Vibes & Moody's

and weekly levels

Hello traders,

We had an excellent last week in the markets where our long-term ideas and intra-day trades both were directionally correct.

note: Paid subscribers get detailed idea breakdowns based on algorithmic levels and orderflow tools. Telegram channel and chat access is complimentary with the paid substack subscription.

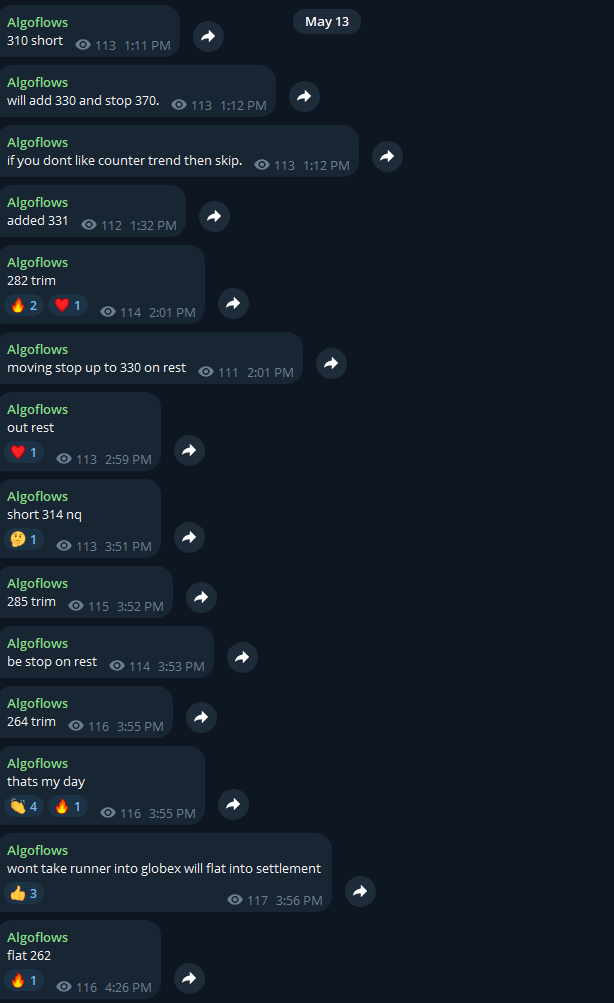

On Friday afternoon, we loaded a sizable swing short on ES and NQ.

and during settlement on Friday the big credit downgrade news dropped

Moody’s cut the US rating from AAA to Aa1, ending its perfect status since 1917. The firm blamed decade-long rises in debt and interest costs driven by failed deficit reversals. Fitch downgraded the US in 2023; S&P did so in 2011. AAA denotes the highest credit reliability and strong repayment capacity.

Update: as of Sunday globex open, both the trades were deeply in the green.

Our model’s stops are at 21465/5974. First target for our model is 21140/5906.

Spotlight: The Tariff Tightrope and Moody's Verdict – Navigating New Policy Landscapes

Two significant developments are reshaping the policy and credit landscape for U.S. markets: adjustments to U.S. tariff policy towards China and Moody's downgrade of the U.S. sovereign credit rating.

White House Tariff Adjustments: A Truce or Tactical Shift?

On May 12, 2025, the White House issued a Presidential Action that modified existing tariff rates on goods imported from the People's Republic of China (PRC). This action involved suspending, for a period of 90 days effective May 14, additional ad valorem duties previously imposed under Executive Order 14257 on a list of Chinese goods. Concurrently, a new baseline additional ad valorem duty of 10% was established on all articles imported from the PRC, including those from Hong Kong and Macau. This 10% rate effectively reflects a suspension of 24 percentage points from a previous, higher rate. Furthermore, the de minimis tariff rate applicable to low-value imports from the PRC was reduced from 120% to 54%.

The stated purpose of these modifications is to reflect the ongoing discussions between the United States and the PRC aimed at addressing trade imbalances and related national and economic security concerns. This move is seen by some analysts as a de-escalation from a potentially more aggressive initial tariff stance, possibly influenced by market reactions and economic feedback. Indeed, prior to this modification, Fed Chair Powell had commented on May 7 that the then-announced tariff increases were "significantly larger than anticipated" and could pose risks to both inflation and employment. The 90-day window for the suspension suggests a period intended for negotiation or further assessment. However, the retention of a 10% baseline tariff and other existing sectoral tariffs (e.g., on autos, steel, and aluminum) indicates that trade protectionism remains a prominent feature of U.S. economic policy. The inflationary impact of these tariff structures will continue to be a key focus for the Federal Reserve.

The administration's tariff policies, while targeting specific trade objectives, carry direct fiscal implications, such as the generation of tariff revenue, which has reportedly been earmarked by the administration for potential funding of other fiscal measures like tax cuts. However, these policies also have indirect economic consequences, including potential impacts on inflation and growth, which in turn affect the broader fiscal metrics that were central to Moody's recent rating action. An aggressive tariff posture, if it dampens economic growth or necessitates compensatory government spending, could inadvertently worsen the fiscal outlook.

Moody's Downgrades U.S. Sovereign Rating: A Fiscal Wake-Up Call In a significant credit event, Moody's Ratings on May 16, 2025, downgraded the long-term issuer and senior unsecured ratings of the U.S. government to Aa1 from Aaa. The outlook on the rating was revised to stable from negative. This action means Moody's is now the last of the three major rating agencies to strip the U.S. of its top-tier Aaa/AAA rating, following Standard & Poor's in 2011 and Fitch Ratings in 2023.

The rationale provided by Moody's for the downgrade centered on the deterioration of U.S. fiscal strength. Key factors cited include:

A significant increase in government debt and interest payment ratios to levels notably higher than those of other similarly rated sovereigns.

An expectation of widening federal deficits, projected to reach nearly 9% of GDP by 2035, up from 6.4% in 2024. This widening is attributed primarily to increased interest payments on debt, rising costs of entitlement programs, and relatively low revenue generation.

An anticipated rise in the federal debt burden to approximately 134% of GDP by 2035, compared to 98% in 2024.

Moody's base case assumption includes the extension of the 2017 Tax Cuts and Jobs Act, which is projected to add roughly $4 trillion to the federal primary deficit (excluding interest payments) over the next decade.

Despite these concerns, Moody's acknowledged several exceptional credit strengths of the U.S., including the size, resilience, and dynamism of its economy, the preeminent role of the U.S. dollar as the world's global reserve currency, the effectiveness of monetary policy conducted by an independent Federal Reserve, and robust institutional features such as the separation of powers.

The downgrade has potential implications for U.S. borrowing costs over time, although the "stable" outlook suggests that Moody's does not anticipate another imminent downgrade. This action is likely to intensify scrutiny on U.S. fiscal policy debates and could influence investor confidence. The immediate market reaction, particularly in Treasury yields and the demand at upcoming Treasury auctions, will be a key indicator of the downgrade's initial impact. The "stable" outlook, while offering some reassurance against further rapid deterioration in the credit rating, might also reflect the unique buffers provided by the U.S. dollar's reserve currency status and the unparalleled depth of its capital markets. There is a risk, however, that this perceived stability could inadvertently lead to complacency among policymakers regarding the urgent need for fiscal adjustments to address the structural issues highlighted by the rating agency.

Note: Tactical trade idea sheet would be sent out by Tuesday to paid subscribers.

We have a rather quiet data-week ahead of us with a standard jobless claims report and PMI on Thursday.

Another interesting tidbit this weekend was the President’s truthsocial post which implied he favors price controls on Walmart. This is something to keep an eye out on because markets do not like government meddling into the top & bottom lines of private corporations.

The market has already discounted the “loose cannon” nature of the President’s posts and what we really need to look at are the policies enacted and executive orders signed over the rhetoric posted on social media.

WEEKLY LEVELS

Subscribers are urged to use the tradingview indicator to plot the levels.

Keep reading with a 7-day free trial

Subscribe to Algoflows Capital to keep reading this post and get 7 days of free access to the full post archives.