Weekly Plan 3/24 and Three Stocks to watch(or not watch. I don't know your viewing habits)

Bulls firmly in control

Hello traders,

After a hectic week, I hope you got some well deserved rest and recreation.

Last week, we saw Powell not cut rates and the markets rallied off the dot plot projections.

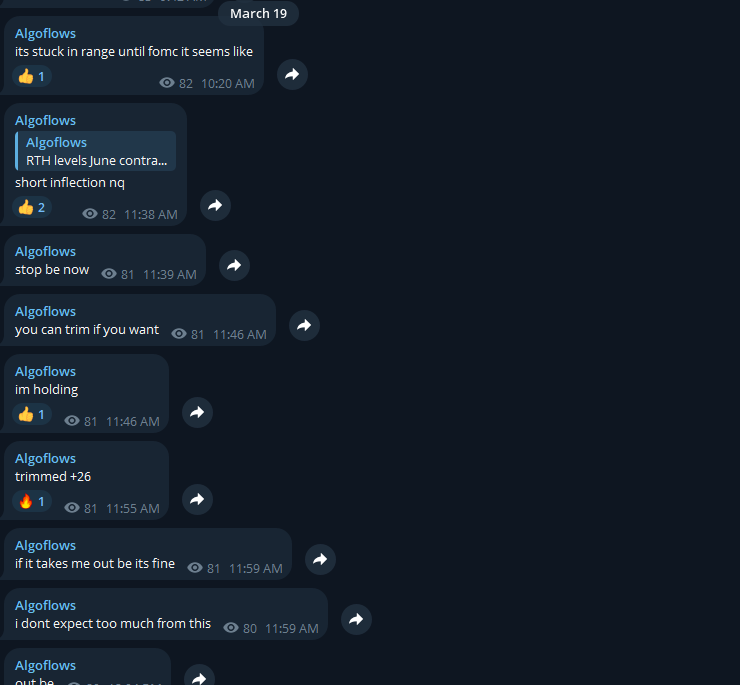

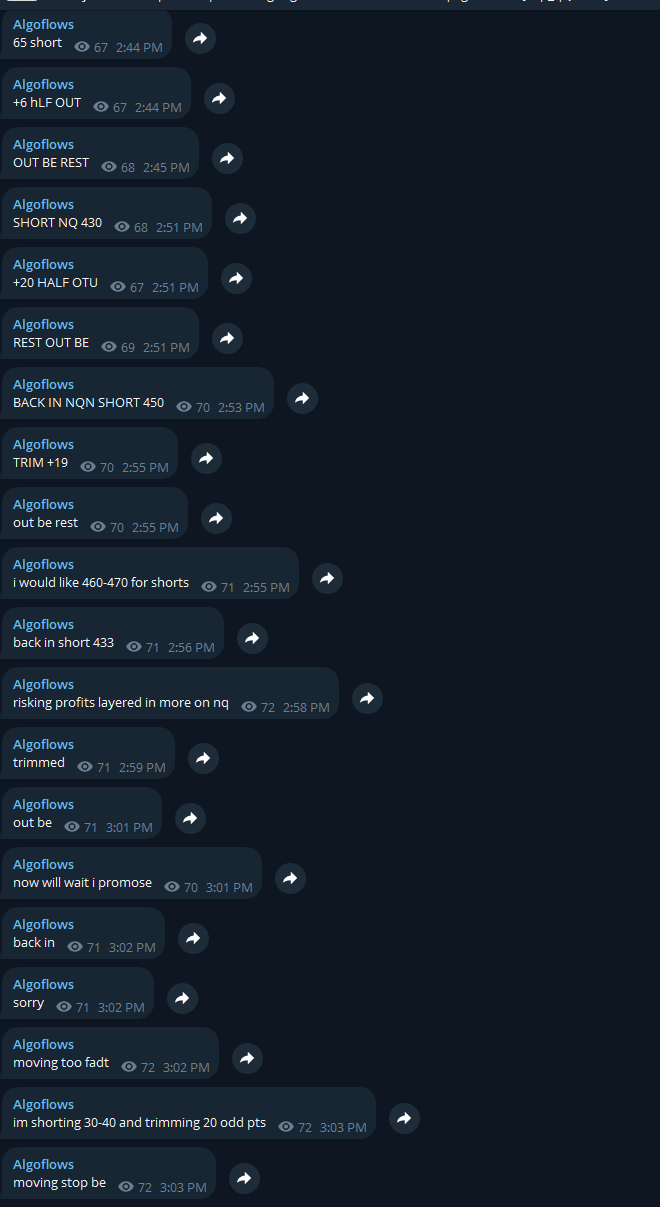

Last week we traded the volatility pretty well capturing points every session.

On Friday, my bot initiated a short position, which resulted in a stop on the Nasdaq but successfully secured an 6.5-point gain on the ES. Currently, the bot's stance leans towards neutral to bearish, but I decided to close the position before the market closed on Friday.

Take advantage of APEX’s 80% promo code and pass account in one day. Also $35 resets on your accounts. Use code MGUOHAIU or alternatively just click the button below

Paid subscribers are requested to join the telegram at their earliest convenience. Link is in your welcome email.

Moving on,

Main story this week is (oh he is blatantly copying John Oliver now) is PCE.

Also this is a short week with Friday being Good Friday market closure.

Due to Fed’s stance based on last week’s FOMC, commodities are getting bid up and crude oil if maintains its momentum can see 83.5-84.8 area.

Gold had a lacklustre (get it) week but overall 2112s seem to be a decent spot to punt some longs on GC_F. A more speculative trade would be to long gold mining stocks like Barrick Gold and the likes.

New Section: Undervalued picks.

These are three individual equities which are not in the twitterverse spotlight that look interesting for the medium-long term on the basis of valuation and leadership.

Canadian Natural Resources Limited (Ticker: CNQ 0.00%↑ ), which has recently come under my radar due to its outstanding operational and financial metrics, and strategic leadership under Murray Edwards.

Key Highlights & Investment Rationale:

Low Cost Structure: CNQ has demonstrated an exceptional ability to maintain a low-cost structure, which is a crucial differentiator in the energy sector. This allows the company to remain profitable even in lower commodity price environments.

Long-Life Assets: The company's portfolio includes long-life assets that provide a stable and predictable output, reducing the risks associated with exploration and development.

Low Decline Rate: CNQ's assets have a lower-than-average decline rate, ensuring sustained production and revenue without the constant need for significant capital expenditures.

Track Record of Execution: The company has a long track record of successful execution in operations and mergers & acquisitions, highlighting its operational efficiency and strategic growth mindset.

Corporate Culture & Governance: The leadership, under Murray Edwards, has fostered a culture of excellence and accountability, which is reflected in the company's governance practices and overall performance.

Succession Planning: CNQ has shown strategic foresight in its succession planning, ensuring that the company is well-positioned for continuous leadership and innovation.

Lean Operations: The company's lean operational approach has resulted in higher efficiency and lower costs, setting it apart from its peers.

Strategic Astuteness: CNQ's strategic decisions, particularly under the stewardship of Murray Edwards, have consistently positioned the company ahead of industry trends and challenges.

Brookfield corporation (Ticker BN 0.00%↑ ) and Brookfield Infrastructure Corp BIPC 0.00%↑

I wouldn’t say much about this company but just watch this video

When you look at Brookfield Corporation, you're essentially acquiring a significant collection:

First, there's a behemoth 75% slice of BAM, ringing in at an imposing $39 billion. Add to this the stakes in their publicly listed offshoots — Brookfield Renewable, Infrastructure, and Business Partners — collectively valued at $20 billion in the current market climate.

But that's not all. You're also getting hands on varied stakes in BAM's funds, valued north of $12 billion, not to mention the colossal Brookfield Property Group, a global network of malls and office buildings. And let's not overlook the insurance arm, rich in annuities, boasting a $4 billion equity valuation.

The cherry on top? Absolute control over the net carried interest from BAM's existing funds, alongside a significant one-third share from the new ones.

Now, the street's optimistic view hinges on a straightforward premise: the aggregate value of these assets, even after reducing debt and preferred shares, significantly exceeds Brookfield's current market cap. This, despite the looming shadow cast by commercial real estate's uncertain future amid escalating office vacancies and interest rates.

But let's not mince words. This perspective, while not without merit, doesn't quite capture the entirety of the scenario. The sheer scope and significance of Brookfield's assets present a narrative far beyond the immediate apprehensions tied to property markets. This is where the broader perspective comes into play, offering a narrative rich with potential and resilience, often overshadowed by transient market sentiments.

As far as BIP goes:

Crafting a pioneering data center powerhouse, Brookfield Infrastructure has deftly moved through the burgeoning tide of data and AI, establishing itself as a formidable player. Since dipping its toes into the data center area in 2019 with a bold $1 billion acquisition of AT&T's data center collection, thereby launching the Evoque Data Centers platform, Brookfield has not looked back. That same year, it teamed up with Digital Realty for a tactical play in South America by snatching up the Ascenty data center platform, followed by another collaborative venture to set foot in India's data center territory.

Fast forward to last year, Brookfield didn't just rest on its laurels; it aggressively expanded its data center repertoire:

Compass Datacenters became part of its portfolio through a staggering $5.5 billion transaction, enhancing its presence in North America with cutting-edge mega data center campuses. By acquiring Data4 for a cool $3.8 billion, Brookfield marked its entry into the European data center market, a move that now sees it operating 31 data centers across six countries. In a tactical acquisition, Brookfield leveraged its Evoque platform to salvage 40 data center sites from Cyxtera's bankruptcy ashes, further solidifying its footprint. Now, Brookfield boasts a commanding presence in the data center sector, with over 135 operational facilities worldwide and a substantial 750 MW of critical load capacity. But here's the clincher: the company is not just sitting pretty with its current assets; it's vigorously pursuing growth, eyeing the construction of an additional 900 MW of data center capacity in the pipeline over the next three years. This tactical expansion is not mere speculation—it's a calculated move set to amplify the company's funds from operations (FFO) by a whopping 2.5 times in the same timeframe.

Moreover, with visions of developing beyond 2.3 GW of data center capacity in the next five years, Brookfield is tactically acquiring more land to fuel this expansion. An indication of this ambition is the recent land acquisition in Milan, earmarked for over 60 MW of additional capacity.

But let's not overlook the broader picture: Brookfield Infrastructure's foray into data centers isn't just about building infrastructure; it's about promoting high-octane growth. This tactical pivot is poised to deliver substantial dividends to investors, enhancing the company's projection of increasing its FFO per share by over 10% annually. This, in turn, positions Brookfield to boost its already attractive dividend yield of 4.7% by 5% to 9% annually, so that makes it an even better deal.

If you find any such interesting picks, do message me on Telegram and I can do a deep dive on them as time permits.

Levels: