Subscriber Q&A

Replies to Questions from subscribers

Hello traders,

These are a few answers for the subscriber questions raised this past week..

I hope to do more of these in the coming weeks.

1) Question about the ATM. I have the screen shot for the 2-1-1 setup, but wondering about passing the eval. Should I use this for that or some other method just to pass eval on one $50k acct?

Answer:

I use Kelly betting criterion to create a bet size.

The formula for which is as follows.

f = (bp - q) / b

f is the amount you should bet (fraction of your bankroll).

b is the decimal odds on your prospective bet - 1

p is the probability of winning (as calculated by you)

q is the probability of losing (1 - p)

I will use 1/8th Kelly without a defined edge and 1/4th Kelly when I have an edge.

For a $50k account, you usually have a trail draw down of $2500.

Scenario A) No edge(coinflip accuracy)

Without an edge(50% winrate) and a 1:2 risk/reward you should have a max loss of $78.13.

That is just shy of the $80 loss you will have on a 4pt stop with 4 MES contracts without commissions. With 3pt stop on 4 MES contracts you will lose $60 pluys commissions. So something in that range would be a good bet size if you do not have an edge.

Scenario B) Defined Edge

In this case, you have a defined edge and you will be able to bet higher with 1/8th Kelly

with around $125 stop loss per trade. Now that can mean 6 MES contracts with a 4pt stop or any other variation.

In my opinion, always start trading considering you do not have an edge.

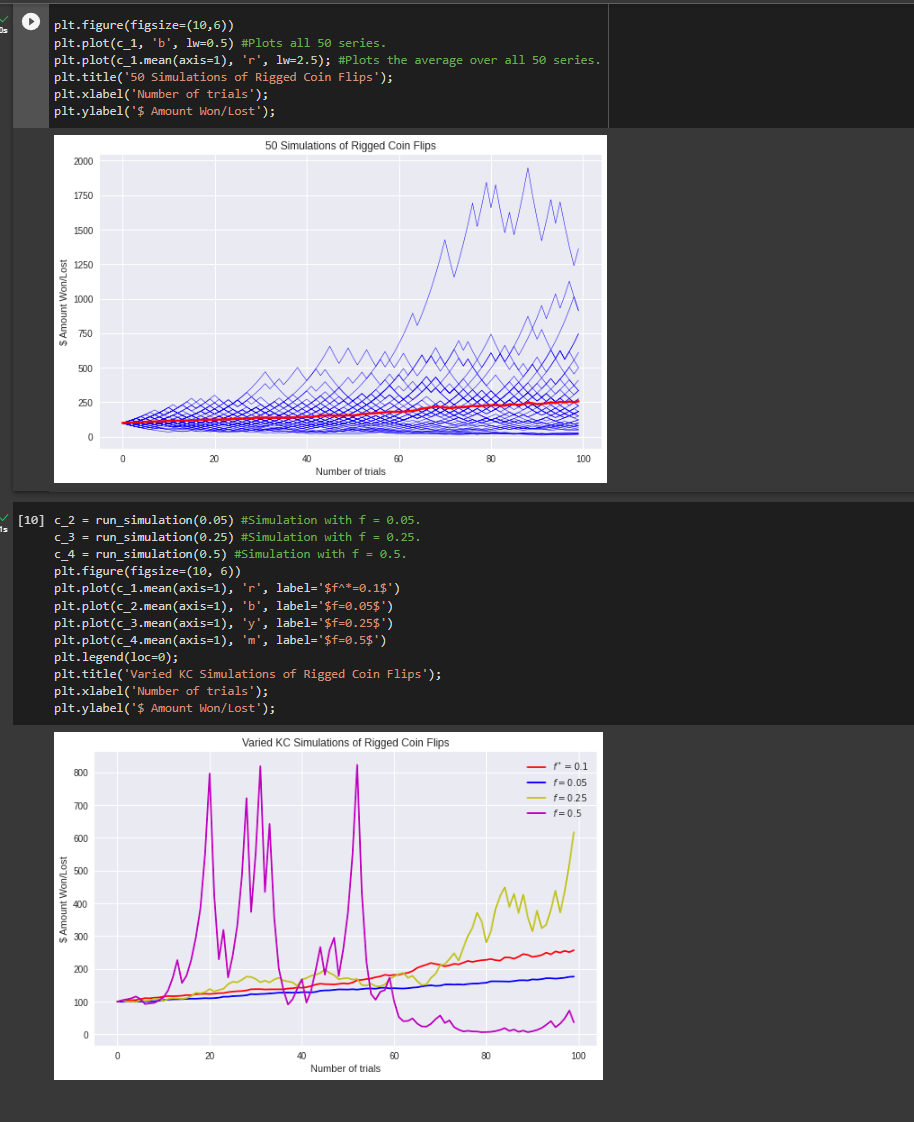

Now let us run simulation for 50 trades with this edge of 55% winrate.

As you can see the closer to full Kelly you get, higher the odds of you busting your funded account as they include “trailing drawdown” from the highest point of the account. With Half Kelly you can see the volatility will cause you to bust a few accounts before you hit a payload.

If anyone wants the python code then write a comment below and I can share it.

2) Please add simulation for /cl. Have you observed that 2:00-2:35 pm EST the crude always swings big up or down?

Answer: I have added the simulation for Crude in this week’s plan.

Crude oil swings not based on time of day but due to news and macroeconomic activity.

There is a theory propagated by Qadan Et Al that Crude prices are linked to the Day-of-the-week effect. I have personally not backtested this theory but if there is enough interest, I do not mind digging deeper into it.

3) Hi Algo...Couple of questions regarding 88.25 short. How do you tell these shorts are from a single large participant as these came at different time intervals and different sizes?

When you say offers not closed...how to find it and where to find if the short position opened is closed or not?

Answer: A lot of large participants in the futures market use iceberg orders to masquerade their large order. There are tools to detect these orders in various commercial products like Bookmap and TTW-tradefinder. I use my own homebrew script to identify these orders.

And in order to identify if that said individual has not closed their shorts, you can identify an iceberg buy order with a similar size. Of course, this is not an exact science and a lot of times traders are purely guesstimating as to how and when the shorts would be covered. Another way to look at it is to identify options flow change on ES or SPX to identify directionality of momentum.

4) Algo, can you share details on structured learning. Best approaches to grow small accounts with your levels.

There are three pillars to a successful trader. A defined edge, proper risk management and a level headed brain that does not tilt.

Another thing that you need to have is patience. This is marathon and not a sprint. If your goal is to be consistently profitable trader, you cannot expect home-runs everyday. The go-big or go-bust strategy rarely works (see above simulation of Kelly Criterion).

That is it from me and trade safe everyone.

-Fin

Thanks, Algo.

Thank you, excellent information and advice