Weekly Market Outlook 9/21/2025

Rates: Cut. Immigration: Reformed. what next?

Hello traders,

As anticipated, the Fed cut rates by 25bps last week and penciled in another 50bps of cuts until EOY.

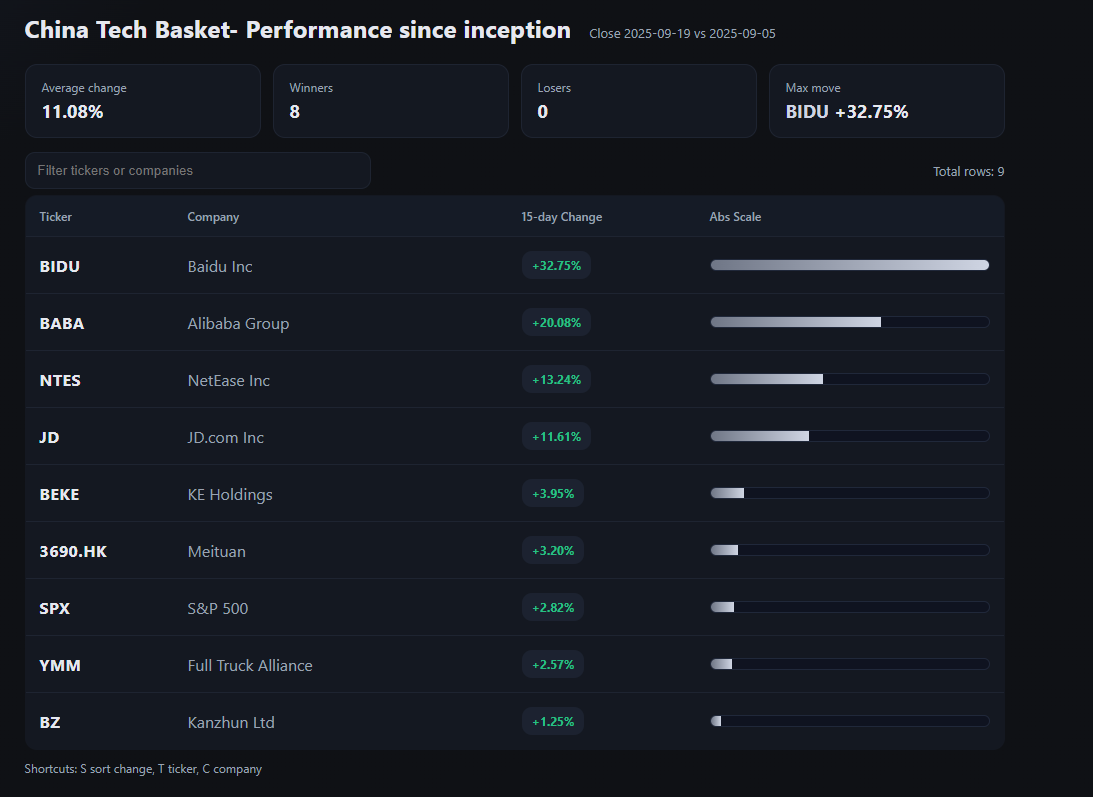

This and structural tailwinds for China-tech caused our China basket to outperform the broader market by 900bps with Baidu being the largest gainer at 3200bps and Alibaba a close second at 2000bps or so.

The China basket post is now free for everyone to read and you can find a glimpse into the thought process of taking these asymmetric bets as and when they show up.

Another rate-cut bet that paid off has been SOFI Technologies stock, which we were able to capture most of the upside since end of June, where the stock has soared 8500bps(85%) and options tripled with more than a quarter left on them.

We did great intraday as well, a snippet here

Realtime Discord access with intraday orderflow & option dealer summaries included with the paid newsletter membership . Click here to subscribe.

CUT IS HERE, WHAT NEXT?

Beneath the index gains, breadth has thinned. Roughly half of S&P 500 constituents sit above their 20-day moving average, a neutral reading that contrasts with the optics of new highs. The advance and decline measures have drifted sideways to lower since July. The dispersion reflects rotations inside the indices rather than a classic everything rally. That matters for risk control. A market can climb with narrow participation, but the climb grows more sensitive to headline risk and positioning stress.

The calendar is quiet into Friday. Headline PCE is expected to tick to about 2.7 percent year over year from 2.6 percent, with core steady near 2.9 percent. Recent PPI components that feed PCE were generally tame, leaving room for a small downside surprise. The policy context also carries a labor filter. The Fed has described a normalization in job growth as immigration policies tightened labor supply and shifted the breakeven pace of monthly hiring lower. That framing supports a glide path of easing unless the data lurches.

Rates have respected familiar levels. The 10-year Treasury found buyers near 4 percent after an FOMC-day shakeout. Technicians see a range between roughly 3.8 and 4.25 percent until either labor softens decisively or inflation re-accelerates. A sustained break would need a clear impulse from employment or prices. Without that impulse, bonds are a range trade.

The dollar’s bigger trend has been weaker this year yet remains prone to tactical squeezes when policy surprises or growth relative to peers wobbles. That choppiness has fed into commodities. Oil’s tape has been heavy. Supply overhang and fading catalysts have capped rallies. A failure to hold the high-60s opens risk toward the high-50s. Gold has held firm near record levels. A high-tight flag argues for targets between $3,750 and $4,000 an ounce if fiscal and policy backdrops remain supportive. Silver has been working out of a multi-decade base that points to larger measured moves over time if liquidity stays abundant and real yields drift lower.

Trump’s H-1B Fee Shock, “Gold Card” Residency, and a Pending “Platinum Card” Reshape U.S. Immigration and how to trade it

President Donald Trump on Friday signed actions that rewire parts of legal immigration. A new $100,000 payment now gates entry for new H-1B petitions. A separate “Gold Card” executive order creates an expedited residency track anchored by a $1 million gift. A higher tier “Platinum Card” priced at $5 million is being prepared that would allow up to 270 days a year in the U.S. without tax on non-U.S. income, though that tier still requires further steps before launch. Tech employers, foreign talent, and immigration lawyers moved fast to assess exposure.

What changed on H-1B

The proclamation restricts entry of H-1B specialty workers unless the sponsoring employer makes a $100,000 payment with the petition. The restriction runs for 12 months from 12:01 a.m. ET on September 21, 2025, absent extension. Agencies were told to align decisions and deny entry where payment is missing. Labor and Homeland Security were directed to start wage-level and selection reforms.

USCIS guidance clarified scope. The $100,000 requirement applies prospectively to petitions filed after the effective time. It does not apply to beneficiaries of petitions filed before that time, to currently approved petitions, or to holders of valid H-1B visas. The memo states current holders may travel without impact under the proclamation.

Early reporting varied on whether the fee was annual or one-time. White House and USCIS guidance pointed to a one-time payment for new petitions, which corrected initial remarks from officials that implied a recurring charge. Market commentary and company travel advisories reflected the confusion, then eased after the clarification.

The new “Gold Card” path

A separate executive order establishes the Gold Card. Individuals who make a $1 million unrestricted gift to the Department of Commerce can be treated as meeting eligibility markers for employment-based immigrant visas under existing statutes. Corporations can sponsor an individual via a $2 million gift, with the ability to reassign the sponsored slot later subject to fees and vetting. Commerce, State, and DHS have 90 days to stand up the process.

The public site trumpcard.gov outlines mechanics. Applicants pay a nonrefundable processing fee, pass DHS vetting, then complete the gift. Approved applicants are routed to EB-1 or EB-2 classifications where available. A corporate Gold Card option allows reassignment of the sponsored employee without a new $2 million gift, subject to maintenance and transfer fees. Tax treatment for Gold Card recipients mirrors other permanent residents.

Media briefings framed the program as a premium, fast-track residency channel intended to attract capital. Coverage also flagged open legal questions about whether visas can be conditioned on gifts at this scale without congressional action and how caps under 8 U.S.C. 1151 apply.

The “Platinum Card” tier

Officials also previewed a higher tier dubbed the Platinum Card. The tier would require a $5 million contribution and permit holders to spend up to 270 days in the U.S. without U.S. tax on non-U.S. income. Axios, Bloomberg, and other outlets reported that this option is being added to the program design but would need further steps before it is operative. The trumpcard.gov site shows a waitlist and states the Platinum Card has not yet launched. Some reports note that elements may require congressional approval.

Legal posture

The H-1B proclamation cites INA sections 212(f) and 215(a) to restrict entry absent payment. That authority has been used before to throttle classes of entrants, but tying a set dollar payment to petition approval is novel and likely to be tested. The Gold Card order tries to fit gifts within existing employment-based categories by instructing agencies to treat the gift as evidence under EB-1 or EB-2 and national-interest waivers. Courts will probe whether that interpretation survives challenges and how statutory caps apply. The Platinum Card tier’s tax and residency features raise separate statutory questions, which is why coverage notes further approvals may be needed.

Practical effects for employers

Near term, employers that planned to file new H-1B petitions face a material cost shock. Large firms can absorb the fee more easily than startups and mid-caps. Some will accelerate O-1 or TN usage where possible. Others will push more work offshore or rely on near-shore hubs. Company guidance this weekend prioritized travel stability for current H-1B staff and paused nonessential international trips until agency field offices align on procedures.

Compliance teams will need new controls. Treasury or payroll must verify the $100,000 payment is remitted and documented before filing. Immigration counsel must track the 12-month window and any extension after the next lottery report to the President. Labor will monitor rulemaking on prevailing wage levels and any reprioritization of selection toward higher pay bands.

Effects on foreign workers

For current H-1B holders, the USCIS memo is the key document. It asserts continued travel and renewals for existing beneficiaries are not blocked by the proclamation. Anxiety remains around consular practice and airline check-in checks before embassy and CBP guidance filter down. The safest reading is that status quo holders are not retroactively charged and should carry petition and memo copies when traveling.

Prospective H-1B candidates face thinner pathways. Some will pivot to O-1 where credentials allow. Others will target employer transfers to Canada or Europe. A subset of wealthy applicants or corporate sponsors may consider the Gold Card route, though timelines, vetting, and caps will gate throughput.

International and political reaction

Overseas, governments and industry groups flagged risks to talent flows and families. The Indian government and trade bodies warned of disruption and urged clarity on renewals and dependents. U.S. reporting highlighted the weekend rush to interpret policy as companies advised foreign workers on immediate travel choices. Expect diplomatic notes and industry comments during the 90-day implementation window.

On Capitol Hill and in the courts, litigation is likely. Petitioners will argue that fee scheduling and immigrant visa criteria are legislative functions, not matters for proclamation. The administration will argue national interest authority and existing immigrant visa categories give enough room. The Platinum Card’s tax-residency feature is the most exposed. That is why multiple outlets note it will require further approvals before activation.

Markets and sector specifics

Tech and IT services face higher staffing friction and costs. Margin pressure rises for models built on steady H-1B inflows. AI and semiconductor leaders with deep balance sheets will adjust more easily than services rollups. Universities and research hospitals that sponsor specialty staff will weigh budget offsets or alternative visa types. Immigration law firms will see a spike in O-1 and EB-1A filings as clients hedge away from H-1B exposure.

Family-based and humanitarian channels are unchanged by these actions, but processing bandwidth and fee collection mechanics will pull agency attention. USCIS payments infrastructure and forms policy are already in flight for updates, which will interact with the new requirements.

OKAY SO WHATS THE TRADE ALGO?

I thought you would never ask

As we digest this news, I have a few trade ideas that can be considered based on these sweeping changes.

1) Pair: Short India IT on U.S. onsite risk vs Long nearshore digital

Short leg: INFY, WIT. Thesis: higher friction and cost for new onsite H-1B staff slows U.S. bench growth, crimps margin mix, and elongates deal ramps. India flagged adverse impact.

Risk controls: cover if White House or USCIS carves explicit exemptions for client-critical transfers.Long leg: GLOB or EPAM. Thesis: shift to distributed and nearshore delivery as clients dodge H-1B bottlenecks.

Structure: 60/40 notional short/long. Review on DHS rule text.

2) Long Canada and LatAm talent proxies

Long: GLOB. Optional add: DAVA on weakness. Rationale: re-route headcount away from U.S. visas toward Argentina–Uruguay–Mexico–EU shops.

Catalyst: client travel advisories freezing H-1B moves, pushing SOWs offshore in Q4.

3) Long U.S. staffing and assessment

Long: RHI or MAN. Thesis: employers absorb part of lost H-1B pipeline with domestic hires and contract staff while reforms proceed.

Hedge: small short in INFY or WIT to neutralize macro beta.

4) Long U.S. STEM edu upskilling

Long: ATGE, STRA. Thesis: policy shock lifts demand for domestic credentialing and nontech-to-tech pivot programs that bypass visas.

Entry: scale on red days only. Exit on DHS softening.

5) Long luxury U.S. housing and South Florida exposure on Gold-Platinum wealth inflows

Long: TOL, LEN, RH. Thesis: Gold Card million-dollar path plus prospective Platinum 270-day stay boosts trophy homes, high-end interiors, and move-up demand in tax-friendly states. Platinum still pending. Size accordingly.

Stop: break of 50-DMA. Trim into earnings.

6) Long U.S. wealth managers and brokers

Long: GS, MS, SCHW or the IAI ETF. Thesis: onboarding high-net-worth Gold Card applicants and associated family assets. Tail increases if Platinum activates.

Risk: court stays.

7) Long U.S. hotel majors and branded residences

Long: MAR, H. Thesis: higher-net-worth mobility visas increase extended-stay and branded residence demand in gateway cities. Platinum tax feature is optionality.

8) Short U.S. H-1B-heavy IT services rollups

Short: CTSH as tactical hedge. Thesis: near-term onboarding friction and client project delays as policies settle. Reverse if agencies issue generous carve-outs.

9) Long immigration-beneficiary realty brokers

Long: COMP, RMAX. Thesis: Gold Card closings increase high-ticket transactions. Execution risk until Commerce, State, DHS publish workflows.

10) Event-driven options

QQQ put spreads 1-3 months. Rationale: tech margin headwind narrative if markets extrapolate higher labor costs. Use defined risk only.

Pairs options: Buy GLOB calls vs buy INFY puts into first agency FAQ drop.

11) Tactical FX overlay

Long MXN basket vs INR via forwards for sophisticated traders. Thesis: reallocation from India-onsite to nearshore LatAm delivery. Monitor RBI response.

Timeline and binary risks to price

Now: Clarifications confirm one-time fee on new petitions only. Existing holders unaffected. Travel advisories still in play.

T+30–90 days: Gold Card implementation rules, fee tables, portals. Position luxury housing and wealth managers into first approvals, not before.

Platinum: contingent. Treat as an out-of-the-money call on Florida luxury and U.S. wealth platforms until legal pieces are explicit.

Position governance

Cap single-name risk at 50 bps.

Use pairs to isolate policy path from market beta.

Tie adds and trims to official DHS, State, and Commerce postings. Primary sources beat headlines.

WEEKLY LEVELS

NOTE: SUBSCRIBERS ARE URGED TO JOIN THE DISCORD AT THEIR EARLIEST CONVENIENCE.