to the carnage in crypto.

In last week’s newsletter, I showed medium term bearishness on NVDA 0.00%↑ (Nvidia) and we saw a whopping 20% decline on the name.

What’s next Algo?

*Alright let me think and put on my WSJ reporter hat for a second*

Markets Prepare for Key Week as Economic Strength and Algorithmic Insights Shape S&P 500 Outlook

As the U.S. equity markets enter February, the S&P 500 continues to hold its ground near record levels, supported by resilient economic fundamentals and increasingly sophisticated algorithmic trading strategies. While challenges such as trade tensions and sector-specific headwinds persist, the broader market remains underpinned by robust consumer spending, a tight labor market, and the growing influence of data-driven trading models. The upcoming week promises to be pivotal, with key earnings reports, economic data, and geopolitical developments likely to drive sentiment.

Economic Resilience Anchors Market Optimism

The U.S. economy has shown remarkable resilience entering 2025, with recent data pointing to a solid foundation for growth. Fourth-quarter GDP grew at an annualized rate of 2.3%, slightly below expectations but still indicative of steady expansion. Meanwhile, initial jobless claims fell to 207,000 in late January, well below forecasts and signaling continued strength in the labor market.

Consumer spending remains a critical driver of this resilience. Real wages have risen steadily, supported by subdued inflation and strong employment trends. This has allowed households to maintain robust consumption levels despite higher borrowing costs. Analysts note that this dynamic is particularly important as it offsets potential drags from weaker sectors like housing, which has faced pressure from elevated interest rates.

While some structural risks loom—such as restrictive immigration policies and reduced public-sector hiring under the Trump administration—the immediate outlook remains constructive. These factors may gradually constrain labor supply and growth potential over time, but for now, they have not derailed the broader economic momentum.

Key Earnings Reports Could Drive Sentiment

The upcoming week will see several high-profile earnings releases that could significantly influence market sentiment. Alphabet (Google’s parent company) is expected to report an 11.9% year-over-year increase in revenue for Q4 2024, with earnings per share projected to rise nearly 30%. Similarly, Amazon’s revenue is forecast to grow by 10%, while its EPS could surge by nearly 50%. Speaking of Amazon,

The De Minimus entry rule change would mean people ordering from Temu & Shein and other direct from China e-commerce stores will now have to pay duties.

“In 2022, GAP paid $700 million while H&M paid $200 million in import taxes. Temu paid ZERO.”

This new development likely strengthens Amazon’s position in the e-commerce landscape.

These earnings results will be closely watched not only for their implications on individual stocks but also for what they reveal about broader economic trends. Strong performance from these tech giants would reinforce confidence in the resilience of corporate America, while any disappointments could raise questions about valuations in a market that has already surged more than 20% over the past year.

Trade Tensions: A Persistent Wildcard

Geopolitical developments remain a source of uncertainty for markets. President Trump’s recent announcement of tariffs on Canada, Mexico, and China has introduced volatility as investors assess the potential economic impact. While these measures could weigh on corporate margins in the short term, they also present opportunities for domestic industries poised to benefit from protectionist policies.

Outlook: Constructive but Cautious

The S&P 500 enters February with a mix of optimism and caution. On one hand, strong economic fundamentals and robust corporate earnings provide a solid foundation for continued gains. On the other hand, challenges such as trade tensions and sector-specific headwinds warrant vigilance.

In this environment, investors would do well to balance optimism with prudence. Leveraging algorithmic tools alongside traditional analysis can provide valuable insights into market dynamics while helping navigate an increasingly complex landscape. As February unfolds, all eyes will be on how these forces interact to shape the next phase of the S&P 500’s journey.

*Jesus Christ Algo, Up or Down smh*

I would love to buy ES at 5850s and NQ at 20380s if the opportunity is presented this week.

Moving on,

Weekly Levels

Here are the weekly levels:

Subscribers are urged to use the tradingview indicator to plot the levels.

Keep reading with a 7-day free trial

Subscribe to Algoflows Capital to keep reading this post and get 7 days of free access to the full post archives.