Weekly Plan 2/12

Balloons are not the only thing inflating

Hello traders,

I hope you had an excellent weekend of rest and recreation. I know it is Superbowl Sunday and it would be a time most wouldn’t want to trade. Hope the team you support wins or the one you hate loses.

Last week, we had an excellent week with calling the top of the range and

being able to short on both Thursday and Friday.

Over the weekend, we went long on Bitcoin and got about 300-400 points on the long.

But resting on past laurels is not something I’m fond of, so let us dive in into the biggest points of interest this week for the markets.

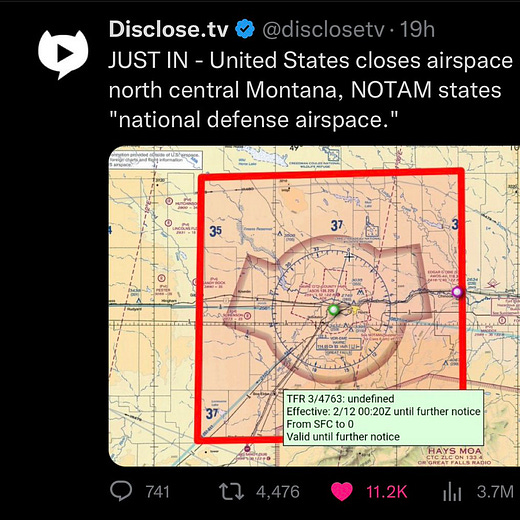

Everyone trying to guess what these Balloons are while the trader in me is

trying to find an opportunity to exploit it in the markets. The markets want to

price Chinese stocks lower because of these Balloons/UFOs and probably

expect sanctions by the west on China for the nefarious spycrafts. However,

I would be waiting to buy some Chinese equities and ETFs in this entire

expected drawdown and possibly sell cash secured puts on MCHI 0.00%↑ , KWEB 0.00%↑ and BABA 0.00%↑ . More adventurous souls can buy LEAPs although I’m not inclined to buy LEAPs without watching Monday’s

price action.

CPI and PPI:

You can go on marketwatch, CNBC or any other finance website and find elaborate takes on the CPI and how the weights for the time series data for CPI have been changed and so forth. The reality is that a softer CPI and PPI(to some extent) is gonna cause the markets float upwards and the risk on nature of buying tech, crypto and ARKK companies will continue. A hot CPI on the other hand is definitely going to test 4000 and 3960 levels on the ES. This is a binary event and anyone who is taking a position ahead of the trade is either a savant macro expert or a gambler. And if you really want to gamble, might as well bet on the Eagles ML and Kelce TD.

What I want to see is a downtrend in Sticky CPI(picture above). As touched upon in a previous weekly plan , without the sticky CPI coming down, Jerome and his brady bunch would not be inclined to lower rates anytime soon.

Jobless Claims:

After a very erratic last quarter when bad news meant good news, the markets are now treating bad news as somewhat bad news and repricing the orderbook.

The expected number of jobless claims is 200k.

The Fed faces a challenging situation when it comes to controlling inflation. According to the Phillips Curve theory, when the economy is strong and unemployment is low, workers are more likely to demand higher wages and companies may raise their prices to keep up with rising labor costs. This leads to inflation. To combat this, the Fed may need to raise interest rates, making it harder for people to borrow and spend money. This, in turn, can slow down the economy and increase unemployment.

However, this is a delicate balance that the Fed needs to maintain. They must find a way to keep prices stable while also promoting economic growth and job creation. It's important for traders to understand this dynamic and how it affects the economy and the financial markets. If we see a higher than expected jobless claims, the doves in the Fed might push for 25bps raise or even some cuts later down the road.

How is any of this actionable info Algo?

I believe that understanding the machinations of the Fed is one of the keys to position yourself in the right trades. Also I want to increase the word length of this Substack so let us all pretend we learned something here.

TLDR: High Jobless claims, market goes up.

The Plan for ES this week