Weekly Plan 3/12

Move over CPI, SVB is now the talk of the town.

Hello traders,

Trying to make sense of what happened last week over the weekend was an arduous task.

So I asked ChatGPT to explain it in a line.

We did think we would see weaknesses in banks last week and went short OZK 0.00%↑ as opposed to going short $SVB but if my grandma had wheels she would be a bicycle.

The freemarket capitalists of Silicon Valley who dance to the libertarian drumroll everyday on the internet are now suddenly asking for a bailout from the Fed. Oh well, socialize losses and privatize gains team is here and how.

From:

To:

Anyway, I have no dog in this fight other than I was long crypto last night and booked most of my gains a little while ago.

I have nothing against Silicon Valley VCs( heck I tried to raise capital for my startup in the worst time to raise capital (2022)) and most of them are smart, kind and empathetic individuals. But some truly are vultures who want nothing else but to enrich their own pockets.

Moving on, these are the events I will be watching closely this week to trade.

1) US Gov. action on SIVB 0.00%↑ : I believe as early as Monday we will hear from Sec. Yellen or Powell about providing some sort of a backstop to the SIVB saga. That can cause a vicious bounce in banks and subsequently ES.

2) CPI and PPI: We have an important CPI reading on Tuesday, a PPI reading on Wednesday and that will decide where the Fed wants to go in terms of rate hikes going forward. If I were a betting man I would say the Fed says “ we want to do a 25bps hike but some members urged for a 50bps hike and we have that in mind” but having a bias into data prints is mostly a losing endeavor over a larger period as there is no edge in predicting the said prints.

3) Eurozone interest rate decision: Ms. Lagarde and her friends will decide the fate of EU markets on Thursday and are firmly in the 50bps camp. If we get a surprise 25bps then the markets could rally a bit in the london session. Other than that I don’t want to destroy my sleep schedule for 10-20pt move on ES.

Our plan for this week is as follows.

Note: I have moved to the M contract on ES and NQ. I’m on the J contract for CL and GC.

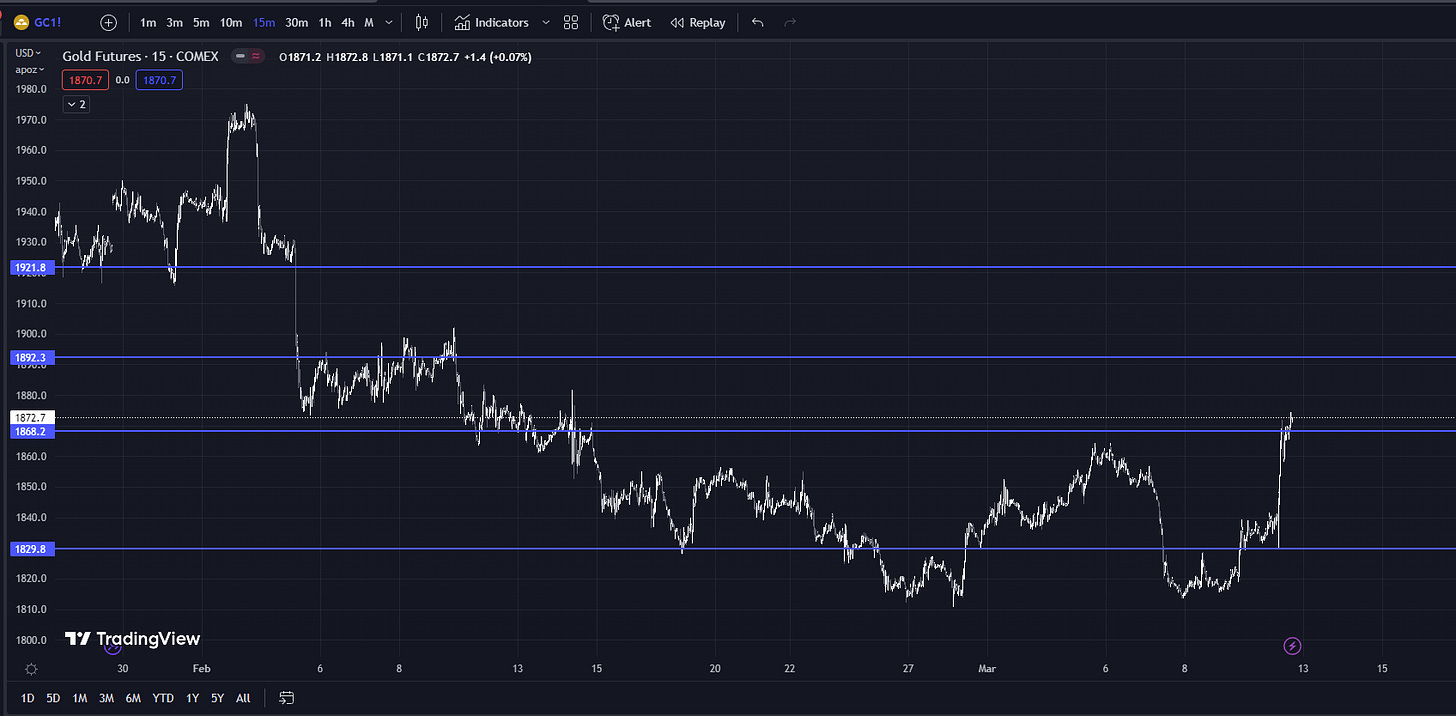

GC:

Our plan for last week on GC was spot on

With 1814 being the perfect bounce zone and defined profit taking at 1855 and 1870 levels.

For this week these are my levels for GC.

Primary directional inflection point: 1868.2

For Bulls: 1892.3, 1921.8

For Bears: 1829.8

I think the move in GC is capped at 1920-25 and anything above it is an impulse move to upside which would sell-off sooner rather than later.

ES:

These are my weekly levels for the ES contract. For those who want to trade tonight’s overnight session, I will send overnight levels on Telegram 10-15 minutes into the session.