Weekly Plan 2/27

Doves of January, Hawks of March

Hello Traders,

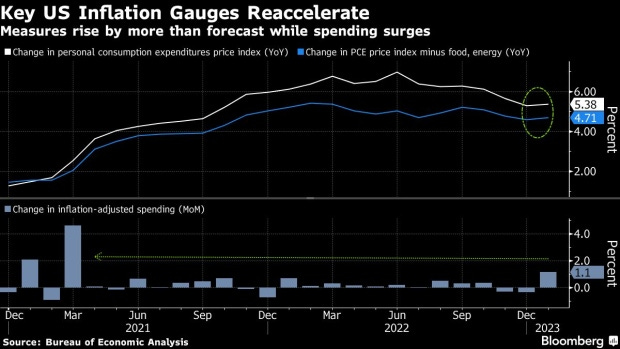

We had an eventful week with PCE showing very sparse signs of abatement.

We know that PCE is the Fed’s preferred gauge to measure inflation.

In her interview with Bloomberg News on Friday in New York, Cleveland Fed President Loretta Mester expressed her dissatisfaction with the current inflation readings, stating that they have not yet met the necessary criteria. The US government report, released recently, indicates that the Fed's preferred gauge of price pressures saw a 5.4% increase in the 12 months leading up to January. This reading represents an increase from the previous month's 5%, and significantly surpasses the Fed's 2% target. Notably, economists were anticipating an unchanged reading. According to Mester, the report highlights the need for the Fed to take further action regarding their policy rate in order to ensure a decrease in inflation.

Last week most of our calls worked well and we netted around 120 ES points and countless NQ, CL and GC points. And all of our earnings plays paid handsomely. It is rare to get a 100% winrate on earnings so it cannot be turned into an expectation but it would always be an exception.

However, we begin each week with a fresh slate and do not rest on our laurels. As traders, our focus is always on the next move and trying to capture the most amount of points.

Looking at a slightly broader market, I still believe bulls have not lost everything and this pullback is something that happens regularly in bull markets.

After an unusual spike in January, the Feb bear victory has happened 8/10 times historically. Going forward, March-August risk-on seems to be the favored trade with my favorite pair trade would be to long tech/ short value. Again, this is a trade with a defined stop loss and taking profits at regular intervals. Even with a defined edge, pertinent risk management is king.

The upcoming week is poised to be quite significant for the markets as it is largely centered around the release of crucial data. One major area of focus will be on the earnings reports of various retailers like COST 0.00%↑ , BBY 0.00%↑ , TGT 0.00%↑ and KR 0.00%↑ , which will provide a valuable insight into the current state of consumer spending. The performance of these retailers and the consumer spending trends they reveal will be crucial indicators for the wider economy, as consumer spending makes up a significant portion of the US GDP.

In addition to the earnings reports, a number of other important indicators are set to be released as well. On Monday, we will see the release of durable goods orders data, which provides information about the demand for long-lasting consumer products such as automobiles and appliances. This data can give us clues about the state of the manufacturing industry and consumer confidence. Speaking of which, Tuesday will also bring the release of the Conference Board's Consumer Confidence Index, which measures the level of confidence that consumers have in the state of the economy.

Moving on to the latter half of the week, Wednesday will see the release of the Institute for Supply Management (ISM) Manufacturing Index. This index tracks the performance of the manufacturing sector, which is a critical component of the US economy. It provides insight into the level of growth or contraction within the sector, and can therefore offer important signals about the overall health of the economy.

Finally, Friday will see the release of the ISM Non-Manufacturing Index, which tracks the performance of the service sector of the economy. This index includes areas such as retail, health care, and financial services, among others. The performance of the service sector is equally important as that of the manufacturing sector in terms of its contribution to the overall economy. Therefore, the release of the ISM Non-Manufacturing Index can also provide valuable insight into the state of the economy as a whole.

Moving on,

These are the key levels for this week.

Levels for ES :

ES kissed its 200SMA and then bounced back at the end of Friday’s session.

With that in mind we will look at the following key inflection points this week

Primary directional inflection point: 3973.50

For Bulls: 3990.75, 4001, 4018.50

For Bears: 3955, 3941.

Updated forecasts would be sent via Telegram in the AM.

Levels for NQ:

Primary directional inflection point: 12008

for Bulls: 12102, 12189

for Bears: 11965 and 11926.75

Updated forecasts would be sent via Telegram in the AM

Levels for CL:

Primary directional inflection point: 76.51

For Bulls: 77.58

For Bears: 75.98, 75.62 and 75.07.

Note: Crude upside move seems to be capped at 80-81 range on the J contract. Unless we see the Russia-Ukraine situation souring more, a push in crude seems unlikely.

Earnings:

Lot of interesting earnings this week. However, I have my eyes glued on TGT 0.00%↑ and I would like to punt on the next earnings on the basis of their ER reaction.

I like to be a cautious bull on MRVL 0.00%↑

Selling put credit spreads would be my risk-averse strategy. A risk on strategy would be of course to buy calls, but do remember that is a high risk-high reward strategy

That is it from me for now, hope to see you all in chat.

-Fin

Are the levels in weekly plans meant as weekly levels? Doesn't seem that way.

Have sent request to join both Telegram group chats too, tku.

New sub here. Can you pls send link to you telegram?