Weekly Plan 7/23

Earnings Earnings Earnings

Hello traders,

Hope you had a great weekend.

Let us recap last week.

I deployed a newer model as stated in last week’s plan

And the results have surprised me quite a bit.

Moving on,

Quite a big week in equities this week with all the earnings

I love CMG 0.00%↑ (chipotle) as a company, as you can see here in this picture below

and as such I’m not opposed to selling puts/ put credit spreads to own the stock.

Tech earnings could go either way and hence I do not want to gamble on them (just yet).

F 0.00%↑ (Ford) definitely looks like they would need to pull a rabbit out of their hats to get ahead of the slowing auto sales and not miss. Downside directional bets could work here. Analogous thinking for General Motors.

Now back to the broader markets. I will echo what I have been saying since February.

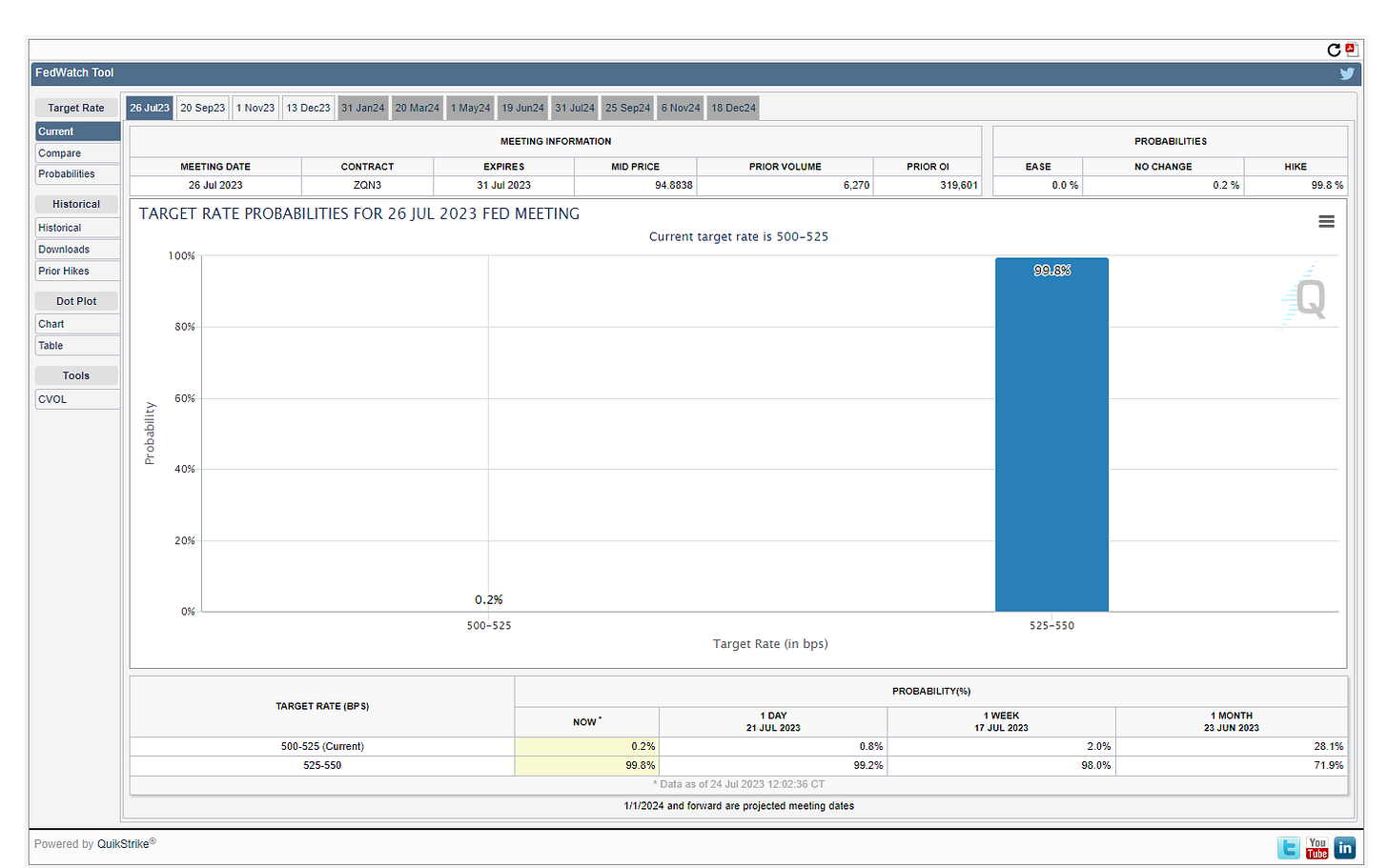

We have FOMC this week and Jpow is almost certainly going to do a 25bps hike.

Will this cause the market to reverse? I personally would like to see 4464 retested on ES and 15196 on NQ.

Upon digging deep into historical trends, it's clear that August hasn't been a bed of roses for either bulls or bears. Yet, the current year paints a starkly different picture. The market has soared remarkably in the first six months, giving a strong hint towards a future uptrend. In contrast, were we amidst a bearish or idle market in the first half of the year, August could be anticipated to lean towards the downside. However, with this year's dynamics, a severe downturn doesn't seem on the cards, despite the 4.24% downturn observed in August 2022.

Historical data gives us a fascinating projection – a probable 8-11% rise in market value by the end of December 31, 2023, compared to where we stood on June 30, 2023. This projection speaks volumes of the bullish market we're in, forecasting a second half teeming with potential. It's not hard to envisage numerous portfolio managers racing to cover the ground they lost in the first half of 2023 (oh hello Mike Wilson).

Even if the bears somehow manage to push a 3% pullback on ES during August, it should be celebrated as a significant achievement, given the prevailing bullish market. Also, lending weight to the bullish narrative is a statistic from Bank of America's Global Fund Manager Survey. The survey reveals fund managers being the most bond-heavy since March 2009, showcasing an ongoing hesitance towards equities. As per the surveyed investors, 48% foresee the onset of a global recession by the end of the first quarter of 2024, while 19% anticipate no such downturn in the next 18 months.

Reminiscent of March 2009, Jon Stewart lambasted CNBC for downplaying the gravity of the financial crisis. His scathing remark was, "Had I placed my bets according to CNBC's guidance, my account would be at a million dollars today... assuming, of course, I had started with $100 million." During the same period, the chief equity strategist from Citigroup predicted to The Wall Street Journal that the S&P 500 would touch the 1,000 mark by 2009 end. His counterpart at JPMorgan Chase anticipated the market scaling up to 1,100. Their forecasts were pretty much on the mark as the S&P rounded off the year near 1,120, reflecting an impressive over 60% surge.

I would not put too much weight into doom-and-gloom analysts or twitter experts. Extremes will generate more clicks, whereas most of the times markets are boring and slow.

Levels for this week:

If you stuck around until now, here is the best part of the newsletter

Weekly levels: