Weekly Market outlook 9/2/2024

Short week Shenanigans

Hello traders,

A quick update on the equity picks from last week’s plan

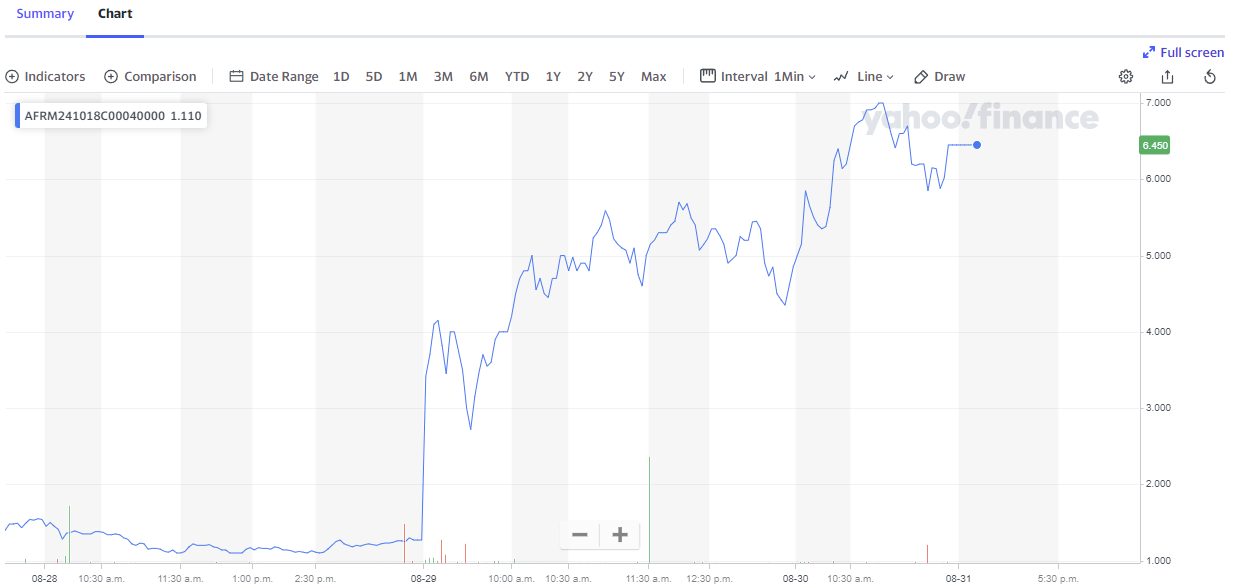

With AFRM 0.00%↑ up 43% or so from the Monday open

With the suggested options going up about 520%

As far square is concerned, it is still rangebound but went as high as 5.94%

The thesis of Powell cutting this month is the proverbial rising tide that is lifting these boats.

Last week we had quite a few good index options trades with a couple notable ones below

Other than that our regular futures trading was productive as well,

Moving on,

As we look ahead to next week, Friday's NFP report isn't just another piece of data—it's the key event that could shape the Fed’s next move between a 25bps or 50bps rate cut, with major implications for the markets. The focus has clearly shifted. It’s no longer just about inflation; now, job and labor market data have taken center stage. If the Unemployment Rate stays steady, the Fed is likely to stick with a 25bps cut in September. But let’s not underestimate the risk here—a 50bps cut combined with a weakening labor market could really shake things up, and not in a good way.

We’ll get a lot of economic and labor-related numbers throughout the week, but honestly, most of it is just noise. The real story will be Friday’s NFP report, specifically the unemployment rate. If it starts creeping up, we could see some serious volatility, which would force the markets to reassess their positions. On the flip side, if if jobs stay flat or even dip a little, it could give the market a reason to stay in risk-on mode.

Bulls are in total control of the tape and ES can easily go to 5740+ crossing all time highs as long as the NFP data is agreeable to the goldilocks/soft landing narrative.

Only worrying sign for bulls is break of 5480 which seems a long distance away as of now.

Weekly Levels:

Levels for the week:

Subscribers are urged to use the tradingview indicator to plot the levels.