Weekly Plan 4/2

New Quarter, New Spooz

Hello traders,

Hope you had a great weekend. Shorts ended up getting squeezed more this past week

and there is no such thing as easy money in this market.

As per our weekly plan, SPOOZ floated up, Crude exploded and GC pingponged last week. ES did frustrate us a lot during RTH but adjusting sleep schedule more than made up for it. Also, if anyone knows a European country with good weather do reply in comments so we can move there and trade without destroying our circadian rhythm.

As stated by Kendrick in the last week’s plan OPEC has announced surprise cuts to production and this should provide additional succor to the oil markets.

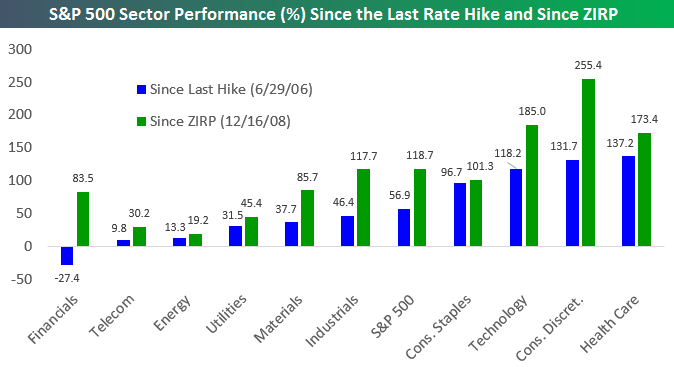

Just a few images here to elucidate the point what happens if you buy and hold through rate hike cycles(without accounting for dividends).

And if we roll back the time to 2015

The following offers an examination of the S&P 500's performance, along with its ten constituent sectors, during two distinct periods: 1) the last instance of the Federal Reserve increasing interest rates on June 29, 2006, and 2) the implementation of a zero-interest-rate policy (ZIRP) on December 16, 2008. While these analyses may not necessarily yield definitive projections for future market behavior, they remain intriguing exercises in their own right.

In the period since the Federal Reserve's (under Greenspan's leadership) most recent rate hike on June 29, 2006, the Health Care sector has experienced the most significant growth at 137%, followed by Consumer Discretionary at 131% and Technology at 118%. The S&P 500 index, in its entirety, has risen by 56.9%. In contrast, the Financial sector is the sole decliner, with a reduction of 27.4%.

Upon the institution of the ZIRP and the ensuing pause in interest rate adjustments beginning on December 16, 2008, the S&P 500 has appreciated by 118.7%. The Consumer Discretionary sector has demonstrated the most remarkable growth with a 255% increase, while the Energy sector has exhibited the most modest uptick at 19.2%.

As older readers know, we were bullish at the start of March and the S&P500 has rose 4% for the month and Nasdaq is up about 11%

This week we have these major events to look forward to. Also adding brief explanations for each event for newer traders who joined the substack.

1) ISM Manufacturing PMI (Monday):

The ISM Manufacturing PMI, or the Institute for Supply Management's Purchasing Managers' Index, is a pivotal economic indicator that reflects the health of the manufacturing sector in the United States.

The ISM Manufacturing PMI is derived from a monthly survey of purchasing managers across a broad range of manufacturing industries. These individuals, who are responsible for acquiring the raw materials and goods necessary for production, provide valuable insights into the overall health of their respective industries. The survey encompasses various aspects of business, including new orders, production, employment, supplier deliveries, and inventories. The results are then compiled into an index, with a reading above 50 indicating expansion, and a reading below 50 signaling contraction.

Now, let us consider the importance of the PMI from the vantage point of the markets. In general, the manufacturing sector is a key driver of economic growth, as it contributes significantly to GDP, employment, and innovation. As such, the PMI offers a snapshot of current conditions and future expectations within this critical area of the economy. Investors and policymakers closely monitor the index for signs of expansion or contraction, which can influence decisions regarding monetary policy, fiscal policy, and investment strategies.

Moreover, the PMI has a bearing on the financial markets, given its ability to influence the broader economy. When the index registers a higher reading, it suggests robust demand for goods and services, which in turn could lead to higher employment, increased production, and a greater propensity for economic growth. Consequently, investors may interpret a positive PMI reading as a harbinger of a bullish market, leading to increased investment and a rise in stock prices.

Conversely, a lower PMI reading may signal an impending contraction in the manufacturing sector, with the potential to disrupt supply chains, reduce employment, and weaken overall economic growth. In such cases, investors may adopt a more cautious stance, potentially leading to a bearish market and downward pressure on asset prices.

We are living in the world where good news is bad news and bad news is less bad news so I will be trying to trade longs based on the reading that are below 47.3. Again, price action and orderflow are always paramount for daytrading and global macro is a distant third.

2) JOLTS Job openings(Tuesday):

The Job Openings and Labor Turnover Survey (JOLTs), conducted by the Bureau of Labor Statistics, provides a comprehensive snapshot of job openings, hires, and separations in the United States. This data is essential for economists and market participants alike because it offers a glimpse into the level of demand for labor and the ease with which workers can find employment.

One might consider the importance of JOLTs Job Openings in the context of the liquidity preference theory, which posits that the interest rate is determined by the supply and demand for money. If there is a high number of job openings, it can signal a strong demand for labor, which in turn could lead to increased investment and economic growth. On the other hand, a low number of job openings could indicate a sluggish labor market and a potential slowdown in the economy.

Furthermore, JOLTs data can also provide valuable information about potential wage pressures. When the labor market is tight and job openings are abundant, employers may be compelled to offer higher wages to attract and retain workers. This can lead to upward pressure on inflation, which would then impact monetary policy decisions.

From a market perspective, the JOLTs Job Openings report can influence the expectations of investors and traders, as they adjust their portfolios based on the perceived strength or weakness of the labor market. Strong job openings data might lead to a rally in stock markets, as investors anticipate higher corporate earnings and economic growth. Conversely, weak job openings data could prompt investors to adopt a more cautious approach, as they foresee potential economic headwinds.

3) ADP Nonfarm Employment Change(Wednesday):

The ADP Nonfarm Employment Change is an economic indicator that plays a crucial role in understanding the health of the U.S. labor market. It's a monthly report released by the Automatic Data Processing (ADP) Research Institute, which provides insights into the changes in the number of jobs added or lost in the private sector, excluding agriculture and government positions.

One of the reasons this indicator garners significant attention from market participants is its correlation with the broader labor market trends. A growing economy typically translates into increased hiring, which supports consumer spending – the lifeblood of the American economy. On the other hand, a contracting labor market can signal economic weakness, potentially dampening market sentiment.

Now, imagine you're a Nobel laureate economist with a penchant for explaining complex economic concepts in layman's terms, and you want to convey the importance of the ADP Nonfarm Employment Change for markets. You might point out that this indicator serves as a precursor to the more comprehensive Nonfarm Payrolls report published by the U.S. Bureau of Labor Statistics (BLS) a couple of days later. Market analysts often view the ADP report as a valuable tool to set expectations for the BLS data, which, in turn, can influence monetary policy decisions by the Federal Reserve.

Furthermore, you'd emphasize that the release of this data can cause significant market volatility, as investors recalibrate their positions based on the health of the labor market. A strong ADP report can drive stock prices higher, as investors anticipate increased corporate profits due to a robust economy. Conversely, a weak report can trigger sell-offs in equities, with investors seeking refuge in safe-haven assets such as gold or government bonds.

4) Friday, the markets are closed for Good Friday.

Moving on, these are our weekly levels.