Weekly plan 7/16

Bias kills

Hello traders,

Hope you had a great weekend.

Last week was an interesting week with respect to price action. As stated in last week’s plan, we did have a soft CPI and market reacted fantastically by going up to 4560 and then finally ran out of steam.

That being said, I(my algorithms are a part of me by law) believe market is very close to forming a short term top and we should see a retracement soon unless of course we get materially important news about “soft landing”.

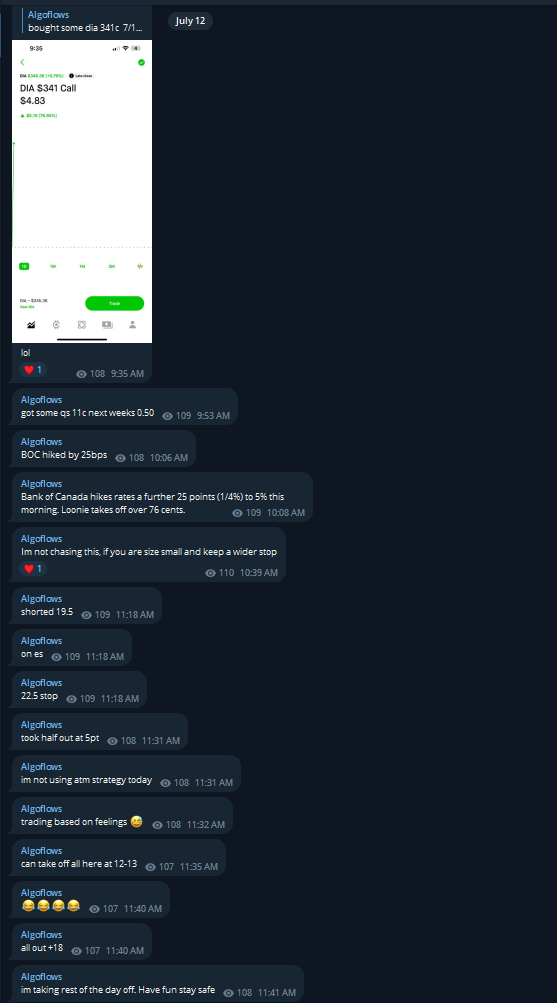

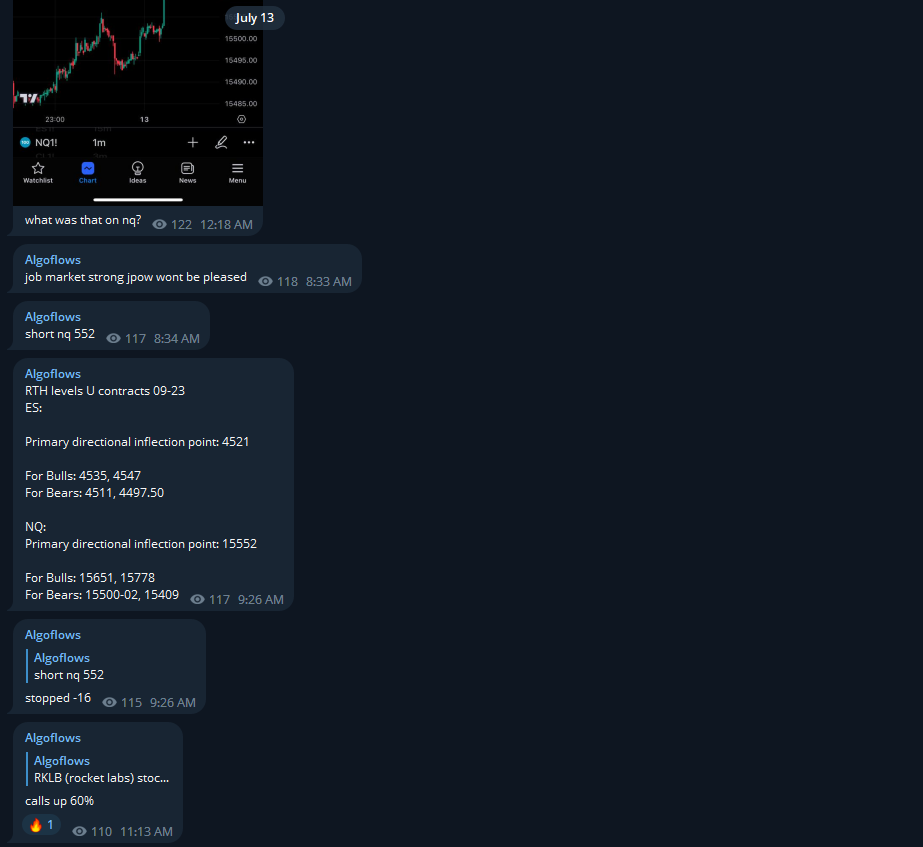

Recap of selected levels and trades from last week

I would be remiss if I did not mention my stopped out trades.

I do not have a 100% winrate and I’m completely okay with it.

Moving on,

This week we kick off the large cap earnings

Rest of the major banks report along with TSLA 0.00%↑ and NFLX 0.00%↑

As usual, trading ERs is a tossup however, I’m not too bullish on Netflix and neutral on Tesla.

Last week the Cash secured puts on JPM 0.00%↑ expired worthless as shared in the weekly plan .

Weekly levels: