Weekly Market Outlook 06/08/2025

Summertime magic

Hello traders,

I hope you had a great weekend.

Readers can jump to Equity Spotlight section directly by clicking here

Recap of select trades from last week.

Realtime Telegram channel +chat access with intraday orderflow summaries is included with the paid newsletter membership . Click here to subscribe.

This Past Week: A Resilient Facade with Underlying Tremors

The first full trading week of June 2025 painted a picture of cautious optimism across Wall Street, with U.S. equities posting solid gains as investors seemingly embraced the unofficial start of summer trading. However, beneath this veneer of strength, financial markets grappled with a complex tapestry of mixed labor market signals, persistent inflation concerns that subtly tempered expectations for Federal Reserve rate cuts, and the ever-present, low hum of geopolitical tensions and international trade uncertainties. The week's movements and reactions served as a critical prelude to a data-heavy period ahead, potentially setting the stage for increased volatility and identifying key inflection points for several major asset classes. Market participants navigated a flurry of headlines, with equities advancing in four out of the five trading sessions to commence the month on a positive footing.

U.S. Equity Indices (ES & NQ): Riding the Jobs Wave, Dodging Political Shrapnel

U.S. stock indices showcased notable strength during the week ending June 6, 2025, with the growth-heavy Nasdaq 100 leading the charge. The S&P 500, often proxied by E-mini S&P 500 (ES) futures, climbed approximately 1.5% for the week, a significant milestone that saw the benchmark index cross the psychologically important 6,000-point threshold for the first time since February. The E-mini S&P 500 June futures contract (ESM25) itself closed up +1.02% on Friday, June 6th, at 6,006.75. Concurrently, the Nasdaq 100, tracked by E-mini Nasdaq 100 (NQ) futures, posted an even more robust gain, adding approximately 2.2% over the week. The June E-mini Nasdaq 100 futures contract (NQM25) finished the session on June 6th up +0.96% at 21,789.50.

The primary catalyst for this upward momentum in equities was a deluge of U.S. labor market data. Sentiment received an initial boost from an unexpected increase in job openings, as reported by the Job Openings and Labor Turnover Survey (JOLTS). However, investors largely refrained from making outsized bets ahead of the week's main event: Friday's much-anticipated nonfarm payrolls (NFP) report. The Bureau of Labor Statistics data ultimately revealed that hiring slowed less than expected in May, with the economy adding 139,000 jobs. This figure, while indicating a moderation in the pace of job creation, was interpreted by the market as a sign of ongoing economic resilience, alleviating immediate concerns of an imminent sharp slowdown. Paradoxically, this "not too cold" data also led traders to pare back their bets on the Federal Reserve implementing rate cuts in the near future, as a stronger labor market gives the central bank more leeway to maintain its current restrictive policy stance.

Adding to the supportive backdrop were what were termed as"positive-leaning trade headlines and Trump-Xi agreeing on rare earth metal deal with China per Trump".

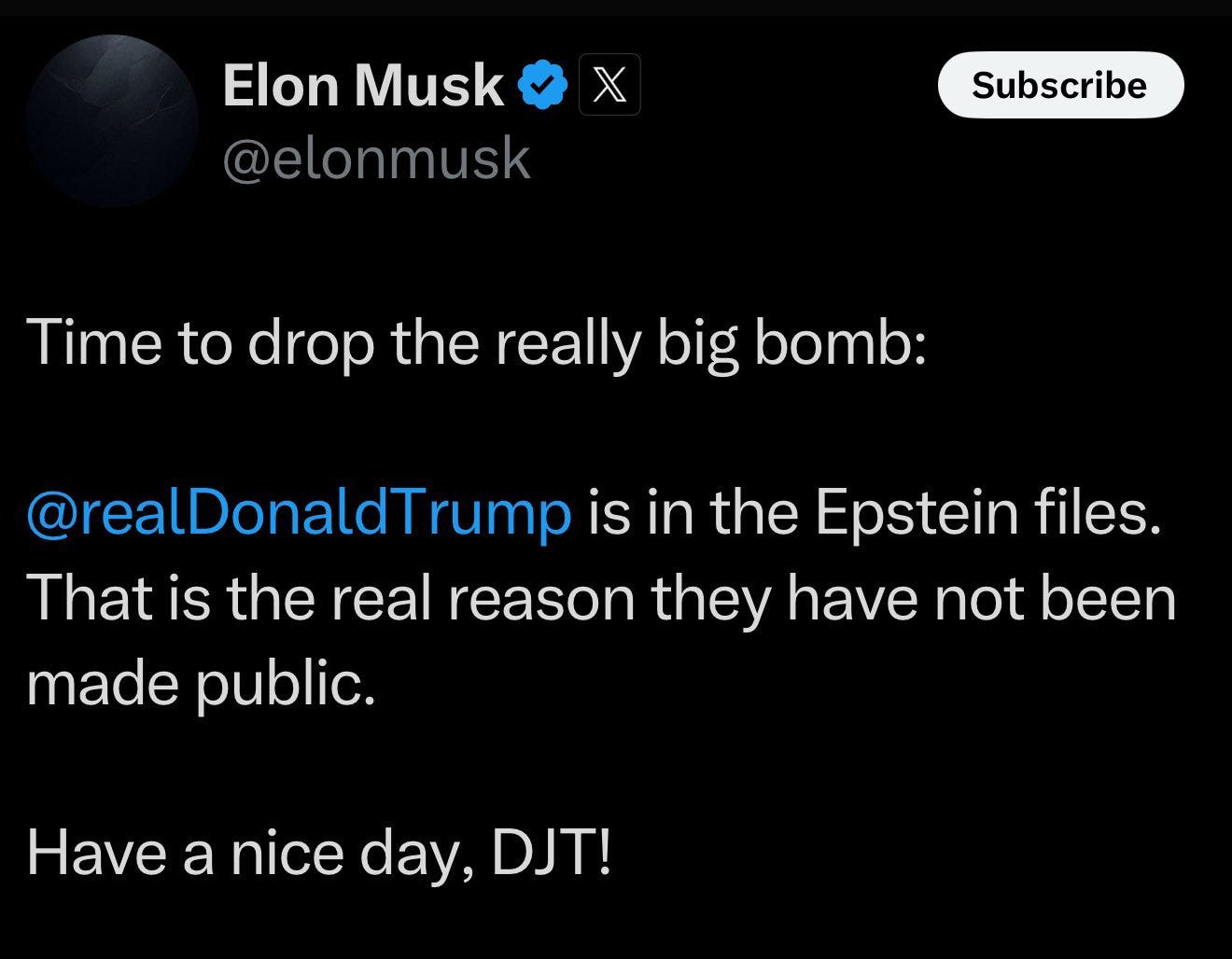

TRUMP-MUSK BROMANCE GOING SOUR

However, the week was not without its moments of turbulence. A significant point of volatility, particularly impacting the technology sector and, most notably, Tesla (TSLA), was a very public and acrimonious feud between President Donald Trump and Tesla's CEO, Elon Musk.

The Epstein tweet has been since deleted by Elon Musk.

This war of words "rattled the tech sector" and was a direct contributor to a sharp decline in Tesla's shares on Thursday, which in turn weighed on the broader market indices. The electric vehicle maker reportedly lost nearly $150 billion in market capitalization during Thursday's trading session alone as a consequence of this high-profile dispute.

Nevertheless, as the week drew to a close, Tesla shares, and by extension broader market sentiment, showed signs of a rebound on Friday as the intensity of the feud appeared to de-escalate, allowing investors to refocus on underlying economic data.

The equity markets, therefore, demonstrated a notable degree of resilience, particularly buoyed by labor market figures that painted a picture of a potential soft landing for the economy rather than a precipitous downturn. Yet, the week also starkly highlighted the market's acute sensitivity to idiosyncratic, non-economic events, such as the Trump-Musk spat. This underscores a potentially skittish underlying sentiment among investors, despite the headline gains, and suggests a market that could be easily swayed by unexpected news flow. The paring back of Federal Reserve rate cut expectations following the NFP release is a crucial takeaway, signaling a recalibration of monetary policy outlook that will likely dominate market thinking in the weeks to come.

Bitcoin's Tightrope Walk: Consolidation Amid Regulatory Currents and Institutional Tides

Bitcoin (BTC) navigated a more subdued week, ending in a consolidation phase. As of June 6, 2025, the leading cryptocurrency was trading around $104,760.02, reflecting a weekly decline of approximately -1.2%. This period of sideways trading followed the attainment of new all-time highs in May, suggesting that a natural phase of profit-taking was underway as some investors opted to lock in gains.

Several factors influenced Bitcoin's price action. The aforementioned profit-taking was a significant element. On-chain analytics from Glassnode, pertaining to early June, corroborated this, revealing that long-term holders (LTHs) – defined as wallets holding Bitcoin for more than 155 days – were realizing substantial profits. At one point, daily realized profits by LTHs reached approximately $1.47 billion, with cohorts that had held Bitcoin for over 12 months being the dominant force in this activity. This pattern is often interpreted as mature capital rotation, where early investors de-risk or reallocate capital after a significant price appreciation.

The regulatory landscape also remained a key focus for cryptocurrency traders. Market participants continued to monitor potential updates to U.S. crypto regulations, with the progress of legislation such as the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act being a notable development under observation. Alice Li, head of U.S. operations at crypto venture capital firm Foresight Ventures, opined that improving regulatory clarity in the United States could be a significant catalyst, potentially pushing Bitcoin past $150,000 during the current market cycle, citing President Trump's Bitcoin reserve approval and stablecoin policy developments as key drivers.

Despite some LTHs taking profits, the undercurrent of institutional interest in Bitcoin appeared to remain a positive background factor. Data indicated that U.S. spot Bitcoin Exchange Traded Funds (ETFs) attracted substantial inflows, around $5.24 billion in May alone. Furthermore, 13-F filings for the first quarter of 2025 revealed that large institutional investors reported holdings of $21.2 billion in Bitcoin ETFs, with financial advisors notably increasing their allocations to the asset class. This suggests a growing strategic, longer-term commitment from more traditional investment managers.

However, Bitcoin also demonstrated its continued sensitivity to broader macroeconomic shifts and overall risk sentiment. For instance, the public dispute between President Trump and Elon Musk was cited as a factor that spooked some crypto investors, contributing to a brief but sharp plunge in Bitcoin's price to $101,429 on Thursday, June 5th, triggering over $300 million in long position liquidations.

Bitcoin currently finds itself in a delicate equilibrium. While the underlying trends of institutional adoption and increasing corporate treasury allocations paint a positive long-term picture, short-term price action is being heavily influenced by profit-taking from investors who entered at lower prices and a heightened sensitivity to regulatory pronouncements and broader market shocks. The $100,000 level emerged during the week as a critical psychological and technical support zone, a breach of which could signal further corrective action.

Fixed Income Landscape: Yields Climb as Fed Rate Cut Hopes Recede

The U.S. Treasury market experienced a notable shift during the week, with yields pushing decisively higher across the curve. The monetary policy-sensitive 2-year Treasury yield, a key barometer of market expectations for the Federal Funds rate, ended the week approximately 14 basis points (0.14%) higher, closing in a range of 4.04% to 4.05% on June 6th. Similarly, the benchmark 10-year Treasury yield, which influences a wide array of borrowing costs including mortgage rates, rose by roughly 9 basis points (0.09%) over the week, finishing at 4.51%.

The primary driver for this upward surge in Treasury yields was the stronger-than-anticipated May nonfarm payrolls report. As discussed earlier, this data led market participants to significantly pare back their expectations for imminent Federal Reserve rate cuts. When the likelihood of monetary easing diminishes, shorter-dated Treasury yields, which are most sensitive to Fed policy changes, tend to rise.

Adding to the upward pressure on yields were ongoing concerns regarding the U.S. fiscal outlook. Worries over the trajectory of federal government debt and the potential economic impact of large budget deficits have been a persistent theme in the bond market. Scrutiny surrounding President Trump's reconciliation bill, which was reportedly attempting to make its way through the U.S. Senate, also contributed to this cautious sentiment among bond investors.

It is worth noting that yields had experienced a brief dip mid-week. This temporary reprieve came after weaker-than-expected readings from the ADP employment change report and the ISM services sector survey. These softer data points had momentarily reinforced speculation that the Federal Reserve might be inclined to cut rates at least twice in 2025, sending Treasury prices higher and yields correspondingly lower. However, this downward move in yields proved short-lived, as subsequent stronger economic data, culminating in the Friday NFP report, quickly reversed the trend and sent yields marching higher for the remainder of the week.

The bond market is currently operating in a state of heightened sensitivity to incoming economic data, particularly any figures that might shift the prevailing narrative around Federal Reserve policy. The resilience demonstrated in the May NFP report was a clear signal to fixed income investors that the Fed might perceive less urgency to begin an easing cycle, leading to a significant repricing in the short end of the yield curve. Underlying these more immediate data-driven movements, concerns about the U.S. fiscal trajectory remain a persistent, foundational theme weighing on Treasury valuations and suggesting a structural inclination towards higher yields absent a significant economic downturn or a decisive dovish pivot from the Fed.

THE WEEK AHEAD

This week’s most important datapoint is the CPI report on Wednesday, closely followed by the 10/30 yr Bond Auctions.

EQUITY SPOTLIGHT

Last week this newsletter suggested 3 stocks AVAV, ESLT and TDY.

This was their performance this past week.

AVAV: Peak Weekly gain 13.52%, ended the week up 10.87%

ESLT: Peak Weekly gain 5.61%, ended the week up 4.57%

ESLT: Peak Weekly gain 1.45%, ended the week up 1.06%

This week, we will be looking at the following five space companies for a shorter duration trade.

Maxar Technologies Inc. (Privately Held): Maxar is a leading provider of satellite technology and services. The company was selected by NASA to build the Power and Propulsion Element for the Lunar Gateway, a key component of the Artemis program's long-term lunar presence.

Intuitive Machines, Inc. (NASDAQ: LUNR): A key player in the return to the Moon, Intuitive Machines was selected by NASA to deliver scientific and technological payloads to the lunar surface under the Commercial Lunar Payload Services (CLPS) initiative. Their Nova-C lander is designed to be a versatile and cost-effective solution for lunar exploration.

Keep reading with a 7-day free trial

Subscribe to Algoflows Capital to keep reading this post and get 7 days of free access to the full post archives.