Weekly Plan 8/4/2024

Thunderous decline

Hello traders,

Hope you had a good weekend.

Last week we were able to predict the downfall of the markets and were positioned with SPX and QQQ puts.

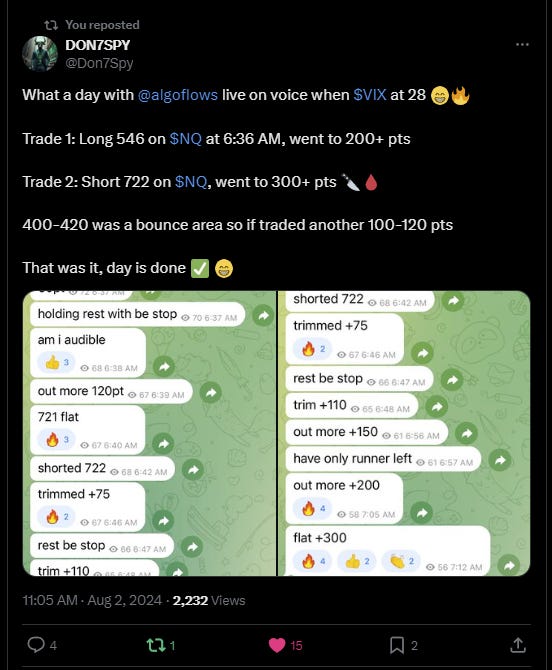

We were also able to do our daily trades with alacrity and captured a lot of points.

And also a few 0dte call options which went our way

More trade ideas are on my twitter and you can scroll them and find them.

Take advantage of APEX’s 80% promo code and pass account in one day. Also $35 resets on your accounts. Use code MGUOHAIU or alternatively just click the button below

Paid subscribers are requested to join the telegram at their earliest convenience. Link is shared in your welcome email.

Moving on,

The Fed is playing a risky game with our money. Powell hints at a rate cut in September, but won't fully commit. He's like a kid who can't decide if he wants ice cream or not.

The Fed thinks it can control the economy like a video game, but they're really just guessing. They say they need more data, but that's just an excuse for not knowing what to do.

Now, we're seeing signs that their choices might be wrong. The job market looks weaker than it has since COVID hit. This shows how little the Fed actually knows.

They keep making mistakes, one after another. It's like they're building a tower of errors, and we're all waiting to see when it'll fall down.

The market thinks it knows what the Fed will do, but the Fed itself doesn't seem sure. It's like watching a circus where the main act doesn't know their own tricks.

In the end, we're all just watching this mess unfold, hoping the Fed doesn't break the economy while trying to fix it.

Fears of a “hard landing” are spooking the overnight market as we speak.

Meanwhile, Nvidia, the darling of the AI chip world, has stumbled. Their new "Blackwell" B200 chips, supposed to be the next big thing, are running late. Why? A design flaw they caught at the last minute. It's like a chef realizing their signature dish is spoiled just as they're about to serve it.

This isn't just any chip. It's the heir to the H100, the golden goose that turned Nvidia into a tech giant. Now, cloud giants like Microsoft are left twiddling their thumbs, waiting for their AI steroids.

Nvidia's trying to play it cool, saying production will "ramp up" later this year. But in the fast-paced tech world, three months might as well be three years. It's a stark reminder that even the mightiest tech titans can trip over their own shoelaces.

This delay exposes the fragility of our AI-obsessed market. We've built castles in the cloud, all resting on the foundation of these silicon wafers. One hiccup in the supply chain, and the whole house of cards could come tumbling down.

This week, we can see some more correction in the indices and there is a fair chance that ES tests 5155-60 area by end of this week or the next.

Keep reading with a 7-day free trial

Subscribe to Algoflows Capital to keep reading this post and get 7 days of free access to the full post archives.