Weekly Plan 3/20

Look who's back, QE's back, back again

Hello traders,

Hope you had a great weekend.

After a fruitful last week for traders(see the daily plans from last week for recaps), we are looking at one of the most important FOMC decision by the Fed.

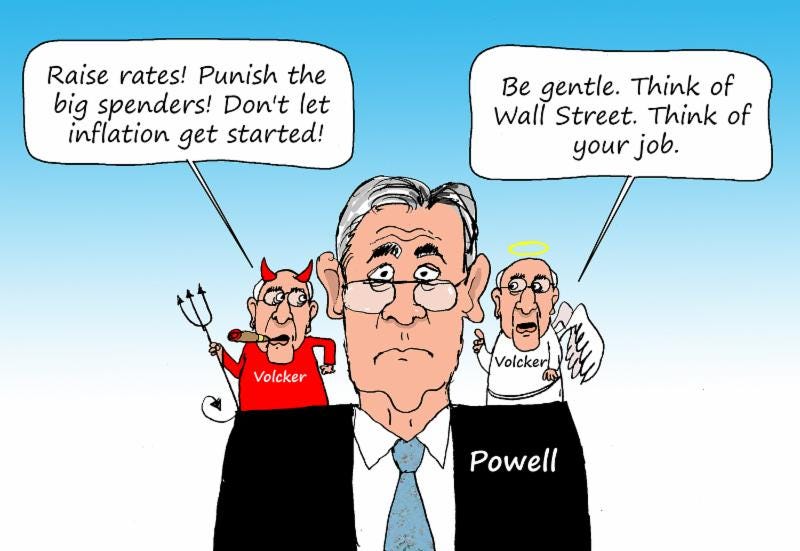

I find myself contemplating the precarious fate of the financial markets, and more specifically, the imminent regional banking system collapse that may send shockwaves throughout the global economy. With a 50 basis point hike now seemingly out of contention, the decision-making process of Jerome Powell, the esteemed Chair of the Federal Reserve, has been thrust into the limelight, leaving many to ponder the potential ramifications of his choices.

In this intricate dance of monetary policy, Jpow is faced with an unenviable dilemma - a veritable rock and a hard place. Should he opt for a 25 basis point hike or maintain the status quo, leaving rates untouched? As an informed observer, it is prudent for me to avoid the siren call of prediction and embrace a more reactive stance. I should allow the empirical data to present itself before making any strategic moves in my trading endeavors.

The position of Chair Powell, akin to the mythological figure of Sisyphus, is fraught with seemingly insurmountable challenges. To raise interest rates aggressively could result in a cascading collapse of regional banks, while a more tempered approach risks allowing the inflationary beast to rear its ugly head once more. And for this Herculean task, a mere $200,000 per annum serves as recompense - a sum that pales in comparison to the perceived tranquility and picturesque views afforded by the high-rise window cleaning profession in Toronto which pays north of $60/hr.

As I navigate the tumultuous waters of global finance, it is crucial to remain vigilant and aware of the myriad events that could impact our trades. This week, the Bank of England's interest rate decision and the release of jobless claims data, both scheduled for Thursday, are events worthy of note. I must resist the temptation to engage in haphazard prognostication and instead, embrace the unpredictable nature of our world, seeking solace in my adaptability and resilience in the face of uncertainty.

Now that we have the languorous prose out of the way, let us focus on levels for tonight globex session and the week.

ES: