Hello traders,

Hope you had a great weekend.

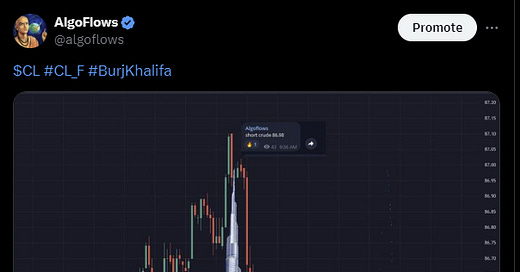

Few select trade ideas from last week.

A few subscribers did ask me the rationale for combo trades as opposed to taking single trades.

The strategy that encompassed short positions in crude oil (CL) and gold (GC), coupled with a long position in the NASDAQ-100 Index (NQ) via call spreads, was proven successful and it played out as follows.

Short Crude Oil (CL): Contrary to typical expectations that Middle Eastern conflicts escalate oil prices due to fears of supply disruptions, bot “anticipated” that the robust global oil supply and strategic reserves would more than compensate for any potential shortfall. Indeed, as the market had already priced in potential disruptions, the subsequent stability in supply led to a decline in oil prices, validating our short position.

Short Gold (GC): Gold's initial surge, driven by its status as a safe haven during the onset of the conflict, presented a prime short-selling opportunity. We correctly predicted that a combination of an improving geopolitical situation and a strengthening U.S. dollar would diminish gold's appeal. As tensions showed signs of easing, gold prices retreated sharply from their peaks, resulting in substantial gains from our short positions.

Long NASDAQ-100 Index (NQ): The bot had a weak long signal on Nasdaq hence using call-spreads over a futures position was the rationale. After an initial spike of 70 odd points and trims at that spot the remainder of call options expired worthless, as that is always a possibility in combo trades.

Also yesterday, we were able to predict crypto bottom after the mini-crash

As of right now, the dip has been bought up nicely.

Take advantage of APEX’s 80% promo code and pass account in one day. Also $40 resets on your accounts. Use code MGUOHAIU or alternatively just click the button below

Paid subscribers are requested to join the telegram at their earliest convenience. Link is in your welcome email and also at the end of this post.

Moving on,

This week would be dominated by geopolitical tensions in the middle east.

We also have Initial Jobless claims this Thursday. Geopolitical tensions are ongoing and I will update the Telegram as I see any developments.

We also have a big tech earnings kick-off this week with Netflix reporting on Thursday after the bell.

For Semis, ASML and TSMC report as well.

A new prop firm Flexytrade is offering 90% off on evaluations to the readers of this newsletter. Use code: ALGOFLOWS

They have no time limit to complete the evaluations. Also, they provide a free Quantower license to trade (Simultenously 20 accounts allowed).

Levels for the week:

Here are the levels for the week: