Weekly Plan 7/28

To cut or not to cut

Hello traders,

Hope you had a great week and are ready for the FOMC week.

A quick recap of the last week.

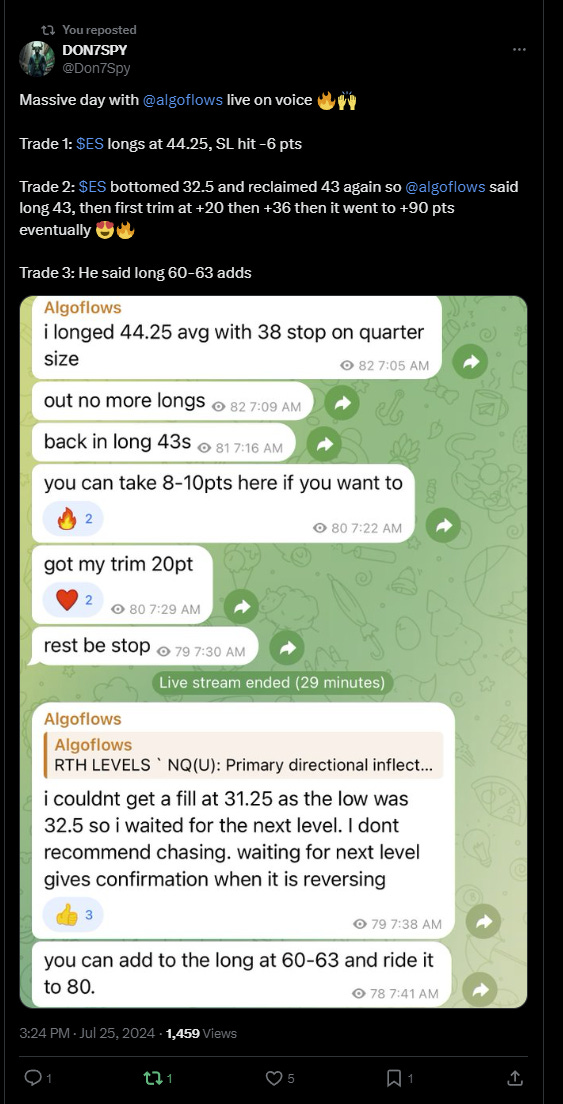

Interesting Sunday night where we were able to get 100pts or so on NQ.

On Monday, the NQ downside and SPX puts.

Quickly followed by SPX calls.

Monday night, we also got a shorts on ES and SPX in.

On Tuesday, we got a few QQQ calls in.

And then we got some TTD ER puts which went 1500% or so

Take advantage of APEX’s 80% promo code and pass account in one day. Also $35 resets on your accounts. Use code MGUOHAIU or alternatively just click the button below

Paid subscribers are requested to join the telegram at their earliest convenience. Link is shared in your welcome email.

On Thursday we got ES longs in and then reversed for puts.

On Friday, the bot was able to identify a steep sell off on the ES futures 20 minutes ahead of time.

The coming week, we have a slew of earnings , the JOLTS report, FOMC and Non-farm payrolls.

I would send a midweek update this week after the FOMC.

Moving on,

The upcoming FOMC meeting is expected to maintain the status quo, with no changes to interest rates. The Fed is projected to initiate the first rate cut in September, as Chairman Powell's recent comments have effectively ruled out a July cut, solidifying expectations for September. However, if the Fed were to unexpectedly cut rates next week, it could be perceived as bearish, suggesting underlying concerns within the Fed.

The “goldilocks” narrative is showing some cracks. We all remember the 2007 article right

In the short term however, I’m looking at