Weekly Plan 4/7/2024

Inflation or disinflation

Hello traders,

Last week was an intense one in the markets.

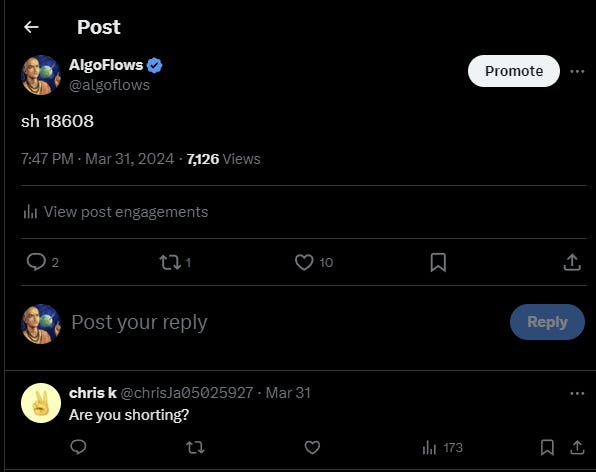

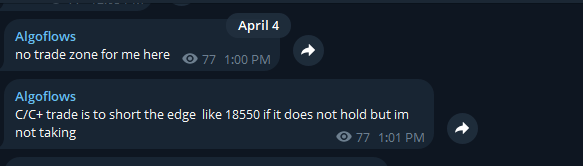

And a nice little free trade to twitter followers on Friday afternoon as well :

There are a few more screenshots but substack email length limit is pretty strict.

This week, we're stepping into a major league of data drops, with CPI and PPI numbers on the schedule. Let's cut through the noise: the Fed's been playing a narrative game, suggesting recent inflation spikes are just blips - seasonal noise, nothing to sweat over. But here's the real talk - if these aren't just blips, we're at the front door of a brand new inflation trend. It's not just about the numbers ticking up again from their lows; we've seen commodities go on a tear recently. This signals something bigger at play.

The Fed's in a tricky spot. They're practically itching for a reason to slash rates, banking on the hope that these inflation numbers are one-offs. They want a return to the disinflation story, betting on an economy that's running warm but not too hot, hinting at potential slowdowns on the horizon. It’s all about crafting the perfect excuse to make a rate cut move.

Here's the straight shot - the Fed is looking for a way out, a reason to hit the rate cut button. They're hoping for these inflation readings to be outliers, to justify a pivot back to rate cuts and keep the economic engine humming without overheating or hitting a stall. This is the game being played at a macro level, where inflation data isn't just data, but a chess piece in the Fed's strategy to manage economic growth, stability, and their policy roadmap.

We did get a big sell last week, but in the larger scheme of things markets are still in balance.

Maybe we get another down week and then the third week of April we get an upswing as historical stats suggest that way.

Take advantage of APEX’s 80% promo code and pass account in one day. Also $40 resets on your accounts. Use code MGUOHAIU or alternatively just click the button below

Paid subscribers are requested to join the telegram at their earliest convenience. Link is in your welcome email.

Moving on,

Due to subscriber demand, I have been posting about some cryptocurrency projects that show some upside potential.

As usual, cryptocurrencies are highly volatile and you can lose all your investments in a flash. If you are trading crypto, you need to understand the inherent risks and adjust bet-size accordingly.

Levels for this week: