Weekly Plan 1/28

QRA, Powell and Earnings

Hello traders,

Hope you had a great weekend. I ended up sleeping 10-11 hours on both Friday and Saturday night so it has been amazing for me.

Recapping last week, we had many excellent sessions.

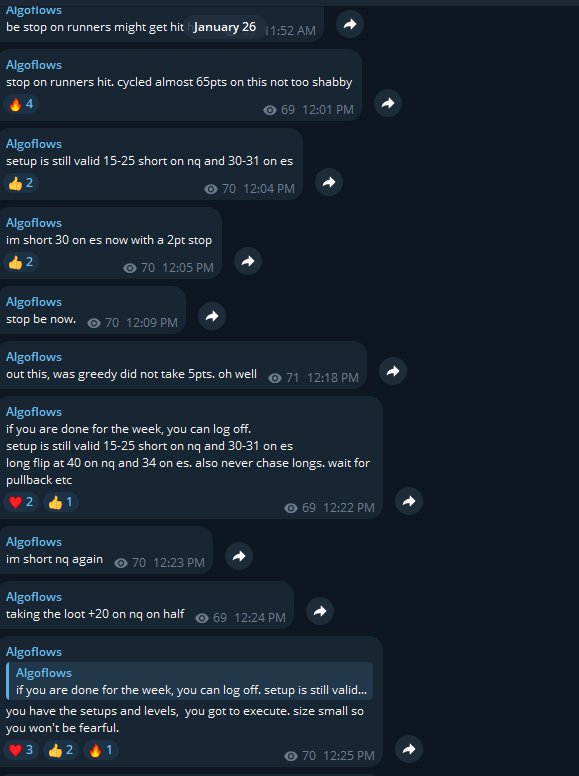

On Friday, due to requests from subscribers I was sharing more than usual of my thought process and trade ideas

Another end of the day idea that netted decent points.

This evening I got stopped a couple times (-14 and -17) on NQ. Getting stopped out is part of the process and there is no need to hide it. Imperfection does not sell, however.

This week, we find ourselves in a captivating dance of hope and fear, punctuated by the sharp rhythm of corporate earnings reports and the alluring murmur of Federal Reserve announcements. The atmosphere is electric with expectation. Will we hear the ominous trumpet of a market crash, or will it be a gentle dance of mild volatility, a soothing melody to calm market nerves?

First up QRA,

The upcoming U.S. Treasury (UST) Quarterly Refunding announcement is stirring some expectations among market participants. Bank of America (BofA) anticipates an increase in the issuance of 3-year and 10-year Treasury notes by $2 billion each, while expecting no change in the 20-year issuance and a $1 billion increase in the 30-year bonds. However, BMO suggests that the expected increase of $1 billion in the 30-year bonds is not a certainty.

It's notable that in the last Quarterly Refunding Announcement (QRA), the Treasury cut back on the issuance of 10-year and 30-year bonds. This decision led to a flattening of the yield curve, specifically the spread between the 5-year and 30-year bonds (5s30s). The yield curve flattening can be interpreted as a market reaction to lower long-term debt supply, impacting investor expectations about future interest rates and economic growth.

Then we have the Fed, who the futures market is predicting will not cut in this meeting even though PCE did taper quite a bit.

Pause being the key word algos looking for this week’s FOMC. Jerome won’t move from a Hawk to a Dove in an instant so there might be another meeting before cuts start to happen. I prefer to react to the minutes than to predict and “get cooked”.

Then we have Earnings.

This is an action packed week and the megacaps like MSFT, AAPL, GOOG & META report.

There seems to be a price extension on a few of these companies like AMD, QCOM, AMZN and MSFT.

With respect to AMD, the recent Elon tweet about buying AMD chips could provide an upside if it is included in the presentation, otherwise they are decidedly second place to NVDA when it comes to GPU sales. My anecdotal evidence from last year is linked here and I think AMD is inferior to NVDA at least for my use-case.

Other than that I don’t mind call credit spreads on some big tech names like META AAPL AMZN MSFT. This is akin to collecting pennies in front of a steamroller so you should know what you are doing. I will go in more detail about the IV/delta structure on the day of these earnings in telegram.

Moving on,

Levels for this week Until FOMC: