Weekly Plan 1/1/2024

Hello traders,

Wishing you all a very happy new year.

Before we start with the weekly plan, I would like to shed light on a couple ideas I have for this year.

Baidu and Chainlink (crypto). Risk reward in china stocks is attractive at the moment. Also, Baidu LLM Ernie is crushing the benchmarks. Chainlink is the only cryptocurrency that has some semblance of a legitimate corporation with MoU with larger companies for their oracle services.

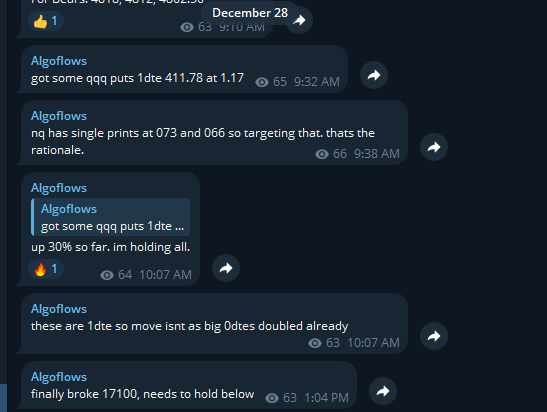

Last week was a relatively quiet trading week for me and I was short nasdaq and took some QQQ puts which served us very well.

Moving on to this week, we do have FOMC minutes, Jobless claims and NFP and that would probably give a definitive direction to the dotplot of Fed rate cuts for this year which stands like this after the 13th December meeting.

**Skip to levels if you don’t care about ADP and NFP numbers**

Today Goldman threw some shade on ADP: "ADP’s negative correlation with nonfarm payrolls suggests that forecasts of ADP should perhaps orient around predicting the noise as opposed to the signal."

Meanwhile NFP revisions in 2023 have been all over the place.

Implications The correlation analysis between ADP and NFP exposes the hidden patterns in employment trends:

A. Context-specific Correlation:

ADP tracks NFP well when ADP numbers are positive, showing the reality of private-sector employment. But when NFP numbers are more positive, the correlation falls apart, showing the interference of government-related factors. This context-specific correlation comes from the different hiring cycles: government hiring tries to be counter-cyclical (hiring more when the economy sucks and less when it booms), while private hiring is pro-cyclical (following the economy). So, when the economy is in the toilet, NFP looks better than ADP and the correlations are bullshit.

B. Outlier Management and Data Smoothing:

Outliers in NFP data can screw up the employment trend, often coming from government-related bullshit or policies. ADP outliers can come from sector-specific shocks or natural disasters, messing up private-sector employment data. Dealing with outliers is key for seeing the truth in employment trends, and it can be done with math and charts. Also, data smoothing techniques help reduce noise caused by outliers, showing the real employment trends.

Weekly Levels: