Weekly Plan 6/16

The Globex tradoor

Hello traders,

Happy Father's Day to all the awesome dads out there! Hope you get to step away from the screens, fire up the grill, and maybe enjoy a drink or two. It's your day to relax and have some fun! Cheers!

Last week was a decent one for us at the substack where we traded at night and were able to capture clean moves to net quite a few points.

Our QQQ call options went from 0.53 to 3.23 at close.

Take advantage of APEX’s 71% promo code and pass account in one day. Also $35 resets on your accounts. Use code MGUOHAIU or alternatively just click the button below

Paid subscribers are requested to join the telegram at their earliest convenience. Link is in your welcome email.

I overtraded on FOMC day and kept scalping short side post 2pm on a clear uptrend. Managed risk well but just staying in the 467 long would have been a prudent strategy.

So that was our week, lots of action this past week and now we have a short week with Juneteenth holiday where the markets would be closed.

This week we have retail sales and PMI data releases.

I have personally stopped paying attention to minor data releases and only thing I care about these days is the Fed, NFP, CPI and PCE. The rationale behind this move is not a quantitative one but a qualitative one.

Listening to Eckart Tolle videos has given me a better insight about myself and I tend to look for a bigger picture of smaller data releases and it has been counter-productive in medium-term trading.

The S&P and Nasdaq breadth has been abysmal and the rally has been largely due to semiconductors and tech.

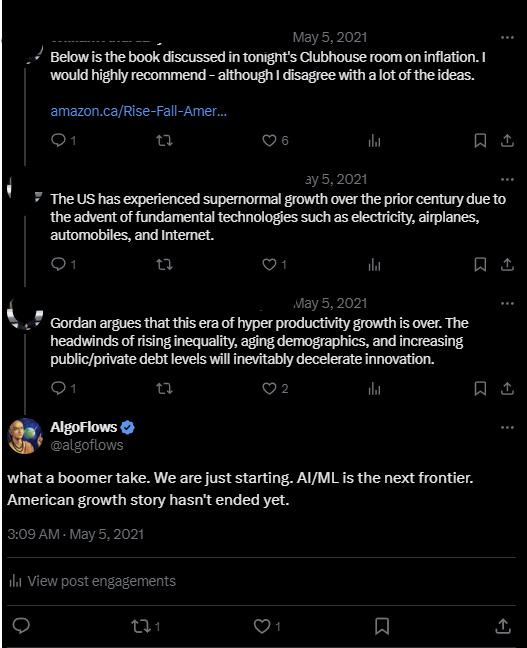

I’m still of the belief that we are still in Act I of the AI hype rally and it is far from over.

But does this mean we get a small correction on the indices? That is definitely possible but until we see major supports on NQ and ES being broken (Weekly Bear#3 and below) I would still be in the camp of the bulls.

Weekly Levels: