Weekly Plan 12/11

EOD means end of december right?

Hello traders,

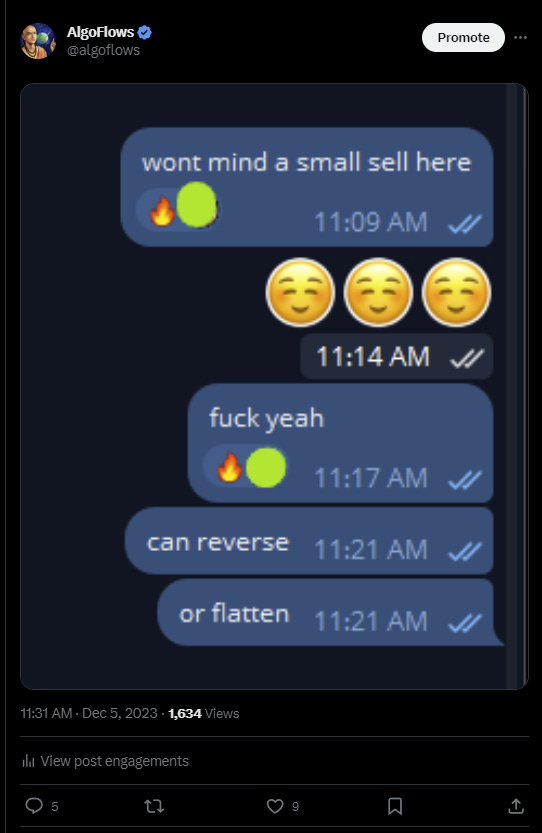

Hope you had a great trading week and have journaled your trades. I do daily and weekly journaling in order to identify certain odd behavior more than anything else. My journal is linked here if anyone wants to read.

Last week was quite a good one where our levels and bias worked perfectly and we were able to extract valuable points from the markets.

There are a few more but I will hit the substack email length limit.

We had a soft NFP on Friday and almost everyone has priced in soft landing and Jerome Powell to be given the Time person of the year award(as long as he gets in 4 platinum albums out by the 31st, may be Gemini can help)

Do we anticipate a breather in equities this week off Jerome, clearly his hawkish tone meant nothing to the market participants and CTAs are almost as long as one can get

Now, let's peek at this week's economic calendar. With CPI numbers on Tuesday and PPI on Wednesday, plus the FOMC in the mix, and don't forget Thursday's jobless claims and retail sales - it's like the market's version of a five-course meal. The recent trend in inflation is like a rollercoaster that's finally calming down, and everyone's eyes are peeled for continued disinflation.

For the upcoming week, brace yourselves for more volatility. If the market perceives Jay and the dots as dovish, ES Z contract could flirt with 4675. But if they go hawkish, it's a nosedive to 4510. CPI and PPI? They're like wild cards - only shocking if they actually surprise us.

As far as the fed is concerned, they are not even sure if we are at restrictive policy level and the talks of rate cuts seem like an overreach by the street. That is somewhat of a risk going into the FOMC.

I would send a midweek update once I roll to new contracts, for now I’m trading Z contracts.

LEVELS: