Weekly Market Outlook & New Telegram Channel

New Telegram channel link at the end of this post.

Hello traders,

Hope you had an excellent weekend away from the screens. (I spent most of it working so can’t complain)

Last week was an interesting one, the equity pick we had from last year FUBO 0.00%↑ (FUBO) being the star of the show.

Fubo got an acquisition deal from Disney and the markets loved it.

The stock went up to 6.4 from 1.2 and closed the week at 5.11 or so. At this point the readers can trim their position and have about 10% of the stock for another growth spurt if they believe there is more upside potential on the stock.

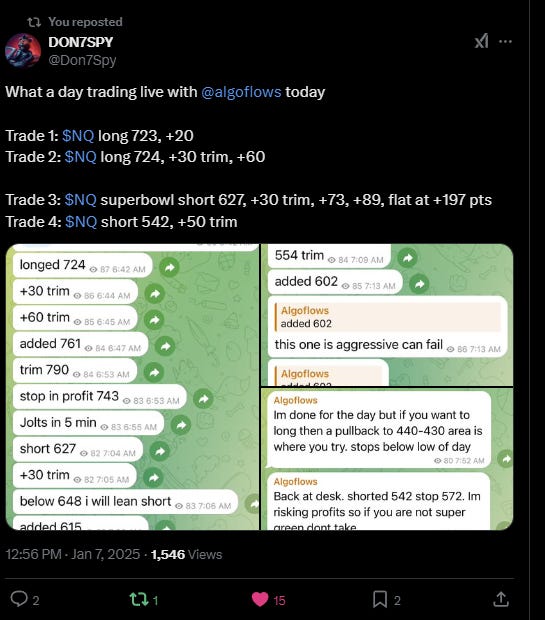

We had quite a few good trades last week as the elevated intraday volatility has made NQ an excellent playground for bidirectional bets.

Sharing a few of the ideas here:

Also, some love for X followers last week on Wednesday with a nice bottom call on $NQ.

And similarly a topsy-turvy Friday where the P&L oscillated wildly.

A reminder to readers: In elevated volatilty, you need smaller size and wider stops. I do not make the rules.

Moving on,

As mentioned in last week’s post, the Fed is playing a delicate dance and now with an NFP report that came in 100k hotter than expectations, any talks of 4 cuts in the year have now been quashed. However, this is just one report and there can be noise in the December jobs report.

This coming week we have PPI, CPI and retail sales and that would likely give us a bigger picture as to if the Fed is correct or has missed the mark entirely.

Broader picture, $SPX seems to have a date with 5783 (election day gap) and a hotter than expected CPI report would do the trick for bears.

However, our algorithms are suggesting as of now that we will have an above median green year on $SPX (and by extension on $NDX), and this volatility is going to just give us good buying opportunities through Q1 and the middle of Q2.

AFFILIATE MESSAGE:

TickTickTrader presents an exclusive opportunity for ambitious traders: Our premium 100K Core Direct Account (skip the evals), now available at an unprecedented $379 (regular $629). This limited-time flash sale delivers unrestricted trading potential across ProjectX and Tradovate data feeds, offering you the freedom to trade without minimum day requirements and withdraw your capital at your discretion. Experience the perfect blend of flexibility and security with our safety net feature and clear pathway to live trading success. Elevate your trading journey today with code ALGOFLOWS100K and save $250 on your path to professional trading excellence.

SALE ENDS JANUARY 13TH

Weekly Levels and New Telegram Link:

Here are the weekly levels and the telegram link:

Subscribers are urged to use the tradingview indicator to plot the levels.

Keep reading with a 7-day free trial

Subscribe to Algoflows Capital to keep reading this post and get 7 days of free access to the full post archives.